Dead Cow Southern Pipeline VMOS.jpg

Map with the progress in the expansions of midstream oil projects. All these initiatives in operation will allow Argentina to export 1.5 million barrels per day in 2028.

The second part, which connects Allen with the deep water port Punta Coloradain Río Negro, is 440 kilometers long, and will require an investment of more than US$2.5 billion.

YPF The construction of a new pumping station is also planned in Chalforé, a park tanks to store crude oil of 600,000 cubic meters and two monobuoys for the world’s largest oil cargo ships, which are called VLCC (Very Large Crude Carrier). There are two monobuoys in case of failure, which guarantees continuous and permanent export.

These pieces are fundamental pillars of the business: they can connect with the VLCC which are used to sell oil to Asia and carry up to 2 million barrels. So, The cost per Argentine barrel exported to that destination is reduced between 2 and 3 dollars per barrel. Therefore, oil companies that use this pipeline will have extra profits, unlike other export points.

image.png

The monobuoys are used to load oil tankers. Through underwater pipelines, they connect to onshore terminals.

When will the pipeline open and how much oil will it transport?

According to the roadmap you accessed Energy Reportthe commissioning is scheduled for the third quarter of 2025, when the hydraulic tests will be carried out. At YPF they want the inauguration to be on July 9, Independence Day.

For the second half of 2026, it is expected that transport 180,000 barrels per day. The plan indicates that a year later it will increase to 500,000 barrels per day, goal that will be achieved with new intermediate fire stations before reaching the Atlantic coast. By 2028 it is expected that the 700,000 barrels.

By 2028, the forecasts anticipate that Argentina’s total oil production will be 1.5 millionabove the amount of crude oil they produce today Venezuela, Colombia and Ecuadoralthough still behind Brazil and Mexico.

Who are YPF’s partners in the Vaca Muerta Sur Pipeline (VMOS)

Vaca Muerta Southern Pipeline (VMOS) is the name of the new private company he founded YPF with its six partners: PAE, Pluspetrol, Vista, Pampa Energía, Shell Argentina and Chevrón. The last two companies are the last to enter, because they still have to validate the membership in their foreign subsidiaries. But they are already inside the project.

In the negotiations for the fine print of the VMOS, YPF did not give in to pressure from any of the partners that they intended to include in contracts between private parties a textual consideration that “regulated” the modification to the article 6 of the Hydrocarbons Law that the national government established with the Base Law, but it has not yet been regulated or put into effect.

That article 6 states that the national Executive Branch may not intervene or set marketing prices in the internal hydrocarbon market and that permit holders, concessionaires, refiners or marketers They may export hydrocarbons and their derivatives freely, subject to the non-objection of the Ministry of Energy. This is the desire of those who seek to protect exports, beyond domestic supply.

Vaca Muerta Sur pipeline

Next week the work will be awarded to the contracting companies. One of those that participated in the tender was the UTE Techint-Sacde.

YPF

In exchange, YPF accepted unanimity in access to the pipewithout priority or dominant positions. As explained by the promoters of the VMOS, each partner will have access to the space in the pipeline for which they pay, and if they have to request an extra at any time, they will only have to ask for it. “The rate is competitive and the same for everyone”they stated in the Puerto Madero Tower.

The first CEO of VMOS will be appointed by YPF and will hold the position for one year, with the possibility of continuing if the partners wish. This decision was made so that the specialists who carried out the work work “in coordination” with YPFwho led the construction. The person most responsible for the oil company is Mario Gallinopersonal friend and former colleague at the Techint Group of Horacio Marin. Gallino was one of those who led the construction of the President Néstor Kirchner Gas Pipeline -now renamed Perito Moreno- and is considered one of the people who knows the most about midstream in the country.

Each oil company will have a seat on the board, but there will also be a smaller participation of other smaller oil companies, which also want to export, but around 1,000 barrels per day. They will be the class B partners that will be able to jointly access a dispatch capacity of up to 65,000 barrels per day.

How much is the construction of the Vaca Muerta Oleoducto Sur (VMOS) worth and how is it financed?

