The Government also announced that the World Bank and the Inter-American Development Bank (IDB) committed credits for US$8.8 billion intended for both the public and private sectors, but He did not provide details on the disbursement schedule or how much of that amount will be net financing. (that is, how much will be left after the payments committed to those same organizations). Regarding the latter, a report from the SBS Group highlighted that, between November 2024 and December 2025, payments to international organizations (excluding the IMF) amount to around US$4.7bn.

These signals triggered strong increases in Argentine assets: Sovereign bonds in dollars jumped and country risk broke 1,000 for the first time in five years. “The news of the repo (even without the final formal detail of the operation) and the financing of international organizations (although in our opinion the first factor weighs more), boosted Global bonds and the reduction of country risk to the lowest since 2019,” raised S.B.S..

image.png

Likewise, the BCRA maintained its currency buying streak. In the last week, it was done with US$329 millionwhich raised the accumulated balance in October to US$1,090 million. “A good liquidation of agriculture (also atypical at this time), together with the increase in private loans in dollars, drive a dynamic that few expected weeks ago. We remember that the reason behind this seems to be a market convinced that crawling peg (the exchange table) of 2% monthly of the A3500 exchange rate will remain, which drives both the aforementioned liquidations and the financing in dollarswith a rate in pesos that remains above the crawl,” said the aforementioned report.

Along these lines, a report from the consulting firm Vector analyzed the mechanics of dollar loans: “Exporters can finance themselves in foreign currency but in reality they do not collect dollars, rather they are sold to the BCRA and the credit is obtained in pesos at the official exchange rate. As the market believes that the crawling peg will continue, this allows you to obtain financial profits by carrying out a ‘carry trade’ with Lecap, whose rates are currently around 3.6% monthly. This should be monitored in the future, given that entails risks of future runs on reserves”.

image.png

Bets on the “carry trade” left juicy profits this year (they accumulate 31.8% in dollars, according to economist Nery Persichini) from the exchange rate appreciation and the compression of the gap. They are also based on the expectations installed in the market that the slowdown in inflation will continue its course, as reflected in the prices of financial assets. These expectations are coupled with the idea that the Government will not release the price of the dollar in the medium term, something that is reinforced by the delay in the negotiation with the IMF, which is always prone to demands at the exchange rate level.

“The Government’s commitment will continue to be to reinforce disinflationary signals and to actually show decreasing numbers in that sense, with a view to reaching the 2025 legislative elections on a good footing. The bet is still risky in a context in which, although the exchange rate momentum is favorable, net reserves remain negative, the real exchange rate has been appreciating for several months and for the moment it seems that exchange controls will remain in force for a while. more time,” warned SBS.

Dollar: descending chart?

In this framework, one of the main questions and sources of concern continues to be the administration of the dollar level. The Government is determined to maintain a scheme in which the exchange rate appreciates progressively and that fuels the “carry trade”. In this framework, some voices in the city believe that the economic team’s next bet could be to reinforce the scheme with a reduction in the pace of monthly increase in the official exchange rate.

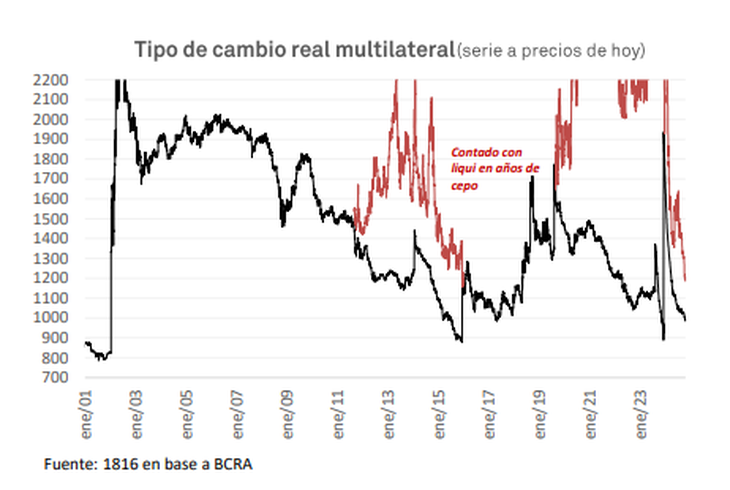

The consultant 1816 He pointed out that, after the December megadevaluation, practically the entire market “believed that the 2% ‘crawling peg’ would last a few months, due to the exchange rate delay it involved.” “Ten months later we think that, if inflation does indeed go down in the fourth quarter of 2024 at the levels suggested by the bonds (2.5% monthly zone), at the latest At the beginning of 2025 the BCRA will lower the crawl rate (at 1.5%? at 1%?)”, he projected. Of course, this would continue the appreciation of the multilateral real exchange rate, which has already pierced the average level of November 2023, as reported Scope.

