In this context of asset regularization, Dollar-denominated bonds are performing well and are an attractive opportunity for the most experienced money launderersThe “most liquid” sovereign bonds climbed last week, with the Bonar 2030 in the lead (+3.3%), the Global 2030 (+1.8%), the Global 2035 (+4.6%) and the Bonar 2038 (+6.1%).

According to the spreads by legislation, the ratio between GD35/AL35 is zero. This suggests abandoning position in local law and buying New York legislation. The same goes for the spread between the AL38 and GD38which is at a minimum of 3%, which is also an indicator to leave Argentine law.

- Positive: In the first half of the year, financial reforms were approved in Congress and the policy of zero monetary emission to finance the Treasury was maintained. Between August and December, the Government must reduce inflation, narrow the exchange rate gap and increase net reserves by US$10 billion. “This would allow it to access international markets to refinance maturities starting in July 2025,” the report analyzes.

- Negative: However, trying to quickly close the exchange rate gap without control measures can lead to more inflation and exchange restrictions. In this scenario, the country does not have access to international markets and, due to increasing maturities, “a bond swap is carried out with a 30% reduction in capital and a payment period extended to 10 years,” he warns, on the other hand.

The consultancy also notes that, in a Base scenarioeven if market access is not achieved in June 2025, “a preventive exchange is carried out without capital reduction or default”, with a 1% increase in the coupon and an extension of payment terms.

Money laundering: opportunities in the “hard dollar”

For its part, in a document sent to clients, the investment advisor Gaston Lentini performs a detailed analysis of the Globals GD29, GD30, GD35 and GD38.

The expert’s recommendation is to “diversify the portfolio by adding short-term and longer-term bonds in order to recover part of the investment more quickly and, in turn, obtain greater profits from higher income and possible price increases in the long-term bonds.”

Negotiable Bonds are presented as a more conservative option when it comes to investing laundered dollars. However, the money laundering regime The demand for these instruments skyrocketedwhich led to the compression of their rates, compromising the yield in dollars. “The process by which the rise in bond prices causes them to yield less is called ‘rate compression’,” explains Lentini.

Allaria-Globales.png

Global prices as of September: Source: Allaria.

This way, Those who are seeking higher returns and taking on higher risksshould consider the possibility of adding hard currency bonds (always foreign law) to their investment portfolio. And, as Lentini explains, “an instrument that pays 20% annually in dollars is not something that is seen every day, Therefore, high interest tells us the level of risk involved.”.

In this case, it is a high risk and it is important to keep in mind that there may be a lot of volatility. The positive thing is that, if everything goes well, the benefits could be very attractive and “Whoever does not need the money in the next few years may be on a great opportunity“, the document states.

A differential risk in bonds

Lentini’s research team makes a key caveat when choosing: “Sovereign bonds present a differential risk depending on the legislation that supports them. The Bonares (like the AL30) are governed by Argentine jurisdiction, while the Globals (like the GD30) are under US jurisdiction,” which is considered safer by the market.

And since the spreads between both bonds are at a minimum, as mentioned above, it is suggested to opt for those of foreign law for greater security.

Earnings, cash flow and investment strategies

It should be remembered that in fixed income, profits come from the cash flow until maturityHowever, when bonds are trading below par, additional profit can be made by selling them at a higher price.

With the bonds analyzed (GD29, GD30, GD35 and GD38), investors have two strategies: wait for rents and amortizations, or take advantage of a rise in price to sellr. Since they are foreign law bonds, payments are made in cable dollars (CCL) and provide greater security by having the money outside the country. They also facilitate future investments abroad, the document states.

Globales 1.png

Meanwhile, the bonds GD29, GD30, GD35 and GD38 stand out for their operating volume and performance. He GD29, maturing in 2029, it is the shortest and yields 22% annually. It is quoted at $63.50 with a parity of 63%. In addition to the income, it amortises capital from the beginning, which makes it attractive.

For example, An investment of US$100,000 in this bond would generate US$49,000 in payments until 2026 and must be left US$51,000 invested. By 2028, 100% of the initial capital (US$114,000) would be received, plus an additional US$47,000 until 2029.

Investment strategies: bonus by bonus, how much do I earn?

So, these are the strategies and returns bond by bond:

- The GD30: The bond matures in July 2030, currently trades at US$56.80 per 100 nominal and is at 59% par. This bond has also already begun to amortize capital and is currently the most liquid. If you invest US$100,000 of this bond and it is expected until 9/1/26, the investor will receive US$43,000. “In green we see that we will receive 100% of what was invested in 2028, that is, if we wait until 9/1/2028 we will collect US$102,300 and we would also have to collect an extra US$70,000 until 2030.”

- GD35: This bond matures in 2035 and is currently trading at US$46.20 per 100 nominal. Its parity is 46%, so if rates normalize, it would rise in price more than the GD30. The GD35 returns capital (amortizes) only in 2030, but pays higher interest coupons. The investment will not be recovered until mid-2031, and a little more than US$13,000 will be received by 2026.

Globales 2.png

- GD38: It matures in 2038, so it is much longer than the previous ones, it is listed at US$50.50 per 100 nominal and is at a parity of 50%. Unlike the GD35, this bond begins to amortize capital earlier, in July 2027, so it has a sweetener that makes it different. The investor will recover the investment in 2030. In turn, if he decides to keep it only until 2026, the title will return US$14,800 through income. This bond is the one that pays the highest income.

“If the bond were to yield 12%, from the current 18%, its price would rise 33% in dollars. It would have a lower rise than the GD35, but higher than the GD30, with the added bonus of paying higher rents and amortizing earlier than the GD35, reducing the risk of the money we leave exposed in the market,” the document states.

Thus, and after detailing the cash flows, capital recovery dates and returns until 2026, There is no single recommendation that can be offered to all investors..

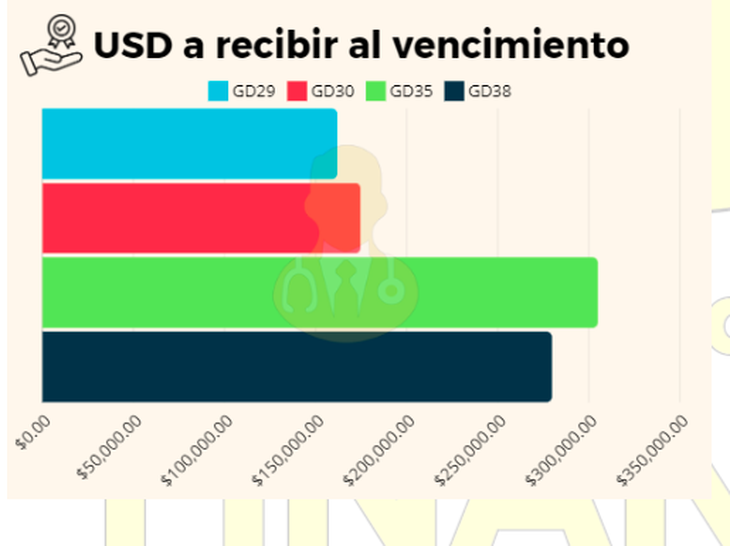

If you’re looking for big returns quickly before 2026, the GD29 is the best choice, paying nearly $50,000 in coupons and amortizations, followed by the GD30 at $44,000. Longer-term bonds like the GD35 and GD38, while only paying rents with no initial amortization, offer more total dollars over the long term: $304,000 (GD35) and $280,000 (GD38).

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.