The AFIP recalled that the recategorization “consists of calculating the gross income obtained and the electrical energy consumed during the last twelve calendar months and, in some cases, the area affected by the activity and the amount of rentals dev

The AFIP recalled that the recategorization “consists of calculating the gross income obtained and the electrical energy consumed during the last twelve calendar months and, in some cases, the area affected by the activity and the amount of rent accrued in that period.”

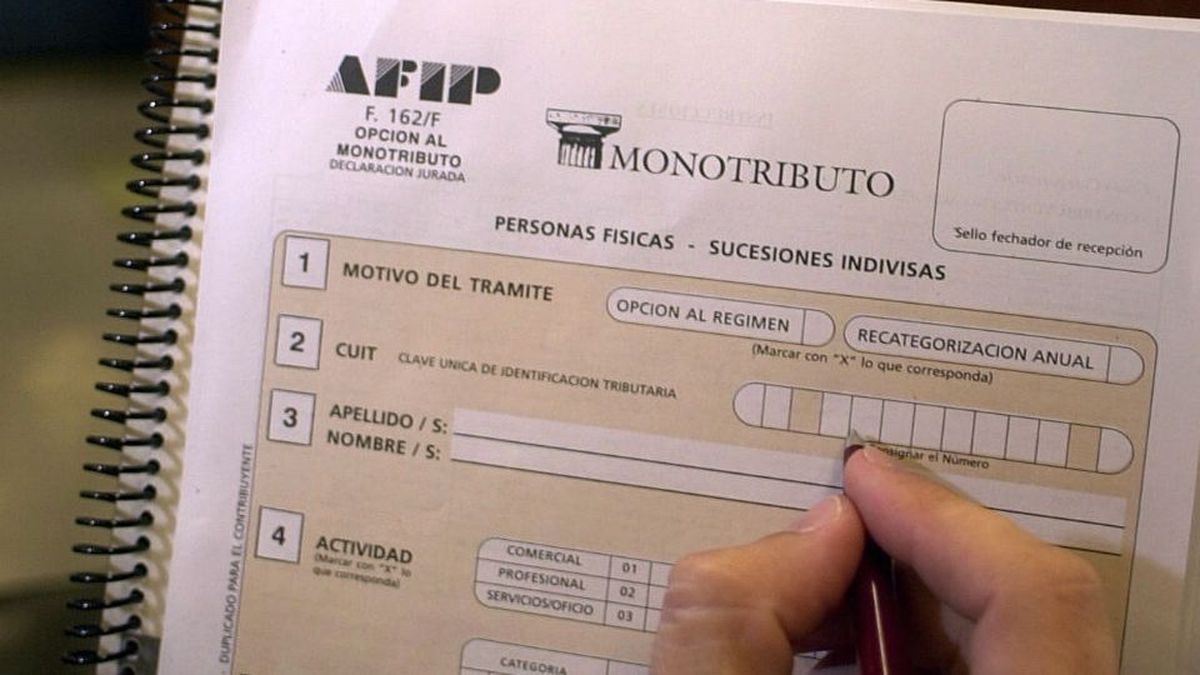

What is the semi-annual recategorization of monotax

It consists of the evaluation of the activity of the last 12 months to determine if they should maintain the category they are in or modify it. When the different parameters analyzed exceed or are inferior to those of the current category, it is necessary to carry out the recategorization.

For your part, you are They occur in the months of January and July.

Parameters to take into account in recategorization

As indicated in article 9 of the Law 24,977it is necessary to make an analysis of what has been done in the last year of:

- The Billing

- The area affected by the activity

- The electrical energy consumed

- The accrued rents

The total of the values that each parameter gives us, will have to be compared with the AFIP table, (it can be consulted by entering the following link https://www.afip.gob.ar/monotributo/categorias.asp, and doing it at the category that corresponds according to the highest parameter.

Time to recategorize

The dates available for recategorization are from 1 to 20 of each January and July.

What if I don’t

If the date passes and you did not recategorize yourself when appropriate, the AFIP can recategorize you ex officio, in addition to applying sanctions.

It’s about a systemic process which operates when a taxpayer did not recategorize or did so inaccurately. The procedure starts when they are detected purchases, expenses or bank accreditations for a value greater than the annual gross income maximum admitted for the category in which it is framed.

The monotributistas that are modified by the AFIP will receive a Notification at the Electronic Fiscal Address (DFE) the first business day of the months of August and February of each year.

The assigned category can be appealed within 15 days of receiving the notification, through the same service. Once the term has expired, the appeal may be initiated through “Digital Presentations”.

Step by Step

Enter the Monotributo web portal.

- Show CUIT, tax code and press “Accept”

- select option “Recategorize Me” (In this option you can see for information purposes, the data that this Agency has on your tax situation)

- select option “Continue Recategorization”

- Inform the new parameters (income, area affected by the activity, consumption of electrical energy, etc.)

- indicate the option “Print credential”

- The system will issue the F.184 -as proof of the recategorization carried out- and the new Payment Credential

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.