image.png

Regarding the rest of the exchange scheme, the 1816 report indicated that they still have doubts about what they will do with the blend dollar (which causes 20% of exports to be settled in the CCL, which helps to compress the gap, but prevents that these currencies enter the reserves), but who are increasingly convinced that “the Government does not want to float before the elections”. However, they do not rule out new partial flexibilities: for example, an eventual release of cash with settlement.

The warnings

The truth is that, beyond the market’s renewed optimism, There are voices that warn about the risks involved in extending an appraisal process exchange rate at these levels and with a BCRA with negative net reserves.

The LCG consulting He stressed that, despite the movements to obtain financing and the latest news, “risks persist” on the external front. “As long as the ‘nominal race’ shows that prices and wages are above 2%, the current backwardness will worsen (today hidden by a still weak economic activity), and the possibility of an external (current account) deficit financed by capital inflows, we already know that it cannot last for a long time. Perhaps less time than necessary for Vaca Muerta to fully export,” he emphasized in a recent report for his clients.

The firm founded by Martin Lousteau stated that an “exchange correction” does not have to be “dramatic”, but indicated that, as there is still a fragile framework, the impact of a devaluation on prices, on investors who are leveraged and on the social climate would cut “with the current sweetness that the markets are experiencing.”

image.png

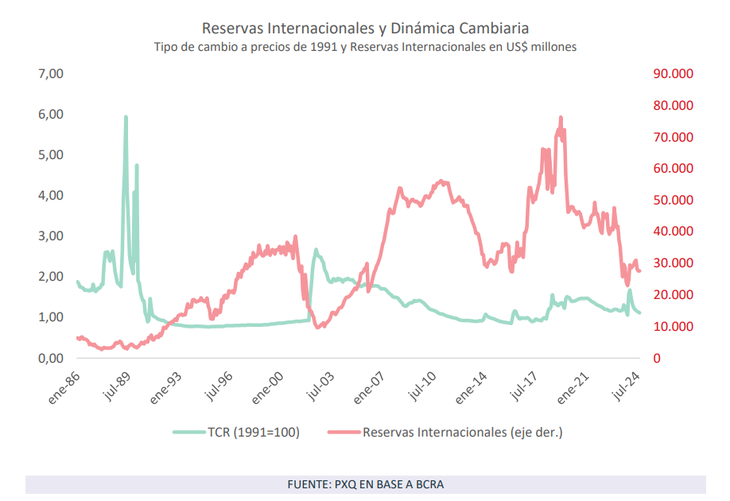

For its part, a report from PxQthe consulting firm Emmanuel Alvarez Agisconsidered that the Government is currently going through its most favorable moment since it took office (due to the reduction in the gap, country risk and inflation) but that, at the same time, “the appreciation of the real exchange rate implies a risk for the sustainability of the economic scheme and correcting it threatens to reduce the political capital of the Presidentwhich crucially depends on each month’s inflation being lower than that of the previous month.” And he summarized: “The question is whether it holds up.”

After comparing with other historical moments in which the country was becoming “expensive in dollars” But that “was sustainable,” PxQ maintained that in the current case “exchange control blocks the inflow of capital.” And he expanded: “Exchange appreciation complicates the dynamics of exports and external debt does not seem to be an alternative in the short term, given current market conditions. For that reason, this time is different, but because this time it is without dollars”. That is, Argentina did not become more expensive in dollars due to an influx of foreign currency.

Thus, the consultant concluded: “The current situation is not sustainable over time.”. If the Government uses this period as the previous period for a program to relax exchange controls, there are chances that Argentina will consolidate a period of low inflation with accumulation of reserves and economic growth. For this, the starting exchange rate should be one that reverses the excess demand for foreign currency and transforms it into an excess supply. If, on the contrary, the Government prefers to avoid disruptions and makes these exchange rates more flexible, the chances of entering a period of financial stress increase.. And they are even higher if, with electoral leadership, the corrections are postponed until after the midterm elections.”

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.