After launching the regime of fiscal transparency between large taxpayers and supermarket chains, The Government hopes that this will be generalized and extended to the provinces and municipalities while it ratifies the current deadlines.

The new scheme of billing works from January 1, according with current regulations. All the rest of the Commerce sector must join from April 1.

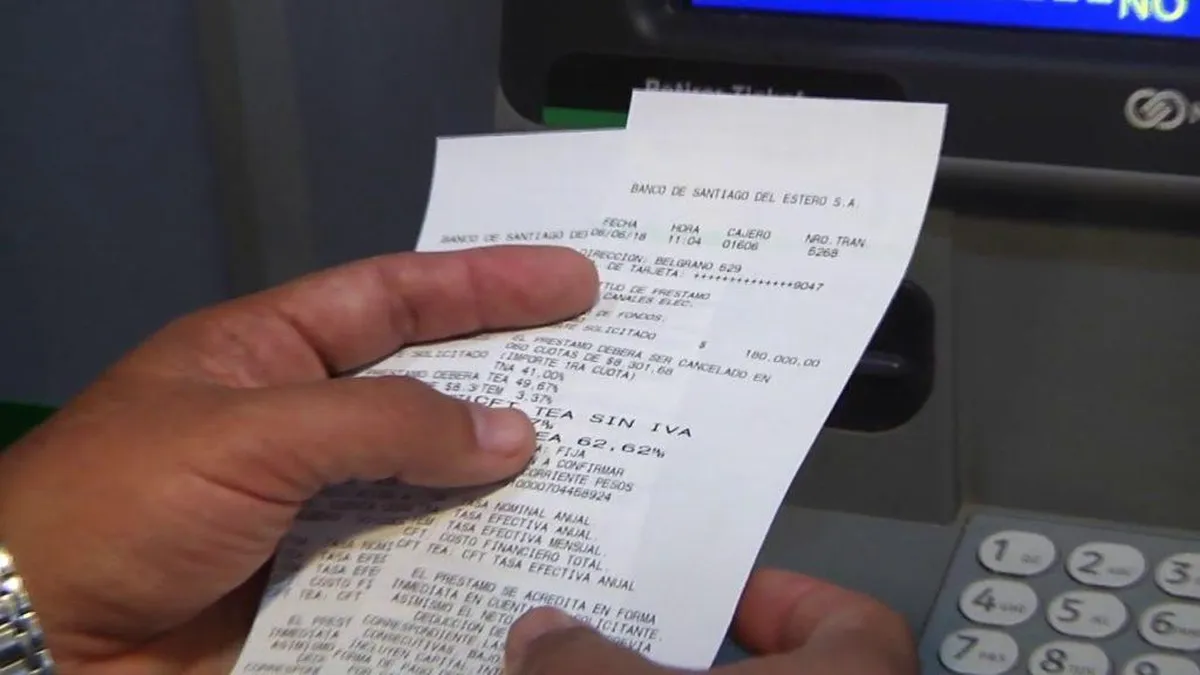

Fiscal transparency forces companies to detail in their sales receipts, whether tickets or invoices, the amount of taxes separated from the price. For the final consumer, the most important thing is the Value Added Tax (VAT). For the moment, they are national taxes.

Sources of the Undersecretary of Consumer Defense and Commercial Loyalty They informed Ámbito that, from that agency, they hope that subnational states will join. “The idea is that, over time, the provinces and municipalities join,” they explained.

fiscal-transparency.png

The Ministry of Economy dependency recognizes that, in some cases, there were delays in implementation, “More than anything, due to computer problems.”

The system is only about 10 business days old since its implementation. The undersecretary indicates that progress will be made in the supervision to the extent that the new billing scheme is developed.

Also, sources from the supermarket sector in the interior of the country they pointed to Scope that the implementation of Transparency Regime is being carried out without problems.

The Customs Control and Collection Agency (ARCA) regulated the regime on December 12.

How it will be implemented

The measure, implemented through General Resolution 5614/2024, It is implemented in a phased manner and will gradually be extended to smaller taxpayers.

The norm contemplates that The rest of the universe of those responsible for VAT registration may optionally join the tax transparency regime until March 31, 2025. and mandatory from April 1st.

All receipts must have a line detailing the amount corresponding to the value added tax and, When issued by a large company, they will also indicate internal taxes that affect the final price paid by the consumer.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.