The Agency for the Transformation of Public Companies continues to incorporate state companies that will be transferred to the private sector through different mechanisms. Currently, the area he directs Diego Chaher The fate of 62 companies in which the State has a majority stake, another 59 in which it has a minority presence and another 8 in the process of liquidation are under analysis, according to the list to which had exclusive access Scope.

So far, there are 129 companies of all types from which the State plans to withdraw by appealing to different procedures. “And, there may be more.”they confess in the presidential environment.

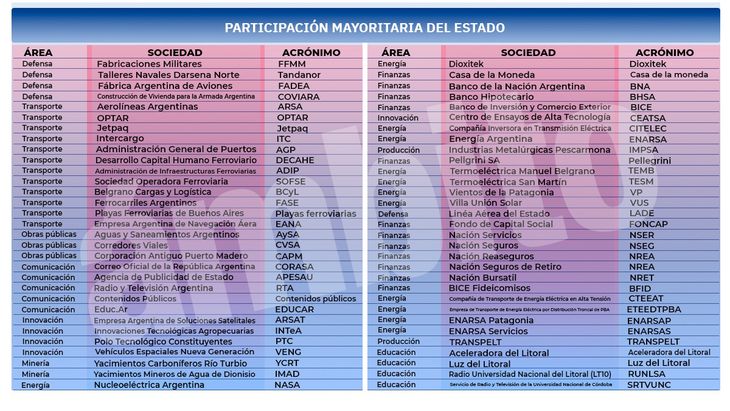

The most relevant companies under study are, among others, Argentine Airlines, Intercargo, General Administration of Ports, Road Concessionshalf a dozen railway companies, ARSAT, ENARSA, IMPSA, Mintthe banks Nation, Mortgage and BICE, Military Manufacturing, Tandanor, Water and Sanitation (AySA) and Public Television.

table-01 PRIVATIZATION

The criteria used by the authorities in charge of the area goes beyond the simple privatization process. In a synthetic way, it aims to analyze the situation of each of these companies, see which segments have value and evaluate the best ways for these activities to move to the private sector. Although the intention is also to use these assets to exchange debts that the Nation has with the provinces.

The intention is to “organize the accounts of the Nation and the provinces,” said days ago the vice chief of the Interior Cabinet, Lisandro Catalán. The official objective is to net the debts between the Nation and the provinces, although “without money.” This is the reason why the negotiation will be open to all types of proposals.

table-02 PRIVATIZATION

At the negotiation table, the payment of the Nation’s debts will be evaluated with tools such as: transfers from national companies whose activity is carried out in the province; shares of national companies; fiscal lands, or national routes that then “serve the provinces to grant concessions and improve their infrastructure,” he explained. Under this umbrella, and as an example, For example, Córdoba was interested in the Argentine Aircraft Factory.

The government of Milei aims for the majority of state companies to pass into private handseven when they are used as payment of the Nation’s debts with the provinces and will be a point that will be put on the negotiating table.

box-03 PRIVATIZATION

What are the six tools for this process

For now, there are six mechanisms that are planned to be applied:

- Initial public offering: to raise funds through a stock market listing. It may be total or partial, sale of shares, capital increase, tender or public offer.

- Concession: of companies or units.

- Transformation: asset splits, sale of expendable assets, transfer of non-strategic units.·

- Assignment: to the provinces.

- Closing: operational closure, liquidation, merger by absorption.

- Strategic partners: associative contracts.

Transfer to the provinces

Also the official intention is to use these assets to exchange debts that the Nation has with the provinces. In this case, the tool was announced last week by the Deputy Chief of Staff of the Interior, Lisandro Catalán.

The official goal is “organize the accounts of the Nation and the provinces.” The Ministry of Economy and the provincial authorities will net the debts and the difference will be settled with state assets since, as Milei says, “not “money.” This is the main reason why the authorities will be open to all types of proposals that the provinces may suggest.

However, it should be noted that the desire of the government of President Javier Milei is not for the companies currently in the power of the National State to pass into the orbit of the provincial states, but for the interior administrations to collaborate with the privatization process, as stated in official sources.

Those around the head of state assure that privatizations will close “a source of income for corrupt politicians.”

The president considers that the transfer of companies currently managed by the public sector into private hands is a fundamental part of his fight “against the political caste.” What’s more, they explain in the presidential environment, “even if the company has a surplus, it will still be transferred to the private sector because if it remained in the public orbit, corrupt politicians would make it lose again.”

However, the purpose of cleaning up public accounts and solving the liabilities that the Nation has with the provinces will in practice mean that pragmatism participates at the negotiating table when netting liabilities.

So far these are the latest developments in the progress of privatizations, the matter is:

Offers received for IMPSA

Until October 31, offers were received for the tender for 100% of the State shares in Industrias Metalúrgicas Pescarmona (IMPSA). It is estimated that the results will be available in 15 days.

OPT FOR EMPLOYEES

Wholesale Operator of Tourist Services (OPTAR), a company that is responsible for the sale of tickets for various airlines, mainly Aerolíneas Argentinas, could be the first case of a firm that is transferred by the State to employees who number around 20.

COVIARA closes

The Government would have resolved the closure of Housing Construction for the Navy (COVIARA) dedicated to the construction, acquisition and allocation of housing for the personnel of the General Staff of the Navy, the Argentine Naval Prefecture and the Ministry of Defense.

AYSA, NASA and ARSAT go public

The intention of the Executive Branch is to expand private participation in the companies Agua y Saneamientos Argentinos, the telecommunications company ARSAT and Nucleoeléctrica Argentina, say government sources, by placing shares on the stock market.

TANDANOR reprofiling

The official evaluation is that the company Talleres Navales Dársena Norte (TANDANOR) has potential to the extent that it is projected as a supplier of ships for the international market. Consequently, they rule out closure or scrapping and are calling for specialists to evaluate alternatives.

YPF’s strategy

YPF’s strategy “focuses on profitability,” said the head of the oil company, Horacio Marín, in the speech he gave this week to the businessmen of the Inter-American Council of Commerce and Production (CICYP), a presentation that was interrupted by numerous applause. In this sense, the company plans to sell YPF Chile, YPF Brazil, Refinor and MetroGAS. The potential spin off of YPF Agro and YPF Arenas is also being considered.

It is planned to focus on technological developments -YTEC- and promote Profertil -the objective is to stop importing urea- and YPF Luz, the third largest generator of electrical energy in the country and second in renewables.

In order to obtain profits, Marín commented that the oil company has as one of its most profitable lines the service stations where it sells a million soccer balls and aspires to beat McDonald’s for leadership in the sale of hamburgers.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.