The decision to choose between sovereign bonds either Bopreal Not only depends on the technical characteristics of each instrument, but also on the risk profile of each investor. In this note I tell you all the details.

The Bopreal, issued by the Central Bank, were created with a double purpose: to settle the debt with importers, inherited from the previous government, and absorb weights to stabilize the exchange rate. Its expiration, concentrated in 2025, 2026 and 2027, places them within the current government horizon, an important detail for those who prefer to avoid political risks.

On the other hand, sovereign bonds, issued by the national state, have much longer terms, extending until 2041. This implies greater exposure to the political and economic risk of Argentina beyond the mandate of Milei. However, they also offer a performance potential that could be attractive to the most aggressive profiles.

What to choose? For the exercise we will analyze the bopreal that expires in 2026 and the one that expires in 2027. The first has an 8% IRR and the second yields 9.5%. They are interesting alternatives.

And the sovereign bonds? Let’s see how the curve is:

Bopreal1.png

For the exercise I am going to focus on a short bonus (A30) and one long (AL35). The first yields 12.2% and the second 11.2%.

The difference between the performance of the Bopreal and the sovereign bonds seems significant, but there are other key factors to consider. First, the “duration” of the Bopreal is lower. This means that the period of recovery of the money invested is shorter, which reduces its sensitivity to changes in interest rates or the macroeconomic context.

In addition, the fact that Bopreal come within Milei’s mandate makes it less vulnerable to possible political and economic changes. On the other hand, the AL30 and the AL35, with a greater “duration”, has more volatility, but also offers a greater “upside” in case Argentina continues to improve its country risk.

What investor profile are you? The choice between both bonds depends on how you locate yourself as an investor:

- Conservative profile: If you look for stability and lower risk exposure, the Bopreal (particularly now 27) are the most appropriate option. Its minor duration and an attractive pull make it interesting. Although its performance is lower than that of sovereign bonds, risk reduction compensates for that difference for those who prioritize security.

- Aggressive profile: If you are willing to assume more risk of looking for greater returns, sovereign bonds are a better option, for their potential for appreciation. Moreover, long expiration bonds such as AL35 offers greater return potential in a country risk improvement scenario. That is, in case things “remain good”, you will win more with the AL35 than with the Al30. And vice versa.

Where do we come from?

Sovereign bonds accumulate returns greater than 300% in recent years, mainly after Milei’s victory. Despite this rise, Argentine bonds are still attractive in 2025, since they have space to continue up.

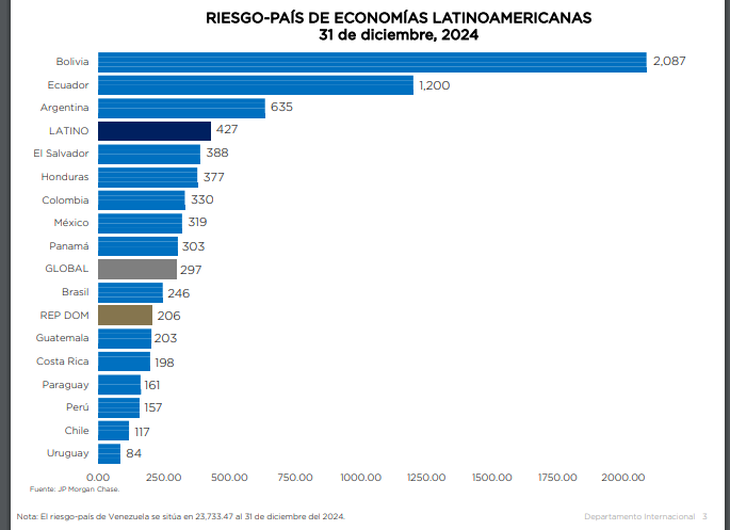

Compared to other countries in the region, the country risk remains high, despite the great improvement:

Bopreal2.png

This suggests that there is room for a new rise in bonds if Argentina maintains its economic and political stability.

The decision between Bopreal and sovereign bonds is not simple, but the risk profile of each investor gives good clues. Bopreal are ideal for those who prioritize stability and lower risk exposure, while sovereign bonds, especially those of long expiration, represent a more risky bet, but with greater return potential.

Obviously someone could have both assets in the portfolio, since they have been attractive for a long time. In conclusion, both the Bopreal and the sovereign bonds have return potential and each investor must analyze the amounts and the risk assumed well.

Finally, I want to invite you to download for free a report that I prepared so you can prepare for 2025. There you will find 7 concrete ideas with really surprising alternatives, which present a great risk-back relationship. You can download it in this link: https://clubdeinversores.com/pdf-7-ideas-de-inversion-para-2025/

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.