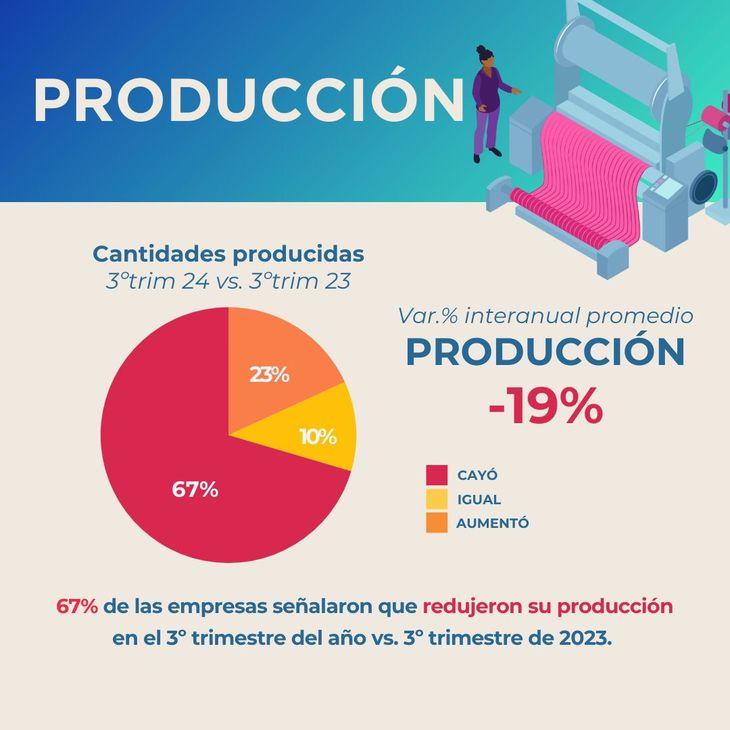

The ProTejer Foundation carried out a new Situation Survey of companies in the textile and clothing chaincorresponding to the third quarter of the year. The results reflected that, despite a slowdown in the fall compared to the first months, Production in this activity is 19% below last year.

The survey consulted more than 100 companies of the different textile and clothing links on the evolution of the main variables of sales, production, use of installed capacity, investments and foreign trade in the III quarter of 2024. This item It generates 540 thousand jobs and, therefore, supports 2 million people at the federal level.

The study confirmed nine consecutive months of strong year-on-year contraction in activity, with growing damage from impact on employment and possible closure of productive establishments in case the idle installed capacity remains.

The main cause identified that impacted the decline in activity was the loss of purchasing power of the population.

In breakdown, 7 out of 10 companies respondents saw reduced sales and production in the third two months of the yearwhere this first item also recorded a average year-on-year drop of -18%; while in the case of production, -19%. Likewise, the use of installed capacity fell in 64% of the cases surveyed. On average, the drop was -12 pp in the third quarter of the year in its year-on-year comparison.

sales.jpeg

Data from the Situation Survey on sales.

The main reasons that explain the drop in production is the loss of purchasing power of the population (almost all companies consider this cause as relevant), changes in the share of imported goods in consumption (3 out of 10 companies) and macroeconomic expectations and change in the business climate regarding the future (4 out of 10 companies) . With these data, it is denoted that the crisis is jointly impacting all areas of the value chain: from the manufacture of yarns, fabrics, clothing and the marketing of machines, inputs and final goods.

production.jpeg

Data from the Situation Survey on production.

