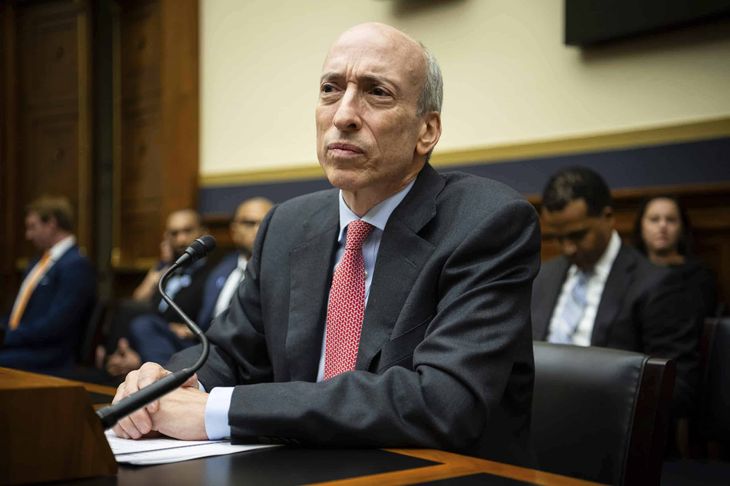

Gensler, harshly criticized for his regulations in the markets, especially cryptocurrencies, will leave his position and the SEC will be in charge of interim presidents.

The president of the SEC, Gary Gensler, whose ambitious agenda generated fierce resistance from Wall Street and the cryptocurrency sector, He will resign on January 20.

The content you want to access is exclusive to subscribers.

“The Securities and Exchange Commission is an extraordinary agency,” Gensler said in a statement issued Thursday. “The staff and commission are deeply mission-oriented, focused on protecting investors, facilitating capital formation, and ensuring markets work for both investors and issuers.”

His departure will leave the SEC in the hands of an interim president who could be Mark Uyeda or Hester Pierce, both Republican commissioners.

Who is Gary Gensler?

Gensler, who describes himself as a “market man” and who was appointed by President Joe Biden in 2021, carried out an aggressive agenda in which the disclosure of information on climate risksstock trading reforms, and crackdowns on crypto scandals. Some of its regulations will leave a lasting mark on finances.

Others have been blocked in conservative courts. The Trump administration’s next nominee to chair the SEC could seek to further dismantle Gensler’s flagship rules and adopt a more cryptocurrency-friendly approach.

Gensler’s policy achievements include acceleration of settlement time for stock market operations in the United States and new regulation that will allow trillions more dollars in U.S. Treasury bond market transactions to be centrally settled each day. Insider managers also face stricter rules on disclosure and share sales.

gary-gensler-sec-demand-renuncia.jpg

Gensler was harshly criticized by the cryptocurrency world

Trump’s victory, a kick for his resignation?

The next president could reverse the focus on hedge fund regulation and venture capital through stronger disclosures, and look for ways to override the agency’s climate risk disclosure rules. Many of them have already been challenged in court. Trump’s SEC probably will relax measures against brokers, banks and hedge funds for using third-party messaging apps to communicate.

The Digital asset industry could see radical change in SEC policy. Gensler doggedly pursued cryptocurrency scammers, as well as companies like Coinbase Global Inc. and proprietary trading giant DRW Holdings for failing to register with the agency. The industry strongly objected, saying that Gensler had provided no real way for the nascent asset class to fit into decades-old structures.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.