The transfer of Leliqs and Passes to Lecaps, plus the credit boom, weakened liquidity regulation instruments. They warn that this creates problems in reducing rates.

Bank liquiditywhich measures the quality of a financial entity’s asset that can be quickly transformed into cash, fell sharply during the first year of the Javier Milei era, both in pesos and in dollars. It happened in the context of a strong credit expansion.

The content you want to access is exclusive to subscribers.

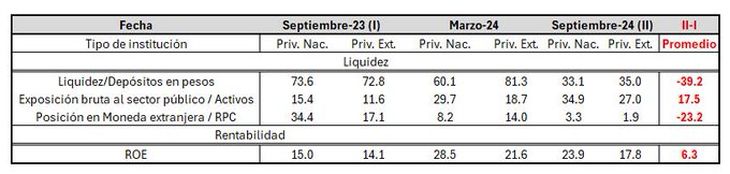

According to the report on banks from the Central Bank (BCRA), the broad liquidity indicator decreased by 30.3 percentage points for the segment in national currencyfrom 68.2% to 37.9% of total deposits in pesos, and 9.8 points for the foreign currency segmentfrom 86.8% to 77.4% on deposits in this denomination.

In monthly termsliquidity in pesos increased 1.2 points versus October. “This increase responded to a greater holding of Lefi and public securities used to integrate minimum cash,” detailed the BCRA. While in foreign currency the indicator contracted 3.8 points in monthly terms.

Why did bank liquidity drop and how can it impact lower rates?

In his X account, the economist, teacher and researcher Damián Pierri pointed out that liquidity regulation instruments were weakened because part of the Leliqs/Pases that the banks had are now in Lecaps without a daily window (as the Lefis do have). Additionally, he added that The lack of liquidity weakens when entities dismantle Lefi to make way for the rise in credit.

Pierri.jpg

In this context, the specialist maintained that the dynamics of the banks’ situation in recent months, characterized by this lower liquidity, greater holdings of public securities and de-dollarization, makes it difficult for active rates in pesos to fall in line with inflation expectations. “The lowering of monetary policy rates would have little impact on active, passive and market rates simply because the banks are not liquid and are increasing margins“, he deepened.

Faced with this panorama, Pierri stressed that, “if reserve requirements are lowered, they increase liquidity in a fragile context” and that “if rates are lowered, the power of the signal is trapped in the banks’ balance sheets.” “Structural problems require comprehensive changes. Monetary policy needs a ‘service’“, he expressed.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.