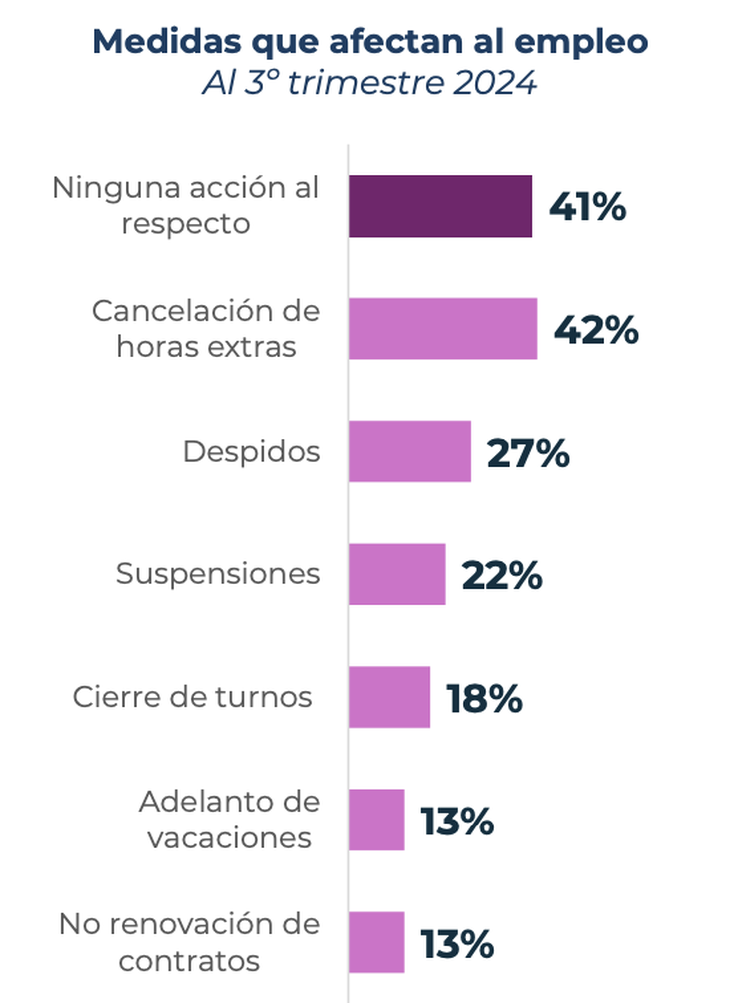

Furthermore, as detailed in the study, other reasons identified as relevant are “the variation in costs of raw materials and inputs, exchange rate appreciation and the change in sectoral policies for the industry.” In addition, during the first nine months of the year, 59% of the companies surveyed took measures that negatively affected employment, such as the cancellation of overtime, dismissals, suspensions, advance vacations and non-renewal of contracts, among others.

measurements.png

59% of companies have taken some measure that affected employment during the first half of 2024.

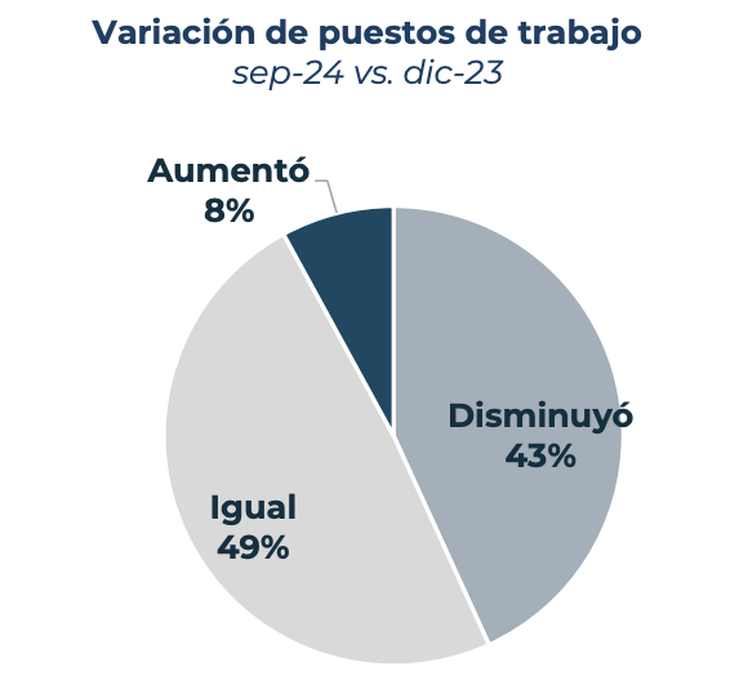

Below that line, 43% of companies indicate that employment fell When comparing September 2024 with December 2024 and only 8% registered an increase in the number of jobs, a figure that reflects a worrying situation, especially if we compare with the first two months of the year, when only 21% registered fewer jobs than in December 2023.

Screenshot 2024-12-13 at 18.52.20.png

The number of jobs decreased by 43%. Only 8% increased their staff.

