The political scenario in the United States is uncertain. In the prediction markets (Polymarket) it seems to regain the advantage Donald Trump, who had lost some points a few weeks ago. According to the data, the bets favor the Republican and give him 52% compared to 46% for Kamala Harris, the Democratic candidate. Without a doubt, the presidential debate on Tuesday will shed some light on the situation for investors, who are more concerned about the electoral contest than about inflation or the possibility of a recession in that country, in a context in which the investment trend is set by the younger generation.

It turns out that a survey of 1,000 investors found that 78% of traders are more concerned about the election between Trump and Harris than about persistent inflation (70%), high interest rates (57%), the poor performance of the stock market (57%) or a possible recession (55%). The data comes from the latest survey by Janus Henderson Investors, who published the results of his Investor Survey 2024: Outlook for a better future.

The document explains that respondents are concerned about the impact that the upcoming presidential elections may have on their financial situation over the next 12 months. However, there is uncertainty regarding the next 10 years and Artificial intelligence (AI), which stands out as one of the main fears. And almost three out of four investors (73%) believe that it greatly increases the risk of financial exploitation, and 56% are “very or somewhat worried because they or a loved one may be a victim of financial exploitation.”

The document also marks Trends that are gaining relevance among investors. Among them, the fear of geopolitical events that shake the markets stands out “with the conflicts in Ukraine and the Middle East as an example”, as well as a sharp drop in exposure to the variable income (-12%) due to high interest rates in the US.

Polarization: the fear of investors

In an election year marked by the political turmoil typical of a presidential election, 78% of respondents are concerned about how the outcome of the election between Donald Trump and Kamala Harris will play out may affect interest rates. In fact, investors are concerned about the impact that the upcoming presidential elections may have on their financial situation in the short term.

In the longer term (next 10 years), investors’ concerns are related to national and global systemic problemsthe document states such as:

- Long-term impact of growing political discord in the US (77%)

- Increase in health care costs (67%)

- National debt (66%)

- US-China relations (64%)

Janus Henderson Investors 2.png

In an election year marked by the political turmoil of a presidential election, 78% of respondents are concerned about the outcome between Donald Trump and Kamala Harris.

Millennials and risk aversion

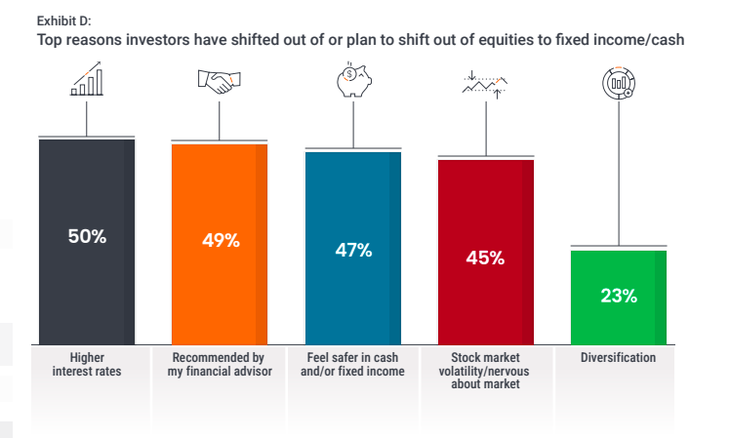

According to the document, One-third of investors have moved out of stocks into cash and/or bonds in the past yearand 32% plan to do so in the next 12 months. Despite this trend of reducing risk exposure, investors believe that the sectors of health/biotechnology and technology represent good investment opportunities in the coming years.

A notable fact from the report is that those who rotated from stocks to cash or fixed income were “disproportionately millennials”, who acted as the main decision makers in the market. In their main argument for switching or planning to switch from equities to other safer instruments, Investors cited higher interest rates as the main reason and reported feeling safer in cash or fixed income and being nervous about market volatility in second place.

Preference for active management remains constant

In a context of high uncertainty, 43% of investors who own mutual funds say they prefer a balanced mix of active and passive funds In their portfolio, 26% prefer active managers, 18% prefer passive managers, 10% have no preference and 3% prefer passive management.

“The areas that investors believe present the best investment opportunities in the coming years are the technology (73%), healthcare/biotechnology (62%) and real estate (38%)“, the document states.

Fears over AI and younger investors

The report states that Nearly three in four investors (73%) believe that artificial intelligence greatly increases the risk of financial exploitation and 56% are very or somewhat concerned that they or a loved one may be a victim of financial exploitation.

In this context, the Millennials (66%) and members of the generation X (63%) are more concerned about financial fraud than baby boomers (48%) or members of the silent generation (43%). “Across all generations, 45% of investors who turn to a financial advisor say that they have already been provided with resources to avoid financial fraud,” the report states. It adds that 29% would like their advisor to provide them with these resources and the remaining 26% say they are not interested in these resources.

Janus Henderson Investors 1.png

In a context of high uncertainty, 43% of investors who own investment funds say they prefer a balanced mix of active and passive funds in their portfolio.

In this regard, the study states that “perhaps surprisingly, concerns about financial fraud are more prevalent between Generation X and Millennials than among older cohorts.” This may mean that younger investors are more aware of how AI can be used to commit financial scams.

He stresses that this does not translate into that investors have a completely negative view of AI. In fact, among those who use a financial advisor or would consider hiring one in the next two years, A large percentage feel good or neutral about their advisor using technology for administrative tasks (83%) or to create educational content (85%)However, more than a third (36%) would object to their adviser using AI to make investment recommendations, and an even larger number (44%) would be upset if they discovered their adviser used AI to respond to their text messages or emails, the report found.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.