CABA: the details of the 2025 Budget

In its last session of the year, the CABA legislature approved the 2025 Budget and detailed its action plan for the next year of management. The approved project expresses investments for different areas of the city and, financially, establishes fiscal balance with Zero Deficit and the lowest debt in recent years.

Security

The 2025 Budget estimates the largest investment in security in Buenos Aires history, with 16.5% of the total projected for 2025. In this way, the Macri administration will seek to add more equipment for the security forces: new patrol cars, more tasers and byrna guns, more video surveillance, greater amount of police on the street and new Safe Points will also be installed.

In addition, they also announced that the works will be completed in the Marcos Paz penitentiary center and, with the transfer of the Penitentiary Service, the problem of the prisoners housed in City facilities.

Education

It is the area with the greatest budgetary participation, with 20.1%. For next year the investment will reach $2 trillion 795 billion.

In detail, resources will be allocated to works and remodeling in schools and hospitals, TUMO centers will be developed and schools will be improved through new building works through a Master Plan, and the incorporation of new technologies and learning systems within the Buenos Aires Learn plan. Additionally, the City will implement important changes to the educational system.

public work

Budget 2025 projects an increase in capital spending19.3% of the total budgetsurpassing the historical average of 16%. This area will be based on two main axes: Comprehensive Urban Mobility and Revitalization Plan for the South zone.

He Comprehensive Urban Mobility Plan It is divided into the Underground Network, Micromobility, Automotive Transport, Electric Mobility, Construction of Under-Level Crossings, Road Works and Traffic Planning. Among others, they are going to completely renew the subway line B cars and renew stations. The Trambus and a new electric bus line will be launched in the Historic Center after the transfer of the 31 lines to the City. In addition to widening and renovating the Dellepiane Highway and building new Underpasses.

image.png

The most notable projects for 2025.

GCBA

On the other hand, work will be done on reactivation of the City Park and its urban environment and the enhancement of the Autodromo. The new Urban Code promotes balance through the development of the South and the protection of neighborhood identity in the rest of the City, with height controls and the expansion of the block’s lungs.

Tax changes for 2025

ABL Update

During Thursday’s session, the Buenos Aires legislature also approved tax modifications for next year. In this way, the ABL update will reflect:

- Table with the highest and best level of disaggregation, going from 7 to 10 scalesthis change results in a more progressive and equitable system.

- Restructuring in the way the ABL is calculated and incorporation of the geographic coefficient to gradually recompose the proportion of the rate in the cost of the service.

- In 2025 the tax will be updated according to the inflation rate plus a percentage determined by the geographical area in which it is located:

- Communes Zone I (South) 2%

- Communes Zone II (Center) 3%

- Communes Zone III (North) 4%

For mitigate the impact of this update are expected bonuses according to the valuation of the property:

- Properties with a homogeneous tax valuation (VFH) less than or equal to $26.6 million will have a bonus so that the 2025 annual tax does not exceed an increase of 20% with respect to the annualized December 2024 tax. This bonus will protect 1,076,914 properties, 54% of the total of the 2,004,740 games.

- Likewise, those properties with VFH greater than $26.6 million and up to $38 million will have a bonus so that the 2025 annual tax does not exceed an increase of 35% with respect to the annualized December 2024 tax, protecting 257,391 properties, 13% of the total games.

- Finally, the remaining 670,435 items with VFH greater than $38 million will have updates according to inflation.

For its part, retirees and pensioners may request the ABL exemption. They must meet the following conditions:

- To request the exemption, current regulations establish that The 2011 Tax Valuation must not be greater than $75,000. This requirement is completely outdated and it is difficult to access the 2011 Tax Valuation, which complicates obtaining the exemption.

- The other requirement is receive an asset equal to or less than double the minimum living wage or two and a half times the minimum retirementwhichever is greater.

On the other hand, for 2025 it was proposed to use the Homogeneous Tax Valuation of the property as a reference, with a maximum value of $40 million. In addition, it will be extended to more beneficiaries: starting next year it will be a requirement to receive an asset equal to or less than four and a half times the minimum retirement.

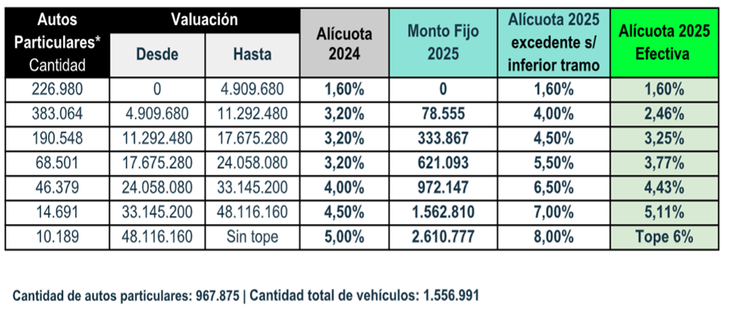

Patent Update

Finally, the Buenos Aires government will also establish changes in the collection of license plates to avoid sudden jumps between similar valuations (for example, a vehicle with a higher value of $1 generated a jump in section towards a higher rate that, automatically, generated double tax). Thus, it was proposed to restructure the way the tax is calculated, in order to achieve a more equitable system through the readjustment of scales and aliquots.

- The new proposal generates progressivity from the increase in the valuation of the vehicle, defining a minimum amount in each scale and an aliquot for the surplus. And tax equity is achieved for vehicles with similar valuations. With the new scheme, the table looks like this:

The universe of 1,556,991 vehicles will be impacted in the following way:

- 81% of the registry (1,265,858 vehicles) will have an effective rate less than or equal to the current during the year 2025.

- In that sense, 37% of the total (581,456 vehicles) will have a reduction in their effective rate with respect to 2024, while 44% (684,402 vehicles) will maintain their current effective rate.

- 19% (291,133 vehicles) would have a increase in its effective rate but which in no case can exceed the limit of 6%.

image.png

The scale of patents established by the Buenos Aires legislature for 2025.

GCBA

In reference to cars hybrid and electric, Until now they were exempt from paying the tax. Starting in January 2025, they will maintain the exemption for the first 24 months. Afterwards, they will receive a reduction of 60%, 40% and 20% on the tax payable, respectively. From the sixth year of filing, they must pay the entire corresponding tax.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.