The Buenos Aires Government maintains that the understanding reached by Macri and Caputo did not close the chapter due to co-participation. Still The automaticity of the payment and the restitution of the 3.5 coefficient remains to be discussed before the highest courtwhich, as they remember, was eliminated “in a manner without consultation and unconstitutionally” by the government of Alberto Fernández.

Changes in the ABL calculation: how much will the tax be in the new 2025 Budget

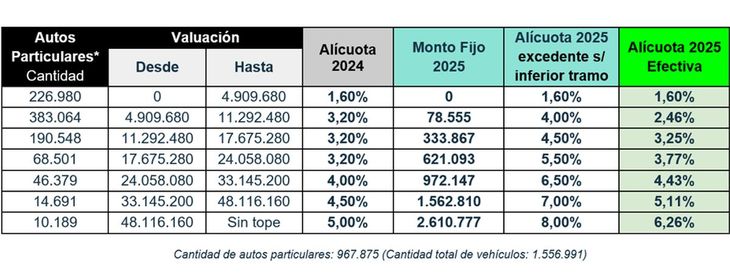

Another no less minor aspect that the new budget contemplates is the one that refers to the ABL games and its calculation, a question that keeps citizens in suspense year after year. From the City They assure that it is a tax with little progressivity given that, as they claim, 99% of the total universe of items are within the same range and with the highest rate.

He Budget 2025 contemplates a new calculation methodology “to make it more progressive and equitable”. The new proposal plans to increase the scales from 7 to 10 and incorporate a geographic coefficient that will also include a zonal bonus, which will refer to the increase ceiling. Thus, the value 0 corresponds to South Barracks, the value 1 to Center Wheelie and the value 2 a Puerto Madero.

budget abl.jpg

The communes of the South Zone of the federal capital, which are within 0 and 0.5 of the estimated coefficient, will receive a bonus from 25%. The change will impact 26% of ABL games. In the Central Zone, whose coefficient is between 0.75 and 1.25, the bonus will start from 50% and will benefit 59% of the total residents. Finally, the Northern Zone will start from a bonus from 100%.

Thus, if the project is approved, the ABL may increase by a maximum of 100%. As an example, a neighbor of the commune of South Barracks that at the end of the year will pay $10,280, with the new proposal it would pay $12,849 (25%) in January, instead of $38,896 (278%) that the tax currently provides. A taxpayer of Northern Horse that in December I pay $41,091, must pay $61,636 (50%) in January, instead of $148,400 (261%). He who lives in Puerto Madero and pay $99,882 in December, you must pay $199,764 (100%) in January, instead of $335,450 (236%).

On the other hand, it also foresees changes in the exemption for retirees, pensioners and people with disabilities. Currently, the regulations establish that the 2011 Tax Valuation should not be greater than $75,000. The calculation component is outdated, which complicates obtaining the exemption.

By 2025, the Buenos Aires Government proposed using the Homogeneous Tax Valuation of the property as a reference, with a maximum value of $30 million. In addition, it will be a requirement to receive an income equal to or less than three times the minimum retirement.

Reverse with the elimination of IIBB exemption for professionals

In another section, the Buenos Aires Budget proposed eliminating the exemptions from Gross Income (IIBB) for professionals who graduated from university courses whose duration is at least four years. The text pointed to officially recognized undergraduate liberal professions.

The initially proposed rate was of 3% starting in 2025 and doctors, accountants, architects, lawyers and engineers, among others, were going to be affected. However, The head of the Buenos Aires government said that it was a mistake and that it was never in real consideration so no progress will be made with the elimination of the exemption.

“I want to be very clear on this: At no time did I consider eliminating the gross income exemption for professionals as an option for next year“, wrote.

“The information that was circulating comes from a working draft that The AGIP presented us as a proposalbased on a criterion of tax equity, but with which no progress was made nor was it presented in the Legislature. In this context of crisis, not charging gross income to professionals is not only an economic decision but also a political one,” he said.

New scales and calculations for patents

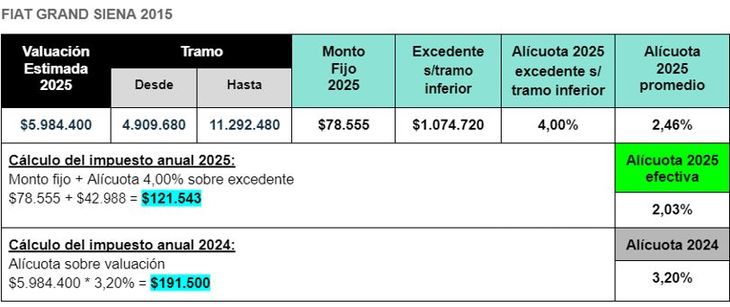

Furthermore, the Budget proposes changes in the calculation of the patents vehicular. The objective is to restructure the current scheme to advance its progressiveness, through the readjustment of scales and aliquots, to avoid sudden jumps between one valuation and the next.

