This Friday morning (in Argentina) the swap renewal agreement with China is signed between the central banks of both countries. This is a key step for the BCRA.

This Friday, when it is 3 in the morning in Buenos Aires and 2 in the afternoon in Beijing, one of the key moments of the four-day mission carried out by the economic team in China will take place, since the president of the Central Bank (BCRA)Miguel Pesce, in the company of the Minister of Economy, Sergio Massa, will meet with the president of the Bank of the People’s Republic of China (BPC)Yi Gang, with the aim of renew the swap of currencies existing between Argentina and that Asian country.

The content you want to access is exclusive to subscribers.

In this meeting, in which the Argentine ambassador in Beijing, Sabino Vaca Narvaja, and the Secretary of International Economic and Financial Affairs, Marco Lavagna, will also participate, the renewal for three years of that agreement, which expires in August this year, but the two parties agreed to advance the renewal to sign it on this trip of the economic team.

Remember that the swap is an exchange of currencies between central banks. The BCRA gives pesos to the BPC and the BPC gives it yuans in exchange. The first agreement between both central banks was established in 2009. In 2014, a second agreement was signed, which was renewed in 2017 and complemented at the end of 2018 with a supplementary one. And, in August 2020, the agreement that is now renewed was signed.

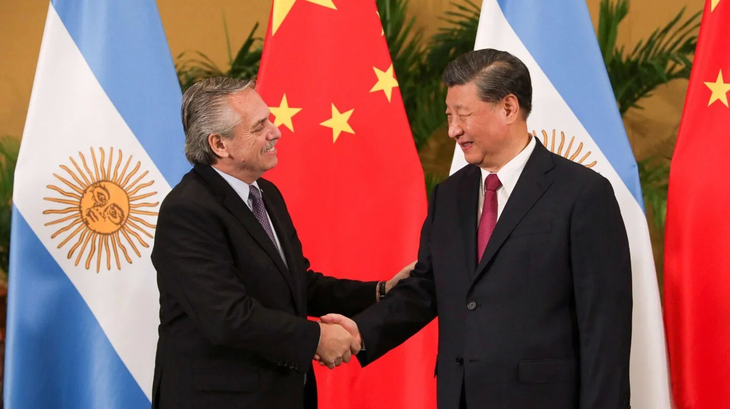

In that framework, the first presidents of both countries, Alberto Fernández and Xi Jinping, agreed to activate 35,000 million freely available yuan (equivalent to about $5 billion) of the swap when they met at the Bali, Indonesia, summit in November last year.

Alberto Fernández Xi Jinping CELAC.webp

Alberto Fernández with his Chinese counterpart, Xi Jinping.

Photo: Argentine Presidency/AFP.

The swap rollover amounts

Thus, what was signed this Friday is the renewal of that system, which involves 130,000 million renminbi yuan from the swap and 35,000 million freely available, equivalent to US$5,000 million, which are already in a BCRA account and which they gave it the possibility to improve the situation of its net reserves.

On the other hand, there was also talk of the possibility of extend that section of free availability. Many voices take it for granted that progress will be made in this regard as well, but another large part of the market considers that it is likely not and that this could “be negotiated at a later stage, always within the general agreement of the US $ 18,000 million” .

One of the reasons that would explain this perception of some analysts is that the freely available money that the BCRA has today within the framework of the swap would not have been used yetTherefore, as long as this situation continues, they believe that an extension will probably not materialize and some mention the possibility of agreeing on a framework for future allocations of freely available amounts in favor of the BCRA.

However, we will have to wait until after the meeting between Pesce and his Chinese counterpart to find out the details of the signed agreement.

Source: Ambito