This week, Economy was going to face maturities of almost $12 billion. Through the exchange of a dual bond with the Central, the amount was significantly reduced.

The Ministry of Economy will announce this afternoon the call and the menu of instruments for the second debt tender in January pesoswhich will take place this Wednesday and in which the Treasury was going to face maturities of nearly $12 billion. However, before the call, the team Luis Caputo carried out a specific operation to postpone a good part of those commitments, in which the holdings that the Central Bank had a dual bond that expires this Friday. Thus, according to private calculations, the Government reduced the weekly payments for renewal by about half.

The content you want to access is exclusive to subscribers.

The conversion of BCRA holdings into the TDE25 dual bond (which indexes the variation in inflation or the dollar, whichever yields more) was made official this Monday through the joint resolution of the Secretariats of Treasury and Finance No. 5/2025, although the exchange of securities it was done last friday. It was the same day that the Treasury made the other exchange: he which allowed him to kick off $14 billion for next year that expired between May and November 2025 and decompress the debt payment schedule in pesos during the electoral process.

The TDE25 expires this Friday and, until last week, represented payments of nearly $9 billion. That same day, $2.9 billion of Lecap expires (fixed rate bill) S31E5. In total, the Ministry of Finance was going to have to face commitments for nearly $12 billion in Wednesday’s tender, a good part of which were also in the hands of public sector organizations.

It is precisely the portion in public hands that the Treasury kicked off for the coming months. In dialogue with Scope, Pedro Siaba Serratehead of research and strategy at Portfolio Personal Inversiones (PPI), estimated that around 70% of the TDE25 was in the hands of state entitiesmainly from the BCRA.

Debt exchange with the BCRA

In exchange for your TDE25 holdings, the BCRA received a basket of three Lecap 46% composed of S31M5, which expires next March; by 36% for S16Y5, which expires in May; and by 18% for S18J5, which expires in June. This implies that the Central will receive fixed rate instruments in exchange for a bond that indexed for both inflation and devaluation.

The conversion was carried out based on market values corresponding to January 23 and was settled last Friday.

Within this framework, this afternoon the conditions and menu of instruments with which the Economy will seek to renew the remainder of this Friday’s maturities will be known.

Debt: the new maturity profile

last fridayin the midst of face-to-face negotiations with the technical staff of the International Monetary Fund (IMF), Caputo also made a bulky exchange of eleven instruments that mature between May and November of this year for a basket of four new dual bonds (who will pay the best between fixed or variable rate) to 2026.

Economy finally achieved an adhesion of 64% (55.25% among private holders), which allowed it to kick off $14 billion for next year and decompress to a similar magnitude the commitments to refinance during the hottest months of the electoral process.. The objective was to decompress that part of the year to reduce the risks that a possible change of mood in the markets complicates the renewal of debt and reheats the pressures on parallel dollars, even more so in the event that progress is made in a more important flexibilization of the exchange stocks.

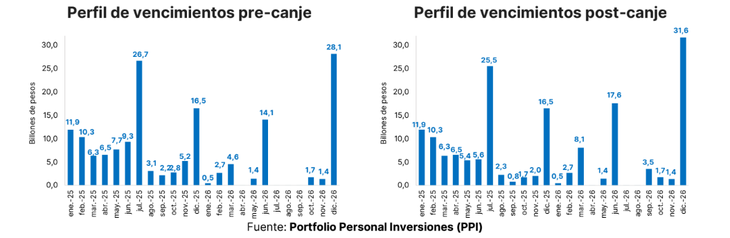

“Prior to the exchange, according to our numbers, between May and November 2025 the Treasury faced maturities of around $56.7 billion. After the transaction, that amount was reduced to almost $43.3 billion. On the other hand, the estimated payments between March 2026 and December of the same year reached $51.3 billion, but now they are around $65.3 billion,” detailed a PPI report sent to its clients.

image.png

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.