“Extreme uncertainty, anxiety and nervousness”: this is how the climate is experienced at the annual convention of the Argentine Institute of Finance Executives (IAEF) which takes place in Puerto Madryn, province of Chubut, where Ambit. Faced with the uncertain presidential election and the lack of consensus, expectations are negative for the short term: companies expect a slowdown in sales, investments and profitability. The request to the next government will be for “eliminate the weight of the State”.

In the opening speech, the president of the IAEF, Diego Cazorla, described the atmosphere of the annual convention: “We are at the gates of a transcendental electoral event that absorbs our attention, in an environment of extreme uncertainty, anxiety and nervousness. Without a doubt, Argentina needs to carry out a difficult stabilization process.”

The executives’ request is for a political agreement once the elections are over: “The quantity and complexity of the challenges (inflation, exit from the stocks, fiscal deficit, tax reform, labor, education, security and others) require that once Once the electoral process is resolved, the political forces establish mechanisms for dialogue and basic consensus to give sustainability to the measures,” said Cazorla before a room full of more than 300 executives.

Casiana Silveyra Perdriel, partner of Beccar Varela and member of the organization, revealed that the number of registered people increased by 87% and that they could not sell more tickets because the flights were sold out. The thing is that the executives, in addition to having two days of talks and networking, will also have hand in hand with economic references of the candidates: they will participate in the meeting Carlos Melconianappointed Patricia Bullrich’s Minister of Economy if she becomes president; Luciano LaspinaBullrich’s most trusted economist and Diana Mondinofrom the economic team of La Libertad Avanza.

iaef 2023.png

Instability and pessimism

As in every convention, the first panel presented the survey on financing and investment carried out by the consulting firm EY, in which 70 companies participated. It is revealed that, in 2023, 69% of companies had growth or maintained sales, while 31% saw sales decrease. In the case of profitability, 47% increased or maintained, and 53% decreased. By 2024, 62% believe sales will grow, 14% will remain constant, and 24% will decrease. While in 2024 profitability will improve in only 30% of firms, 37% will remain constant and 33% will decrease. This is the most negative data since 2020, the year of the pandemic.

Regarding investments, only 37% had an increase in 2023, 50% maintained them and 13% decreased them. By 2024, only 30% project investment growth. You have to go to 2020 to find worse data.

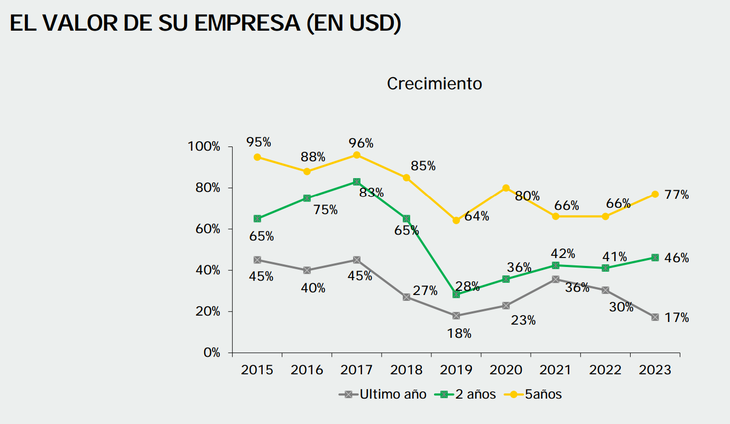

Definitely, The most negative data is found in the question about the value of the company in USD. This year, only 17% of companies answered that they grew. This was highlighted by Pablo De Gregorio, partner at EY: “This result of how they saw the value of their companies is the one that grew the least of all the series we analyzed. 5 years ago 90% said that their companies were going to be growing. We have to change this trend.”

iaef 20232.png

Request to the next government

From the survey it is clear that the main measure that companies believe promotes confidence when deciding on an investment are: a clear and sustainable economic plan (32%), a stable exchange rate policy (23%) and a tax reform (20%). Along the same lines, when asked what State actions will improve competitiveness and facilitate investments, the main response was a tax and administrative simplification (58%) and then closely followed by Government-Union-Business agreements (18%). .

In the EY survey, one of the business responses to what country strategy could be thought of was: “A State that only deals with education, health, defense, security, justice and foreign relations.” In the same line, Miguel Blanco, coordinator of the Business Convergence Forum, said. “Businessmen dedicate a large part of their time to dealing with the State, there are procedures even to pay for technological software. Argentina has opportunities for the economy, but “The main problem is to eliminate the weight of the State.”

WhatsApp Image 2023-09-07 at 17.30.10.jpeg

Troubled year

However, at the same time, the main answer to what global trend affects companies When deciding on a new investment, the main one was “the advance of extreme populism or nationalism” (32%). In second place was “the growth of poverty and inequality in emerging countries.”

Ámbito consulted Carzolo, president of IAEF, about the results of the survey, which show pessimism for 2024. “In my case I am optimistic because I believe that something good can come out of the elections, there is little chance of strange experiments. And there is hope if the foreign currency deficit is recovered,” he replied. The survey shows that companies see great potential for an increase in energy growth and agricultural exports.

However, a problematic year is expected in political terms. “It is difficult to govern with half the people in poverty,” said Carzolo. In the same line, Carolina Castropresident of Industrias Guidi, said in her presentation at IAEF: “Politics next year will not be free of conflicts, and civil society will act as controller.”

Source: Ambito