The Municipality of Morón achieved a measure precautionary before federal justice which will allow you to includer the public lighting rate in the invoices of the clients of the distributor Edenor. The measure was issued against the recent resolution of the National Electricity Regulatory Entity (ENRE) which prohibits companies from including those charges.

The failure corresponds to the Judge Martina Isabel Fonz, head of the Civil and Commercial Court 2 of San Martín. The lawyer granted the Buenos Aires commune protection contrary to the measure of the body that controls the electricity service in the country.

This is a setback to the aspirations of the Minister of Economy, Luis Caputo, who maintains a ballad battle against the mayors of Greater Buenos Aires, who have increased the fiscal pressure on the neighbors of the parties, to the extent that the national government seeks to lower taxes.

Fonz considered that the argument put forward by Morón, that he can make an agreement with the company based on the power that emanates from the National Constitution and the provincial Constitution, is credible and For this reason, he granted the request to continue including him in charge until the underlying conflict is resolved.

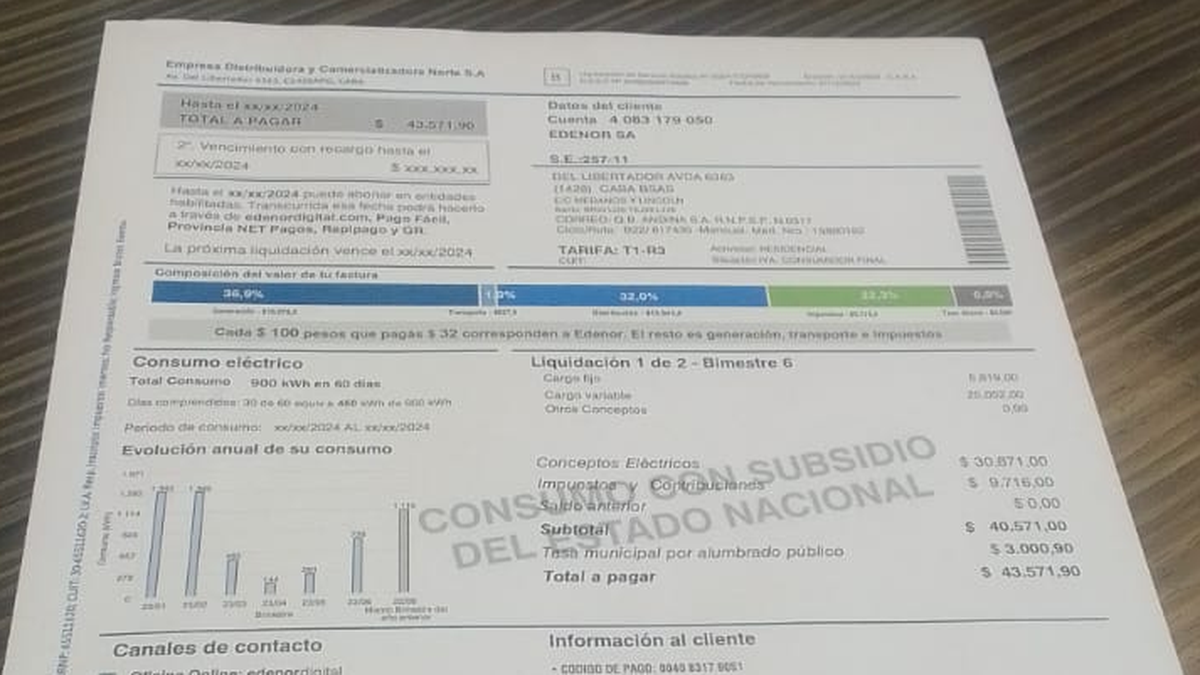

two weeks ago, The ENRE decided to annul the authorization to apply concepts unrelated to the electricity servicesuch as municipal rates, in the invoices of Edenor and Edesur, through Resolution 708/2024.

“It is necessary to annul any authorization that has been granted by this Entity, in order to include in the invoices issued by Edenor SA and Edesur SA for the electric energy distribution service they provide, items to be collected unrelated to said distribution service. federal character,” says the resolution.

The government’s conflict with the mayors

The ENRE measurement is only a link in the conflict of the national government against the suburban mayorswho for some years have adopted the modality of charging communal taxes based on the tax base of the Gross Income Tax of the companies or as a percentage of the sale of fuel.

In the first case, These are the Safety and Hygiene Taxes, and the second is the so-called Road Tax.

The national government maintains that communes can only charge these types of charges for a fixed sum as consideration for a specific service.

The application of aliquots that They imply a greater or lesser collection depending on the variation of the taxable event, formally constitutes a tax, that in theory, the communes cannot charge.

In a conflict that kept the companyto Exxon against the municipality of Quilmes a few years ago, the Supreme Court of the Province of Buenos Aires ruled in favor of the municipality.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.