The official stated that “the economy has reached a cyclical turning point” according to the leading activity indicator (ILA, for its acronym) prepared by the BCRA itself.

The ILA-BCRA is a composite index that seeks to anticipate changes in the phase of the economic cycle based on three criteria: duration (number of months with positive monthly variations of the last 4), diffusion (percentage of sectors with positive monthly variation) and depth (percentage variation of the ILA-BCRA accumulated 6 months annualized). Based on all this, the entity says that in July 2024 the 3 conditions were met that indicate that the ILA-BCRA would have verified a turning point in March. “It is expected that the phase change of the EMAE will have occurred in April or in subsequent months,” he said.

growth.png

Optimism with lower inflation

For Werning, there is an encouraging perspective that consists of a “advancing disinflationthe economic cycle turns, the banking system is reoriented to the productive sector and support for the program in public opinion is high. “Labor income and the demand for money are increasing simultaneously, thus reinforcing the fundamentals that determined the point of economic inflection,” he emphasized.

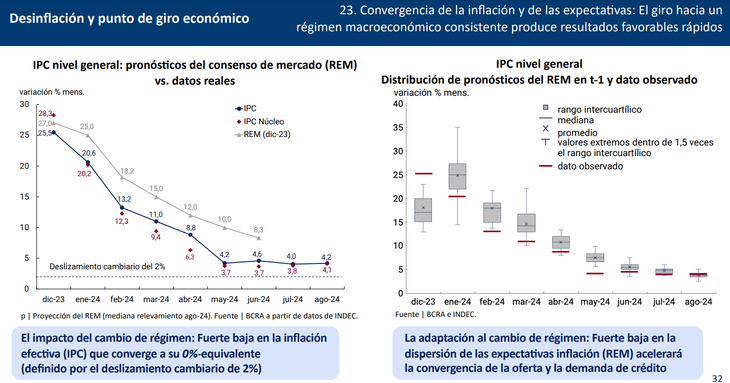

In accordance with the vision of the BCRA a convergence of inflation and expectations began to be observed. This “strong decrease in the dispersion of inflation expectations (REM) will accelerate the convergence of credit supply and demand,” says the work that Vladimir Werning presented last Monday at a meeting held by the Mediterranean Foundation in the province of Córdoba. .

Among the factors that are contributing to this decline in inflation, Werning’s presentation first focused on “four fundamental pillars that rebuild macroeconomic stability.” Among them, the trend change from a primary deficit consolidated in recent years to primary surplus of the non-financial public sector of 2.3 points of GDP in the first eight months of 2024.

The second factor was the sharp drop in BCRA interest payments on remunerated liabilities. With the fall in the BCRA’s remunerated liabilities of net reserves, Wearning demonstrated that the risk of hyperinflation has collapsed. But also, as a result of the improvement in the ratio of imports to the BCRA’s liquid reserves, It also signals a collapse in the risks of debt default.

Regarding the factors that are impacting prices, the work indicates the existence of “high margins and moderate recovery of real wages.” Of the real salaries of the registered private sector, the BCRA considers that they fell to a floor last December and that since the beginning of the second quarter they have already shown a more pronounced recovery.

disinflation.png

On the other hand, also suggests that there are favorable expectations for inflation due to energy and fuel costs. In the first case, he anticipates that progress in covering the cost of energy (due to rate increase and cost decrease) will moderate future adjustments, while in the case of fuels, suggests that after the deregulation of the gasoline market, The convergence of fuel prices at the domestic and international level also alleviates inflationary expectations.

Finally, add the impact of inflation regime change: For the BCRA, effective inflation converges to 0% – (defined by the fixed devaluation of 2%) and, according to its perspective, the adaptation to the change of regime: Strong decrease in the dispersion of inflation expectations (REM) will accelerate the convergence of the supply and demand of credit.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.