Today many are tearing their hair out after the appearance of the black swan SVB (Silicon Valley Bank) that unleashed the banking crisis in the US, devastated the markets and threatens to escalate even more. The truth is that already last year the venture investment firm Greenoaks Capital Partners (GCP) had warned startup founders about possible problems in the SV bank of the financial group of the same name. According to an email accessed by Bloomberg, he did so just a few months before the entity announced that it was selling assets to shore up capital.

But the warning sent out by GCP managing partner Neil Mehta last November about some banks including the SVB that they might fall short and have to offer higher rates to customers following Fed rate hikes, or otherwise they would lose customers. But Mehta explained that these banks were not well positioned to do this because they made a large number of long-term, low-rate loans that were outstanding. “Worst case scenario, you want to be the first to withdraw deposits instead of the last,” Mehta wrote.

The rest is history. More than a dozen GCP startups heeded the warning and withdrew roughly $1 billion from the bank in recent months. And many other venture capital and venture investment followed the advice and thus the bank run was detonated. Nobility obliges, it is worth noting that in the aforementioned email revealed by Bloomberg, in which Mehta encouraged startups to take their business to larger banks with lower risk and that could offer higher returns, he also recognized that the possibility of a serious problem with Silicon Valley or First Republic banks was “highly unlikely”. A visionary.

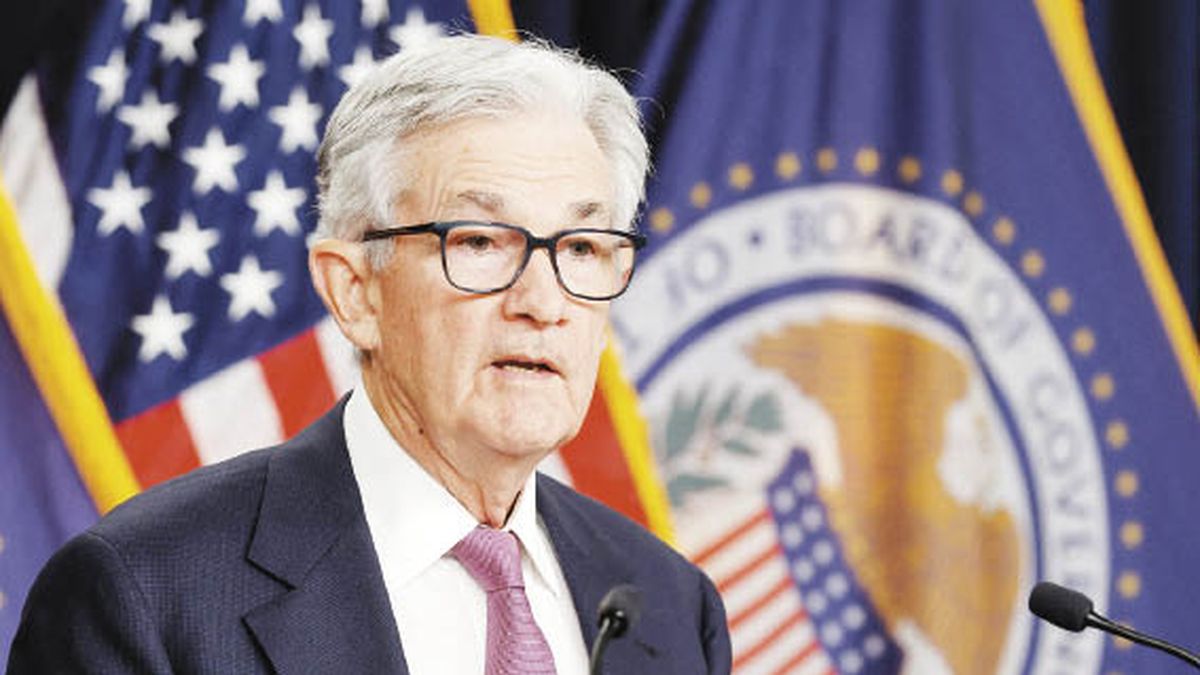

For now, what happened with the SV banks (the biggest financial failure since the collapse of Washington Mutual in 2008) and Signature (another that fell after the SVB) made all the guns point at the head of the Fed, Jerome Powell, as the responsible for the heavy unrealized losses in the fixed-income portfolios of financial institutions that have led to their bankruptcy. In this regard, the FDIC, the agency responsible for guaranteeing bank deposits, estimated that if regulated banks sold their entire portfolio of financial securities, they would generate losses of 600,000 million dollars (more than Argentine GDP). The authorities intervened to prevent a contagion that seems to want to spread like wildfire. Thus, the Fed took measures to protect the US economy by strengthening public confidence in the banking system, making the FDIC’s actions more flexible, and promising that it would provide liquidity to banks and that each member of the Fed would make Repos to borrowers. eligible.

The objective is to satisfy the banks’ demand for liquidity when necessary, to stabilize the financial system and protect depositors. Despite this, influential Pershing Square hedge fund CEO Bill Ackman said other banks are likely to fail despite the interventions, although there is now a clear roadmap for how the government will deal with them. But all eyes are still on Powell.

In this sense, Goldman Sachs maintained that it no longer expects the Fed to raise rates at its next meeting on the 22nd, to which Barclays Bank was also added, also betting on a pause next week. This sentiment carried over to the market where the odds of a 50 basis point hike in March fell from 75% to less than 20, plus expectations of rate cuts in the second half of 2023 have skyrocketed.

So what everyone almost took for granted, that is, that the Fed would keep raising rates, might not materialize. A day before the SVB collapsed, markets were giving a 68% chance of a rate hike of half a percentage point to 5.25% thanks to Powell’s harsh words on inflation before the Senate Banking Committee.

Now, markets are pricing in only a quarter point rise or even no rise on March 22, as yields on 2-year and 10-year US Treasuries continue to fall. That’s why analysts say the Fed may find itself between a rock and a hard place: it wants to tighten policy to keep inflation at bay, but now it will wonder if it’s already too tight, given this surprising turmoil in the banking system and the The pressure that the rise in rates is already exerting on the cash flows of many companies. If nothing else, this tells us that the Fed won’t have an easy time getting out of more than a decade of record-low rates and $7 trillion of Quantitative Easing without something snapping somewhere.

Now markets are once again on a journey to find out what the cost of money is, and some of that earlier reckless abandon could spell trouble. But finally, yesterday Nomura’s experts warned that the collapse of the SVB could accelerate the arrival of a recession in the US in the second half, due to the excessive tightening of financial conditions being carried out by the Fed. They believe that the risk of a run on other banks suggests a growing risk of excessive tightening by the Fed.

Source: Ambito