A group of prominent bankers expressed optimism about the prospects for the US economy under President-elect Donald Trumpand believe their tariff threats will be manageable.

At the same time, many senior financiers and asset managers gathered at the conference Women, Money and Power The Bloomberg agency on Tuesday noted that Europe faces slower growth and political divisions that will hold the continent back. Both regions will have to address inflationary pressures that have affected people’s living standards, executives said at the event.

“The bright spot is the United States“There is a lot of talk about roads that lead here, about fantastic entrepreneurship, this country is incredible,” said Jane Fraser, CEO of Citigroup Inc. “Europe has it more difficult. “They have structural challenges: the labor market is not as flexible, they don’t have the scale that the U.S. has, and they face some competitiveness issues.”

Ana Botín, CEO of Banco Santander SA, agreed, noting that there is an “urgent need” for Europe to reform, arguing that the continent’s member states need to be incentivized toward greater cooperation and taking on more risks, Bloomberg quoted her as saying.

“One thing that works in Europe and Brussels is, ‘My God, the Americans are going to get ahead of themselves again,'” Botín said. “That seems to be the only motivation that works.”

Anne Walsh, chief investment officer at Guggenheim Partners Investment Management, warned that markets have failed to factor in the risk of political chaos in France following a no-confidence vote this month. He added that Germany’s economy also faces “recessionary pressures.”

“Fundamentally, Europe has had difficulties and I think it will continue to face them,” he said.

Some of the recent political tumult that has shaken the continent could represent an opportunity for the United Kingdom to take a more prominent role in the relationship between Europe and the United States during Trump’s second term, according to Jane Hartley, current US ambassador to the Kingdom. United.

The Federal Reserve faces its “last stretch”

“The first call is to the US and our first call is to the UK,” Hartley told the audience in London. “There is concern about the larger countries in Europe, that’s why I keep coming back to the UK, we need the UK to lead because, as we know, recently we’ve seen a lot of political instability in France, political instability in Germany. So the UK needs to play a role.”

Speakers at the event shared a generally positive view of the U.S. economy, predicting that Trump’s promises to impose widespread cross-border tariffs will fade.

The incoming administration will likely “use tariffs as a bargaining chip, and it probably won’t be as bad” as many fear, said Paula Volent, chief investment officer of Rockefeller University’s $2.5 billion endowment.

US Federal Reserve

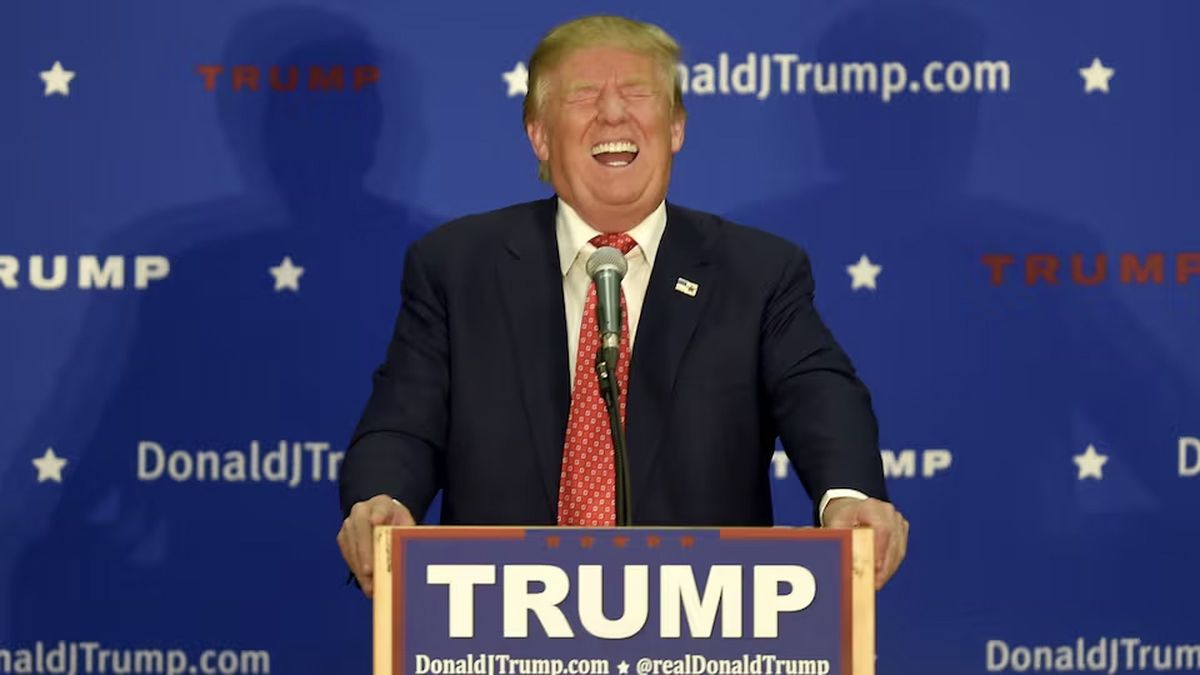

Bankers in the US are excited about Donald Trump’s next term.

Many of the executives predicted that growth in the private markets will continue. Walsh projected that the value of private credit assets could double to $4 trillion globally. Morgan Stanley has increased offerings for wealthy clients interested in investing in private companies in recent years, as many lengthen their path to initial public offerings, according to Elizabeth Dennis, head of the lender’s private wealth management arm. Meanwhile, Citigroup’s wealthy clients now typically have more than a quarter of their portfolios allocated to private markets, according to Ida Liu, global head of the firm’s private bank in New York.

“There will be an increasing allocation to private markets,” said Joan Solotar, who oversees private wealth solutions at Blackstone Inc. “There’s a growing recognition that if you only invest in stocks and bonds, you’re working with a very large portfolio.” limited”.

Franklin Templeton Investments CEO Jenny Johnson offered a warning about the private credit boom, saying these assets should trade at a premium to traditional fixed income products due to their lower liquidity.

“You don’t get any illiquidity premium, and that worries me,” he said. Franklin oversees a total of $1.6 trillion in assets.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.