The Fed chairman reaffirmed the possibility of rate hikes at a faster pace, although he clarified that a decision has not yet been made.

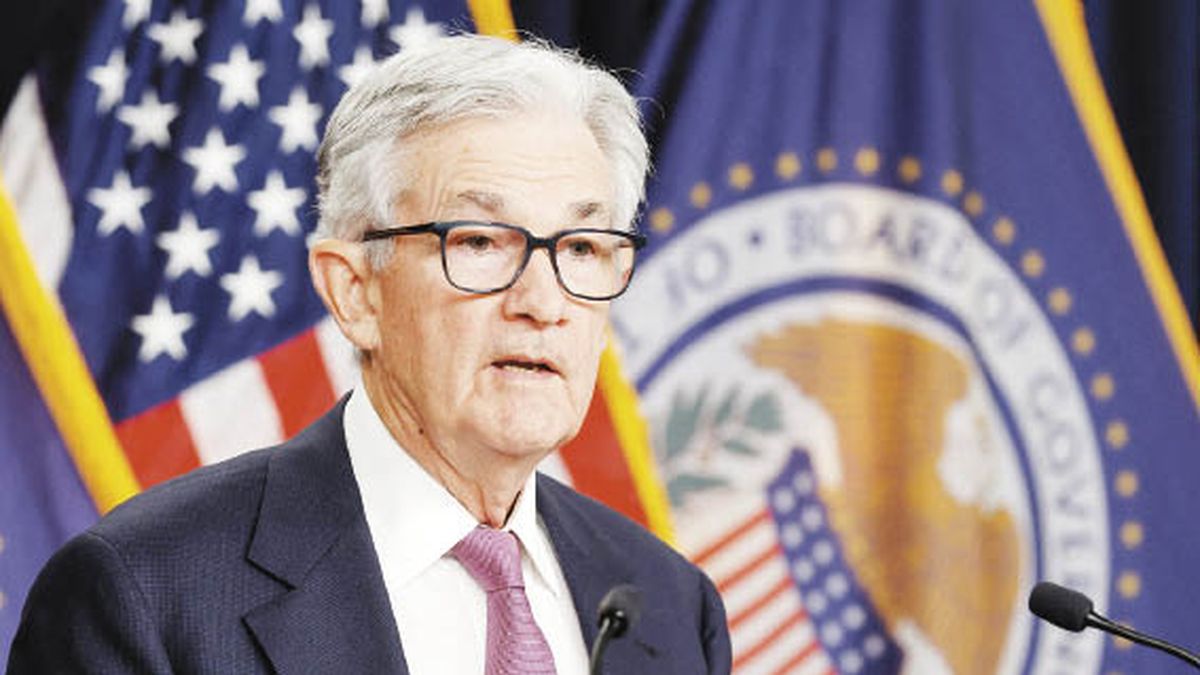

Jerome Powell

One day after the hawkish speech that set off alerts in global markets, Jerome Powell insisted yesterday that the United States Federal Reserve will continue with increases in interest rates above expectations and, if necessary, at a higher rate , although he clarified that there is still no decision made regarding the magnitude of the next rise. The message did not evacuate the concerns of investors.

The content you want to access is exclusive to subscribers.

“We have some potentially important data to analyze. Again, we have not made any decision on the March meeting and we will not until we see the additional data,” the Fed chief said in a hearing before a committee of the United States House of Representatives.

Powell pointed out that the entity will analyze the data on the progress of inflation, economic activity and employment that will be published before the next meeting of the monetary policy committee, scheduled for March 21 and 22.

Just yesterday some of this data was released, such as the JOLTS survey, which showed some 10.8 million job vacancies in January, which represents a drop from the 11.2 million registered a month earlier, but above the 10.5 million forecast by analysts. Also released was the ADP employment survey for February, which showed the creation of 242,000 job positions, above the market expectation of 200,000 jobs. These numbers show greater than expected activity dynamism, and could contribute to a more restrictive stance by the Fed.

Within this framework, the markets remain on alert. Wall Street didn’t get significant relief after Powell’s new speech. The S&P 500 index rose just 0.1%, the Nasdaq 100 rose 0.4% and the Dow Jones Industrial fell 0.2%. Shares had fallen more than 1% on Tuesday after Powell’s comments led investors to raise expectations for a 50 basis point rate hike in March.

Source: Ambito