Traders are opting for well-known investment strategies similar to those of 2016 in recent days and in the countdown to the US presidential election. The focus is on the financial and industrial sectorswho benefited during the previous presidency of donald trumppoint out separate reports from Morgan Stanley, while another of Barclays draw the “only scenario“which would generate real panic in Wall Street.

Thus, Morgan Stanley assures that since the reduction of 50 basis points carried out by the Federal Reserve (Fed), US Treasury bond rates rose markedly across the entire curve. He maintains that it is “correct” that investors’ bets are tilted towards the 2016 game planthat is, towards the financial and industrial sectorss, who benefited during the Republican mandate.

However, he warns that the magnitude of these sectoral movements It is not convincing outside the financial sector. This is because this sector stands as the clear winner of the earnings season that led to a strong revaluation of its profits. In other words, for Morgan Stanley”fundamentals will influence this sector more than the electoral result“.

Furthermore, he highlights that since October 1, when the probability of a Trump victory gained strength in the prediction markets, the materials and small caps sectorwhich had had a superior relative performance ahead of the 2016 elections, Now they have a modest performance.

“One reason for this disparity in small caps, compared to the 2016 scheme, is that the relative performance of these companies is negatively correlated with current rates, while it was positive in 2016”explains the document.

The yield on Treasury bond rates

Pablo RepettoHead of Research at Aurum Values -in dialogue with Scope– explains that the increase in the yield of the “Treasuries” is linked to the economic policy proposed by both Trump and Harris. Although the Republican candidate has a more pronounced approach, his policies were evaluated by a US and non-partisan fiscal responsibility body, which highlighted that these proposals would be highly deficient for the State. “This approach raises significant concerns in fiscal terms and is seen as potentially proinflationary”, warns the strategist.

This worries markets due to the possible fiscal impact. As expectations of a Trump victory increase, Treasury rates rise, affecting future earnings streams for stocks. “This is because, by discounting those gains at a higher rate, their value decreases,” explains Repetto.

Morgan Stanley 1.jpeg

In addition, he warns that concern about consumer spending is growing, which could suffer in a context of inflation elevated. Thus, for the strategist, the scenario projected for a government under these economic policies generates uncertainty and cautious expectations in the markets, leading investors to switch to safe instruments.

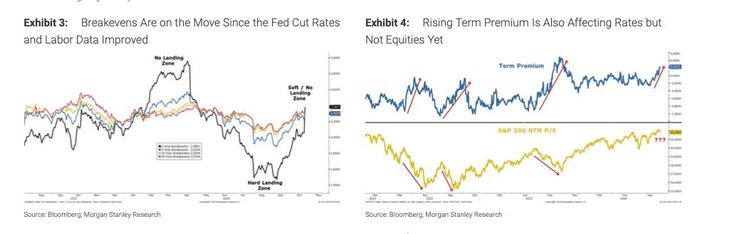

Morgan Stanley, for its part, explains that bond rates rise due to several reasons, similar to those mentioned above, but also because the fixed income market discounts that the Fed’s decision to reduce rates by 50 basis points before knowing employment data stronger could open the door to a return to inflation. “This increase in price dynamics is reflected in the recent increase in breakevens”, slides the document.

And he adds that this scenario could benefit sectors such as raw materials, financials and some “higher quality” small-cap companies that could recover their pricing capacity. However, it indicates that it would be less favorable for stocks with longer duration and interest rate sensitivity, as it could limit the Fed’s ability to make additional cuts.

Barclays and the “only” panic scenario for the market

Barclays analysts indicated in their latest report that they estimate that next Tuesday’s election, “very likely,” will lead to a “smooth power transition”, as they consider that concerns about political unrest appear to be “exaggerated.”

Strategists expressed confidence that American institutions are strong enough to ensure a peaceful transition, so the macroeconomic impact of possible protests by supporters of Trump or Democratic Vice President Kamala Harris should be “minimal.” .

Morgan Stanley 2.jpeg

In that sense, Barclays analysts said that the only scenario that is likely to cause concern in the markets is the potential for a so-called “blue wave”where Democrats capture both houses of Congress as well as the presidency, which could lead Democrats to seek increases in corporate and personal income tax rates, at least among high earners, the London-based giant notes in reference to taxes on high fortunes.

Cedears: sectors benefiting from possible scenarios

Repetto explains that under an election for Trump, the sectors favored by deregulatory policies, with support for traditional infrastructures and large holding companies: include fossil fuels, technological megacorporations and industrial manufacturing. In that context, the stocks that the analyst looks at are Apple Inc. (AAPL), 3M Company (HMM), RTX Corporation (RTX), Tesla Inc. (TSLA), Wells Fargo & Company (WFC) and Exxon Mobil Corporation (XOM).

To diversify and protect profits made in 2024, other analysts suggest considering a mix of basic consumption and health sectors in the portfoliowhich would provide an additional layer of security against possible market fluctuations.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.