Until now YPF presented two projects to join the Incentive Regime for Large Investments (RIGI): the El Quemado solar park in Mendoza and the VMOS.

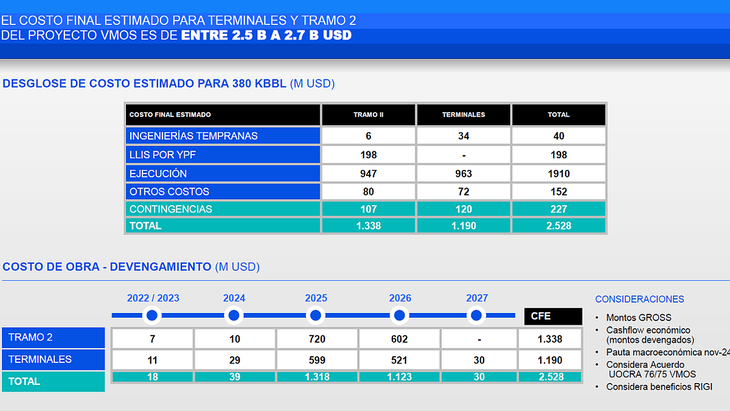

Taking into account the benefits of RIGI, The total cost of work amounts to US$2,528 millionof which the partners will contribute the first US$720 million to start work. The remaining 70% (about US$1.8 billion) will be financed with loans from local and international banks, which each partner must provide. The objective is to achieve US$1.5 billion from abroad and the rest with domestic banking.

“The most important thing about RIGI is that it provides long-term stability and provides a state framework to return to the international market for long-term syndicated loans for Argentina,” said one of the heads of the project. This external credit is paid outside the country and, according to what they said in YPF, “no one can touch it.”

Dead Cow YPF Northern Pipeline

The Southern Pipeline Dead Cow It is the largest private investment in history when other charges that the work will have are added, such as interest on financing or insurance. According to that calculation, The investment can reach US$3.2 billion in total. But YPF clarifies that they are talking about 2,500 because that is how it was presented to the Ministry of Economy as a RIGI project.

“The VMOS has already been submitted to the Regime and became the first project in the O&G industry. “This is one of the most important private infrastructure projects in Argentina in the last 20 years,” Horacio Marín said during a meeting with journalists, in which he participated Energy Report.

Who will build the pipeline for YPF and its partners

Next week YPF and its partners will award the construction of the pipeline, which was divided into two sections, with two different tenders. The most extensive and expensive was international and the smallest for national companies. As this media learned, two companies are fighting over the work: one is the UTE Techint-Sacde (Pampa Energía)who already built a large part of the Gas Pipeline (formerly GPNK) and quoted for both sections. The other is a firm from abroad.

The American Energy Transfer who showed interest in participating in the end was left out because he asked for too much. “They wanted extraordinary profits and we didn’t allow them”said a man from YPF with knowledge of that negotiation.

What has already been purchased are all the hundreds of pipes necessary: they cost US$180 million and they will be manufactured Tenaris. In YPF They estimate that by December all contracts should be signed with partners. In January they will finish the first stage, two months ahead of schedule. In April 2025, the storage tank rings would arrive.

image.png

The table of costs and investments that YPF foresees for the work that will allow the export of more than 700,000 barrels of oil from Vaca Muerta.

The VMOS projected it YPF during the management prior to the arrival of Horacio Marin. However, after studying the original plan, changes were made. To reduce costs, the crude oil tanks were redesigned, improvements were applied in the use of electricity, instrumentation and facilities. The work deadline was also lowered, which results in less cost. With these changes, The pipeline maintained its primary investment forecast, which was around US$2.5 billion. If accumulated inflation is discounted, the savings were US$500 million.

Although Puerto Madero is ecstatic about the project, they are also worried. The CEO announced a month ago that the work would be awarded on November 14, with all partners having signed papers. But they are 14 days late. “The warehouseman’s account is easy: a barrel costs 75 dollars, if 520,000 barrels are exported per day, it is 38 million dollars. If 14 days have already passed, the industry is losing more than 546 million, we have to accelerate it now.”

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.