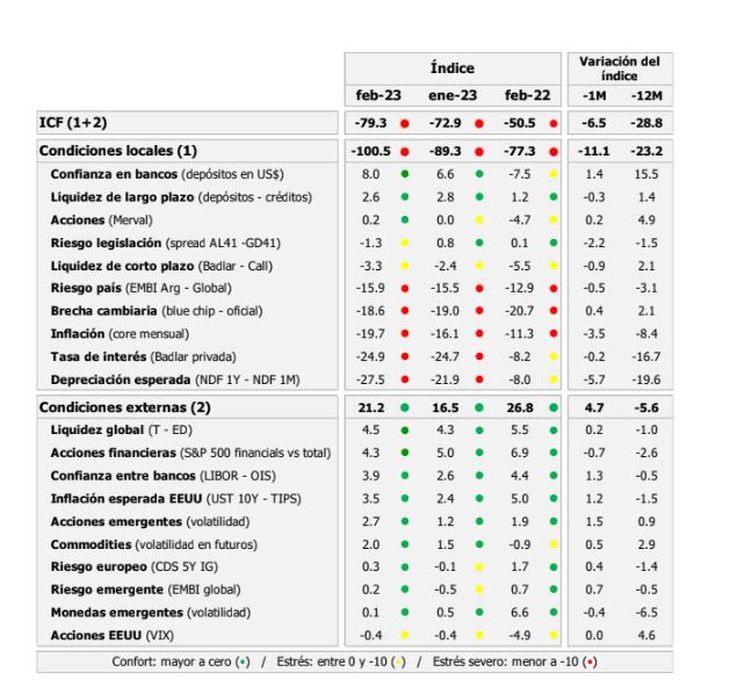

After 3 consecutive months of improvements in the financial conditions index, in February the index prepared by the Argentine Institute of Finance Executives (IAEF), together with the Econviews consultancy, lost more than 6 points.

After 3 consecutive months of improvements in the rate of financial conditions, in February the index elaborated by the Argentine Institute of Finance Executives (IAEF), together with the consultancy Econviews, it lost 6.4 points, going from -72.9 to 79.3.

The content you want to access is exclusive to subscribers.

However, they warn that these values are an improvement of 67 points compared to the floor of October last year when the ICF was -146.2. The deterioration in February was “made in Argentina” since the local component worsened, while the variables included in the global sub-index improved modestly.

– The local component of the ICF has been negative since March 2019 without interruption and has been in a stress zone for 48 months in a row. Seven of the ten components fell in February while the other three had marginal improvements on a month-on-month basis.. Confidence in banks, the Merval index and the exchange rate gap, which actually fell in February, improved.

Confidence in banks is measured from the monthly average of deposits in dollars, something that has been surprising on the rise. Among those that had declines were the expected depreciation, as measured by the NDF market, core inflation that seems to have accelerated and an increase in legislation risk. In other words, the market is willing to pay more for bonds outside of Argentine legislation.

– The external conditions subindex marked its second consecutive month in positive territory, that is, a comfort situation. He went from 16.5 to 21.2 points, his best record since February 2022. Seven of the ten components of this index improved in February, one stayed the same and two fell. The negative factors were the volatility of emerging currencies and the performance of financial shares, whose average rebound in February was lower than that of the rest of the American shares given the expectation of a more pronounced rise in rates. Emerging stocks, confidence among banks and expected inflation were the variables that most supported the global subindex.

ICF.jpg

The 3 variables with positive sign

– Despite the worsening of the local index, There are 3 variables that are in a comfort zone, that is, with a positive value. That the value is positive implies that they are better than the average in their history. Confidence between banks, long-term liquidity and shares are those that exceed the zero line. Of the 7 that are stressed, the expected depreciation, the interest rate and inflation stand out.

How global financial conditions affect Argentina

According to the report, the world is beginning to show a much more difficult place, with expectations of more increases in international interest than the market had internalized in prices a few weeks ago. And although today the Argentina is not very connected financially speaking, it is necessary to have access to the debt market for the public sector in 2025 if a new debt restructuring is to be avoided. Beyond the autochthonous problems, the cost of that debt, if it can be issued, will be much higher than what most emerging countries have achieved in the last two years. Added to this are electoral factors that add a dose of additional uncertainty.

Source: Ambito