The third edition of Export Incentive Program II (PIE), better known as soybean dollar 3, officially said goodbye this Wednesday, although in practice it will continue until next Friday, June 2, and the final numbers are already above expectations despite the negative effects of drought.

According to official numbers, the Dollar Soy 3 contributed US$5,086 million in this third editionthus exceeding the US$5,000 million foreseen by the Ministry of Economy when the tool was relaunched, on April 12.

In turn, it also exceeded the amount that had been recalculated at US$3.5 billion when the damages that the lack of rain.

“The Exporter Increase Program III (PIE) began with a certain delay compared to what was expected in terms of settlements. The truth is that the wheels started relatively slowly, only on the second day of this scheme were the highest settlements made in around US$574 million. But they began to drop gradually and the Central Bank had difficulties in retaining the dollars,” he explained to Ambit the Economist Salvador Vitelli by Romano Group.

However, the factors that affect the low liquidation -according to the economist- were; the drought, due to the fact that 50% occurred due to the lack of rain and played a harmful effect; the uncertainty for the election year that generate that the producer keep of the product; and the soybean price that it came “inflated”, which meant that the assessment was not significant.

“We came with a soybean priced at 90,000 pesos per ton and when the scheme was released the value of soybeans went to 93,000 pesos per ton, it is a very insignificant variation and was the product of a soybean that was highly inflated. there was an expectation that there will be another exchange value in the marketVitelli analyzed.

soybean dollar.jpeg

Graphic belonging to Salvador Vitelli.

For his part, Emily TerreHead of Economic Studies at the Rosario Stock Exchange, highlighted in dialogue with Ambit that “Less was liquidated than the first edition of the soybean dollar because this year soybean production was a third of what the country has produced”.

“We estimate 21.5 million tons, when Argentina produces about 50 Mt, up to a record of 60 Mt”Terre pointed out in reference to the effects of the drought that were the reason for the decrease in the settlement of the soybean dollar 3 with respect to the second edition of the program.

Meanwhile, the consultancy Ecolatina told this outlet that despite the initial goal set at US$5,000 million, this “referred only to the liquidations of the soybean complex” and highlighted: “Therefore, We can infer based on statements by officials that the true target value was between US$7 billion and US$9 billion when also contemplating the liquidations of regional economies“.

The differential exchange rate for the regional economies a $300 applies from April 17 and will be valid until August 31.

How much did the soybean dollar 3 contribute to the BCRA reserves?

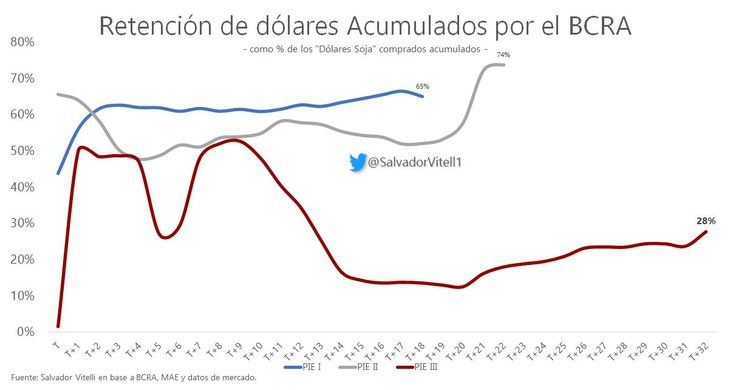

He soybean dollar 3 was implemented to generate more reserve accumulation. However, in this third edition the percentage of dollars accumulated by the Central Bank fell (BCRA) with respect to what was contributed by the soybean complex. The monetary authority only managed to retain 28% of the dollars contributed by the sector since April 12, when in previous editions it managed to retain between 65 and 74 percent.

PIE I and PIE II managed to contribute 65 and 74%, respectively. In this third edition, the soybean dollar only contributed 28%.

In dialogue with this medium, Vitelli emphasized the accumulation of reserves: “Although it has been liquidated (above expectations), if the BCRA cannot withhold, the tool is ineffective in terms of reserve accumulation. Although it allows a certain saving of foreign currency that would have gone anyway, the fundamental thing was to accumulate reserves and it could not be given in a significant amount, since what it could retain was only 28%, “he highlighted.

soybean dollar 3.jpeg

Graphic belonging to Salvador Vitelli.

It should be noted that the duration of the soybean dollar 3 was longer than the previous ones, lasting a month and a half.

Can there be a soybean dollar 4?

Although the Ministry of Economy is betting on the income of foreign currency from China and the International Monetary Fund (IMF), the need to carry out another differential gear since June and July are months of high demand for foreign currency.

In this scenario, the Minister of Economy, Sergio Massaagreed in China on the contribution of US$1,000 million that will make it possible to reinforce the reserves and, in addition, will be key contributions for three energy projects.

In this sense, Vitelli highlighted that “the exchange situation of the BCRA is going to be uphill from June when the settlements collapse as they did after each end of the differential exchange rate”, to this we must add the mitigating factor that the seasonality of the demand for foreign currency, which will make it difficult to accumulate reserves and will generate greater exchange pressure.

“The greater the exchange rate pressure, the greater the chances that another type of differential exchange will be generated. It is rumored a dollar corn. But the chances of this happening will increase as the BCRA takes the selling side. It has been shown that when the situation is critical, it is useful for the monetary authority to generate these schemes,” explained the economist in dialogue with Ambit.

Source: Ambito