In the final stretch of the year, the S&P Merval closes with a very positive balance. The leading index of Argentine Stock Exchanges and Markets (BYMA) registers a rise that exceeds 100% in dollars, measured in Cash with Liqui (CCL), and close to 130%, in pesos. This notable performance causes some voices to catalog the current moment as the second great bullish rally in the history of the Argentine stock market. Furthermore, the S&P Merval is approaching its record of 2,200 pointsadjusted for US inflation, the level reached during the administration of Mauricio Macri.

And some similarities suggest that we are facing a “déjà vu” of the growth that the S&P Merval had with the government of Mauricio Macri, which also attracted strong capital flows into financial assets, with historical highs in shares since 2015 and the emblematic 100-year bond issued in 2017. However, that enthusiasm ended in defaults and significant losses for investment funds. And this time an inevitable question arises:What makes the current momentum of that situation different??

Most analysts are convinced that this time history No will be repeated. This optimism is based on the economic plan of Javier Mileifocused on a drastic reduction in public spending and the elimination of monetary issuance, pillars that strengthen investor confidence. Furthermore, his strict defense of zero deficit reinforces this perception. However, in the city of Buenos Aires it is surprising “the population’s acceptance of the adjustment and how Milei maintains its popularity despite the magnitude of the cuts it executes,” says an operator in dialogue with Scope.

All this occurs despite the fact that the country is going through its second consecutive year of recession. According to estimates of the International Monetary Fund (IMF)the Gross Domestic Product (GDP) will contract 3.5% this year. Furthermore, the majority of workers face serious difficulties in meeting the cost of living and more than half of 46 million Argentines are in povertybut the stock market does not always reflect general economic conditions.

Macri’s “bull market” vs. Milei’s: the fundamentals

Mariano RicciardiCEO of BDI Consulting -explains in dialogue with this medium- that, although the S&P Merval reached a historical maximum of US$1,822, when adjusting the index for inflation and updating the data, it is observed that is still 25% below its real all-time high, that reached in the Macri era.

Furthermore, he highlights that the economic environment of that time must be contextualized. “In that period, the economy showed greater solidity, since There was no exchange rate and international reserves were positive”says Ricciardi.

But, like the financial markets They are moved by expectationswe must analyze the current situation and projections, and under this scenario the current situation “is more favorable than that of 2018”says Ricciardi. And it explains that, unlike the Macri Government, “which proposed a soft adjustment and reaching zero fiscal deficit in the fourth year of administration (which never came), this Government achieved a fiscal and commercial surplus from the first month.”

FMYA.png

Source: FMyA, by Fernando Marull.

The strategist recalls that the current management also demonstrated a much more favorable inclination towards the financial market and large investments, and highlights the Infrastructure Investment Incentive Regime (RIGI)honoring debt and fiscal order as great achievements and positive messages to investors. “All this, added to the good relationship with the US and the potential of Vaca Muertaputs us in a much more favorable situation than in 2018. In this way, we see that, despite being close to historical highs, the Merval can continue rising”, he comments.

Everything is based on expectations: the carrot of the market

For its part, Mateo Reschini Head of Research Inviucomments that, in both periods, the stock market was driven for the hope of future economic stabilization. “The perception that the measures adopted by the government will bring long-term benefits fueled this optimism, although currently the tangible results are not seen, or at least in their entirety.” The analyst highlights five key differences between this “bull market” and that of the Macri era.

- Foreign investment flows: One of the main differences is that, at this time, “so far we are seeing some inflows of funds from abroad.” This marks a contrast with the Macri era, where the flow of capital was not as solid, or did not reach the levels seen today.

- Price levels: Reschini comments that, although current prices in the market are above the levels of Macri’s time, it is important to note that, adjusted for inflation, the same values have not yet been reached. This suggests that although the market appears to be stronger, there are still uncertainties about its true value.

- Stronger fiscal anchor: Unlike the Macri administration, in the Milei era fiscal policy seems more consolidated, which generates an additional level of confidence in investors. This factor is crucial, since a solid fiscal anchor contributes to greater stability and credibility in economic policies, he comments in line with Ricciardi.

- Population resistance to adjustment: Another key aspect is the greater capacity of the population to resist the economic adjustment under Milei, “compared to the Macri era.” This could reflect greater acceptance or even a perceived need for the reforms being implemented by the current government.

The path to a more solid market, another promise from Milei?

Pablo LazzatiCEO of Insider Financeexplains in line with the other two strategists, that the main difference between Macri’s rally and the current one lies in the fact that, at that time, “everything was based on expectations that soon fadedwhile, today, Milei and his team implement concrete measures, such as the largest spending cut in the country’s history and the twin surpluses (trade and financial) in eleven months.

Although he assures that the reduction of the reference rate from 130% to 35% is positive and strengthens the economic-financial scenario, “there is still a way to go to achieve a more solid market and rates similar to those of developed countries (10% -15%)”.

FMYA.png

Source: FMyA, by Fernando Marull.

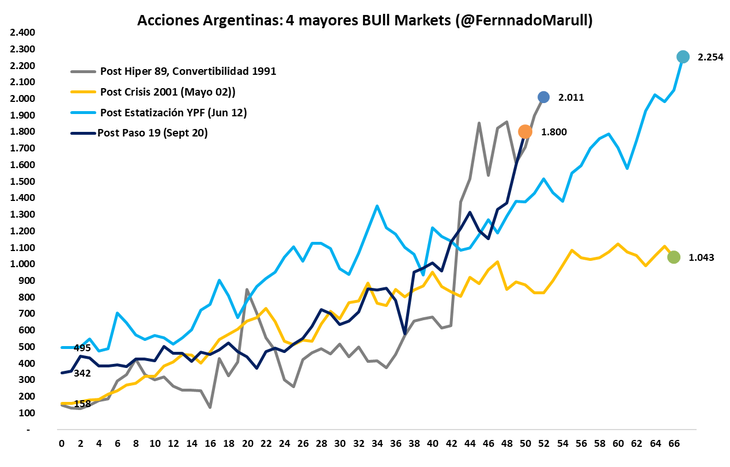

The 4 largest bull markets in Argentina

The analysis of the main “bull markets” in Argentina, according to the consulting firm he directs Fernando Marull (FMyA), identifies four cycles:

- Renationalization of YPF (2012-2018): This cycle began in June 2012, after the renationalization of YPF, and extended for 66 months, until 2018. It reached a maximum of the Merval index in dollars of 2,254 points at constant prices (US$1,832 nominal points on February 1 2018).

- Post hyperinflation of 1989: occupies second place, with an accumulated gain of 1,250% in dollars over 52 months. During this period, the Merval reached a maximum of US$2,000 at current prices.

- Current cycle (2020-2024): According to FMyA, this cycle began in September 2020 and has accumulated 50 months with a return of 426% in dollars. The index reached a record of 1,820 points in the “liqui-counted” market at the close of Friday.

- Post convertibility (2002): After the 2001 crisis, this cycle began in May 2002, recording an average gain of 560% in dollars. The Merval reached a maximum of 1,000 points in hard currency during this period.

So it seems that today the flow is directed from the banks to energy and gas companies such as YPF, Central Puerto (CEPU), Transportadora de Gas del Norte (TGN) and Pampa Energía. Despite the country’s economic challenges, such as recession and high poverty, investor confidence appears stronger due to greater fiscal stability. However, there is still a way to go.

Source: Ambito

I’m a recent graduate of the University of Missouri with a degree in journalism. I started working as a news reporter for 24 Hours World about two years ago, and I’ve been writing articles ever since. My main focus is automotive news, but I’ve also written about politics, lifestyle, and entertainment.