Today, the difference of $1 in the value of a vehicle with another it can generate a substantial increase in the value of the patent, pushing the taxpayer to pay up to double the tax. “The new proposal generates progressivity from the increase in the valuation of the vehicledefining a minimum amount on each scale and an aliquot for the surplus,” the Buenos Aires government stated.

patents new budget calculation 2025.jpg

As an example, a Fiat Siena model 2015 that has an estimated valuation of $5,984,400, will be framed in the section that goes from $4,909,680 to $11,292,480 for which you will pay a effective rate of 2.03%. In 2024, for the same vehicle, the rate was 3.2%.

If the current calculation is taken, the vehicle should pay $191,500. With the new method, the amount will be $121,543that is, approximately $70,000 less than the current scale.

patent budget caba.jpg

Education and Security will concentrate 36% of the City’s 2025 Budget

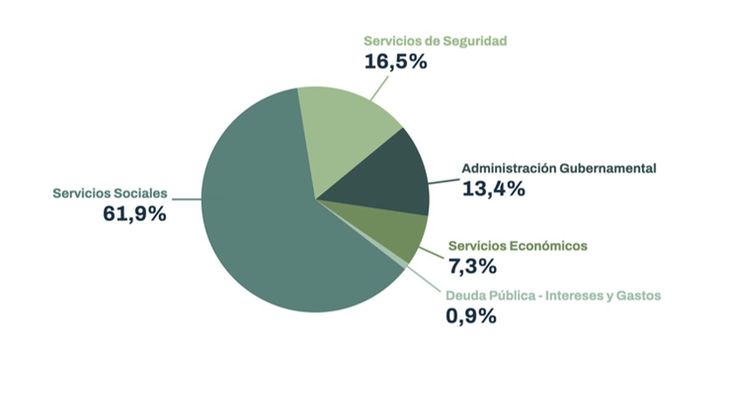

In addition to the changes in the ABL, the project It also contemplates an increase in items for Security. The total estimated disbursement will be 16.5% of the GDP, which will make it the largest in history for that area. The Buenos Aires administration projected total spending on security that will be around $2 trillion 298 billion.

“Social services such as Education, Health and Promotion and Social Action comprise the majority of investment by 2025, with a 61.9% of total expenditure and with a planned credit of $8 trillion 614 billion,” the Buenos Aires government indicates.

porteño budget.jpg

Education, One of the most sensitive areas for the Buenos Aires electorate will be the one with the greatest participation in spending with the 20.1% of the total. Investment by 2025 will reach $2 trillion 795 billion. For its part, Health will represent 16.5% of the expense: $2 trillion 298 billion will be disbursed. 9.2% of the total budget ($1 trillion 287 billion) will be allocated to Promotion and Social Action.

The total of the Public Debt will reduce its weight within the total Budget since it will fall from 1.5% to 0.9%the lowest in 20 years. The disbursement assigned by the Treasury and Finance to cover the items in said area will amount to $126,000 million.

The City will increase investment in public works in 2025: the main projects

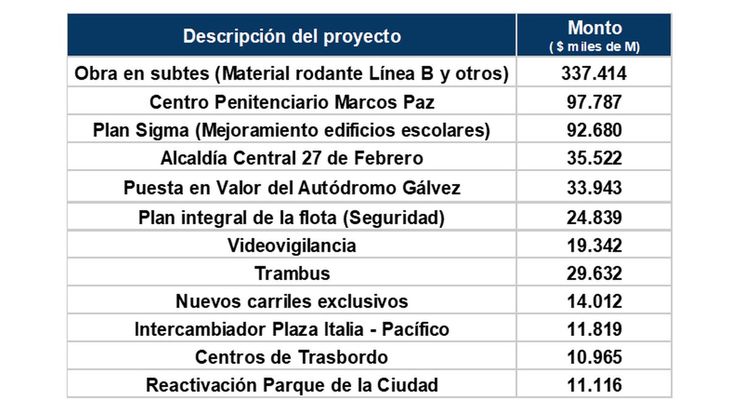

He capital expenditure projected for 2025 will be 19.3% of the total budget. From the City they point out that it will be more than three percentage points above the historical average of the last 16 years, which was around 16%.

He The largest disbursement will be for works on the Buenos Aires subwaymainly for the maintenance of the rolling stock of Line B, among others, for which they will allocate $337,414 million. Reforms are also contemplated in the Marcos Paz prison for $97,787 million and a disbursement of $92,680 for the improvement of buildings in Buenos Aires schools (Sigma Plan).

public works city.jpg

The two main axes of Buenos Aires public investment focus on two pillars. First of all, the Comprehensive Urban Mobility Plan which includes the subway network, micromobility, the construction of underpasses and road works. Secondly, the Revitalization of the South area to promote economic activity.

Source: Ambito

I’m a recent graduate of the University of Missouri with a degree in journalism. I started working as a news reporter for 24 Hours World about two years ago, and I’ve been writing articles ever since. My main focus is automotive news, but I’ve also written about politics, lifestyle, and entertainment.