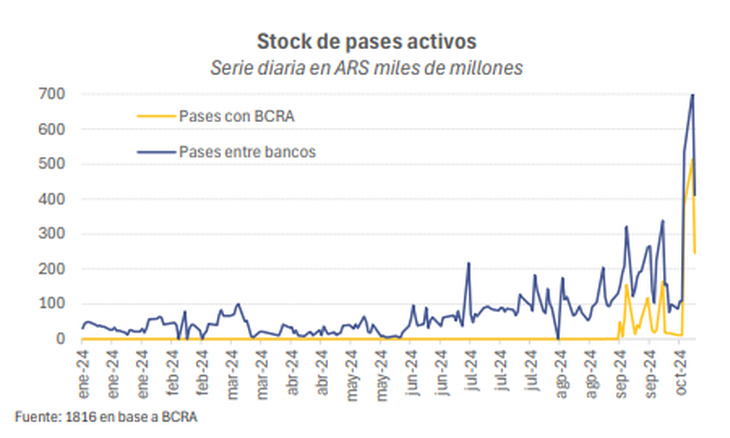

In October, financial institutions increased the demand for active repos to levels not seen in years to supply the credits requested by their clients. Are pesos scarce?

In October, a phenomenon that had not occurred for several decades began to be seen.. Faced with the need to obtain pesos to supply the credit demand of its clients, The banks turned to request liquidity from the Central Bank through from the window of active passes for relatively significant amounts.

The content you want to access is exclusive to subscribers.

As they are very short instruments (with a term of one or seven days), the daily fluctuations in the stock of active repos were important, but the latest official data available show that As of October 22, there were open positions for $199,904 million. The peak occurred on October 14, when it reached $521,141 million. That day the Treasury liquidated the securities of the last tender, in which it absorbed net financing of $830,000 million and left some entities without liquidity.

image.png

Does this mean that the plaza was left dry of pesosa point that the Government aspires to reach before opening the stocks? Not in general terms. The banks have in their possession a total stock of LEFI (Fiscal Liquidity Letters issued by the Treasury, but administered by the BCRA) of $11 billion and the Government has deposited in the Central Bank a liquidity cushion $13.27 billion intended to supply eventual unwinding of the positions that financial entities have in public securities.

But it is true that they occur specific missing liquidity in certain entities. Besides, Some banks prioritize gradual disassembly of Lecap or other Treasury instruments and that is why they resort to the active repo window, for which the BCRA charges them an annual nominal rate of 45%.

The consultant 1816 He highlighted that, in parallel, “The volume also increased considerably of operations of passes between banks with rates more than 300 basis points above the LEFI yield.”

Banks, passes, debt and rates

The consulting firm pointed out that since there is tighter liquidity in local currency, this process will have a impact on interest rates. For now, the 45% TNA charged by the BCRA for active repos exceeds the performance of the LEFI and that of the Lecap and Boncap in the secondary market.

In that sense, as Ámbito said, there is expectation in the city for what the Ministry of Economy will do in the next debt tender in pesoswhich will take place on Tuesday. In particular, the focus is on the interest rate: will it validate the drop in long Lecap and Boncap rates that was registered in the secondary market? Many analysts believe so. In 1816 they proposed that, as there are lower maturities ($1.6 trillion), it may be an opportunity for the Treasury to lower the cost of funding, show an inverted curve and relax the liquidity conditions of the financial system.

Other operators and analysts believe that Luis Caputo will prioritize giving a signal of continuity of the “carry trade” incentive and that is why he will move with caution.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.