Investments, exports and payment chain

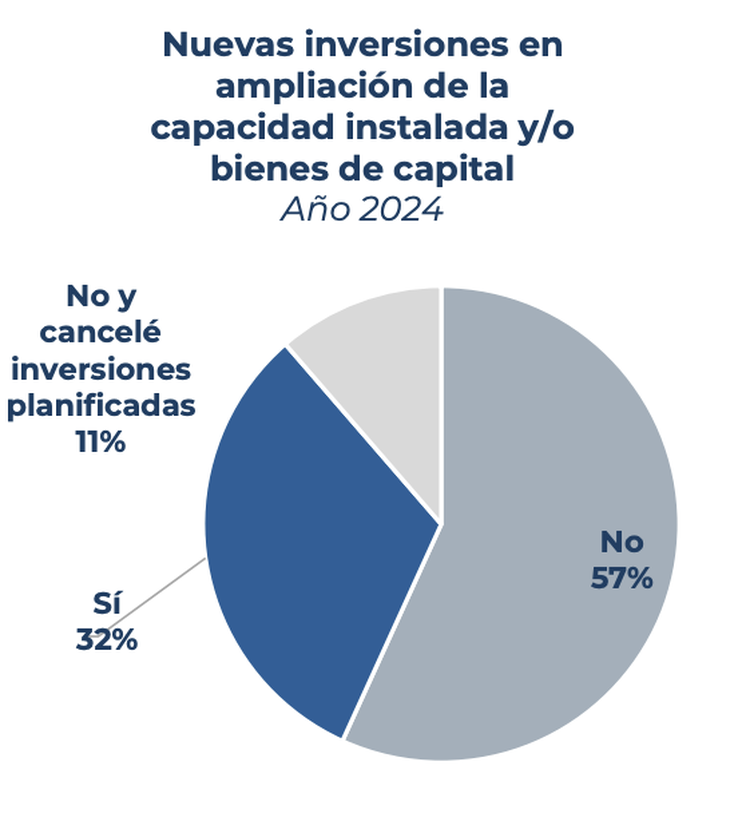

Regarding investments, it was revealed that 7 out of 10 companies will not make or have made investmentsand some of them even canceled planned investments. These numbers reflect a clear contrast with the investment record in previous years.

investments.png

68% of companies will not make investments during 2024 and/or have canceled previously planned investments.

Regarding exports, although 32% of those surveyed have exported in the last 5 years, only 19% have made sales abroad in the first nine months of the year. Along these lines, 7 out of 10 companies encounter difficulties in exporting, the main ones being: the “exchange rate” (73% of companies), “tax pressure” (44%), macroeconomic volatility (32%) and “national bureaucratic obstacles” (32%).

Regarding the payment chain, 28% said they already have difficulties in making current payments (taxes, fees, suppliers, salaries, imports).

Measures to improve the situation of the value chain

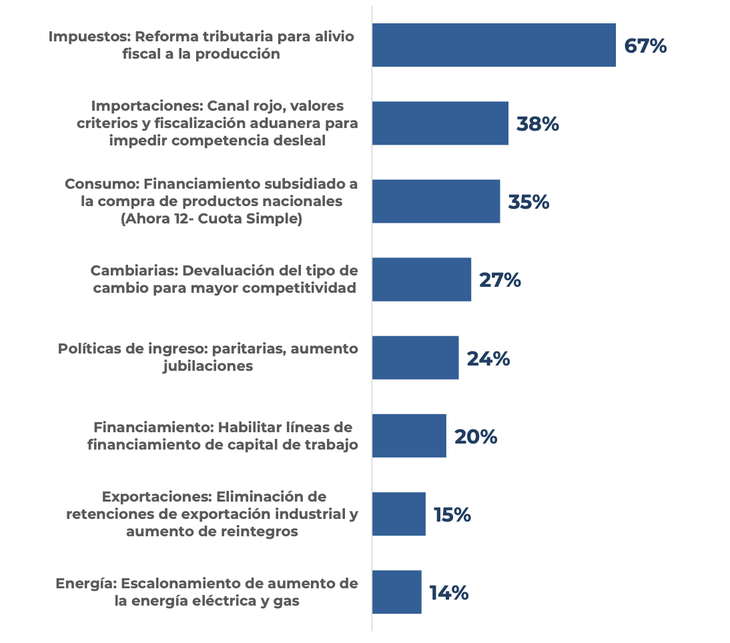

In a context of industrial contraction, where all sectors are affected, companies were consulted about the public policies that they consider most relevant to overcome the current situation. Being able to choose 3 options, 67% of companies consider that it is necessary to advance a tax reform that grants tax relief to production.

value chain.png

Companies look to the future.

Under this line, in second place, 38% consider it relevant to take political measures to protect fair competition against imported competition. 35% consider financing measures for domestic consumption relevant, with programs such as now 12 or simple installment; while in fourth place, 27% of companies highlight the relevance of correct the exchange rate to achieve greater competitiveness and price.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.