The national government will be able to close the year, perhaps, with good data regarding tax collection. Some indicators show that in December tax revenues will once again mark a slight growth in real terms as occurred in November.

The improvement is due to The economy stopped falling since the partial recovery of public income allowed greater consumptionall in comparison to the same month in 2023, which was low activity. In November, collection had grown 4.6% in real terms, helped by money laundering and the moratorium. The final data will be released this Thursday.

Therefore, for this month we have to clear, the extraordinary components that are influencing the improvement in incomeof those that don’t, that are more permanent.

vat.png

For case, The tax moratorium is providing a mass of resources that did not exist in 2023, in the same way as the PAIS Tax that continued to operate until December 24in the case of card consumption. In the case of imports, it stopped generating resources a month ago.

On the other hand, the improvement in economic activity, although slight, withholdings and partly consumption generate improvements in income in two of the most important taxes of the tax structure such as VAT and Income Taxes that are shared. Precisely, the resources for the provinces from these taxes increased in real terms by 7.5% in December, according to data from the Ministry of Economy.

As pointed out byAccording to Politikon Chaco, the Income Tax increased 13.4% in real terms year-on-year in December and VAT also increased by 3% in real terms.as did Internal and Other Co-Participated Taxes, which grew 2% and 173.8% real year-on-year, respectively. The monotax would have grown 142%, among others.

Trend change

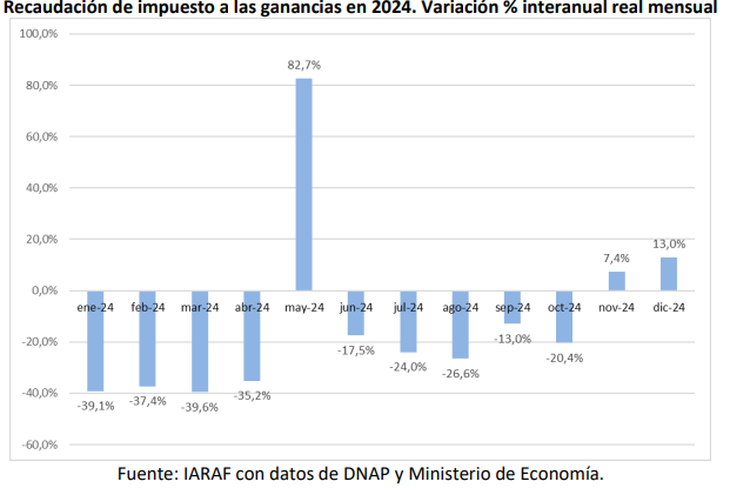

According to him Argentine Institute of Fiscal Analysis (IARAF), together, the collection of VAT and Income Tax would have registered a real year-on-year increase of 6.5%. In the accumulated annual period, the sum of these taxes would register a real negative interannual variation of 9%. However, in December the real interannual collection of Income Tax increased for the second consecutive month, while that of VAT increased for the first time since February.

IIGG.png

Improves the distribution of co-participation

On the other hand, Politikon Chaco, in 23 of the 24 subnational jurisdictions, real increases in automatic shipments of resources of national origin were observed. In this framework, the provinces of Santa Cruz and Tierra del Fuego (8.4% and 8.3%) presented the largest expansions of the month; At the other extreme, the province of Buenos Aires presented a drop of 6.1%.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.