The United States Federal Reserve (FED) raised interest rates 0.25 percentage points this Wednesday. Thus, it is located, from now, in the range of 5% to 5.25% and is the highest in 16 years. This is the tenth consecutive rise that the agency has carried out since March 2022 due to the need to combat a post-pandemic inflationary trend. However, he anticipated that he could pause his aggressive policy to assess the scenario and decide how to continue, a decision that is not innocuous for the rest of the world’s countries, including Argentina and local financial assets, because it has an impact on the cost of money and in the direction of capital flows.

In principle, the economist Federico Glustein points out to Ambit that a rate rise of 0.25% has a relationship in the US monetary contraction process. Thus, the director of CyT Asesores Económicos, Camilo Tiscornia, considers that “what the Federal Reserve decided is in line with expectations.” And he points out that, although they raised the rate again, the statement opens the window to think that they are not going to continue with an aggressive policy.

“A scenario of some restraint in the actions of the organism”, confirms Glustein. But he anticipates this new rise implies a decrease in the volume of global liquiditywhich will also impact a downward trend in financial assets, as a result of the “flight to quality”, which implies a flow of capital towards United States treasury bonds and an outflow of riskier assets.

Immediate effects of the rate hike in Argentina

In the words of Glustein, “this is going to lead to capital migrate to the United States as a consequence of security and profitability with low volatility that no other market provides, above all, taking into account that inflation is in an effective decline”.

Also, as usual, this increased cost of money implied by the rise in rates translates into a recessive condition for the economic activity, since credit hardens and investment is discouraged. However, he warns that it would be necessary to evaluate the horizon, since the possibility of an eventual recession could complicate the panorama.

Positive and negative risks of what comes

And it is that, the statement of the organism indicates that “inflation remains high” (since it was 5% in March and is looking to reach 2%) and employment continues “growing at a robust rate”, but anticipates that it must analyze the consequences of the recent bank failures that occurred in the United States after the the fall of Silicon Valley Bank and closely follow the course of inflation and financial markets in the coming months, the dynamics of these variables will be key to what happens with the US economy.

In this sense, Glustein anticipates that “Argentine assets listed abroad could have a correction if a recessive scenario occurred, while, if that did not occur, they could have a moment of relief.” In addition, he believes that what happens with the local actions It already depends more on the local scenario, while Argentine bonds play in tune with our macroeconomics.

However, looking forward, in Argentina, this will have a slight short-term impact. How is this? It happens that Tiscornia explains that “the strengthening of the dollar last year and the flow of capital to the United States did not suit Argentina at all”, but, in recent months, this has been reversed and this idea that the federal reserve Do not raise the interest rate so much helps in that regard.

This is based on the fact that, since the United States is reaching the peak of the rate hike, it is expected that “the next Argentine government can count on low interest rates” for any debt negotiation or attempt to attract capital, according to Tiscornia. This is positive data considering that, in 2024, Argentina will have to renegotiate several debt maturities in dollars

Likewise, there are those who consider that an eventual stabilization of rates in the United States could mean, in the long term, a good element for the scenario of Argentine assetsbecause it may imply a return of capital to emerging markets.

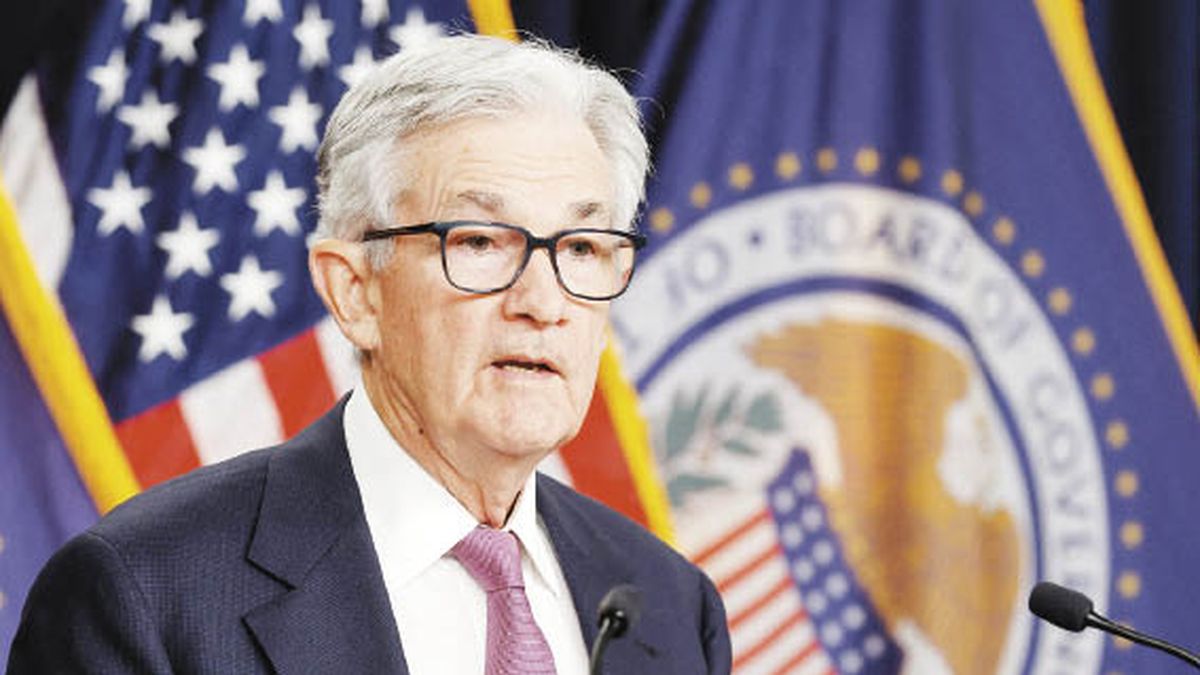

However, for the chief economist of Delphos Investments, Jorge Neyro, “the impact of the rise in rates in the United States in financial matters is less in the short term for Argentina because it is outside the international market” and believes that the trajectory of the assets in the local market will have a trajectory depending on how the words of Jerome Powellpresident of the fed. “If the market considers that the bullish cycle has stopped, it can be taken with some relief by investors, which will be a good sign,” he believes.

Source: Ambito