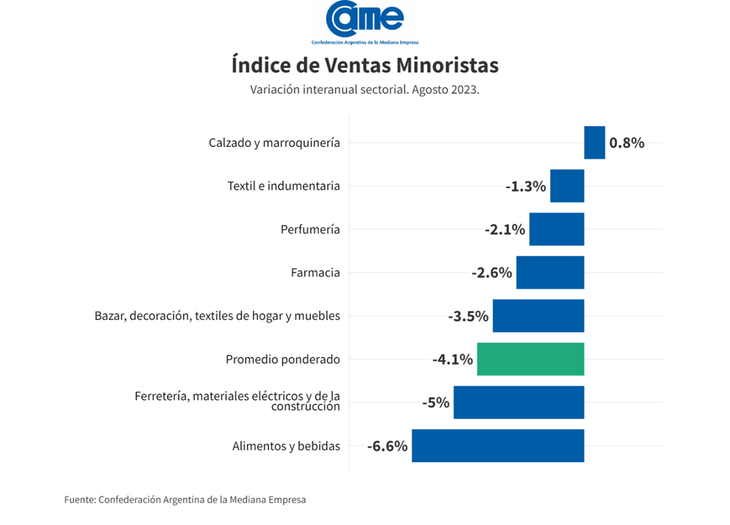

retail sales of small and medium-sized businesses recorded a decrease of 4.1% in August compared to the same period last year. This decline represents a worrying trend, as it continues for eight consecutive months. Furthermore, in the accumulated period from January to August, a year-on-year drop of 2.6% was observed. In monthly terms, sales also contracted 0.5% compared to July.

The month of August presented significant challengess for the commercial sector, which had to adapt to a price dynamics affected by impacts generated initially in the parallel dollar market and later with the devaluation of currency official in the middle of the month. According to the companies consulted, commercial activity experienced relatively good performance during the first half of the month, but faced a notable decline in the second fortnight.

One of the most affected sectors was Food and drinks, which saw a 6.6% decline in sales compared to the previous year. This drop occurred as a result of the widespread price increase that impacted this area.

unnamed.png

This emerges from the SME Retail Sales Index of the Argentine Confederation of Medium Enterprises (CAME), prepared based on a monthly survey among 1,252 retail businesses in the country, carried out from September 4 to 8.

SME sales: sector-by-sector analysis

In August, six of the seven items recorded year-on-year drops in sales. The largest decline occurred in Food and drinks (-6.6%) and the only item on the rise was Footwear and Leather Goods (+0.8%).

unnamed (1).png

The sales They fell 6.6% annually in August, at constant prices, and accumulate a fall of 1.9% in the first eight months of the year compared to the same period in 2022. In the month-on-month comparison they fell 2.3%. Demand was very stagnant. People bought what they needed, looking for deals and substituting brands to compensate for price increases. The riots and vandalism that occurred after the PASO elections created a climate of fear that resulted in the temporary closure or the reduction of operating hours of numerous businesses for several days. This situation had a negative impact in the sales of said establishments.

- Bazaar, decoration, home textiles and furniture

Sales fell 3.5% annually in August, at constant prices, and accumulate a decrease of 2% in the first eight months of the year compared to the same period in 2022. In the month-on-month comparison they fell 1.6%. The loss of purchasing power in the face of inflation became more noticeable this month. There were few people in the shops. Likewise, the results were very varied from one business to another. The most affected were those aimed at home textiles and decoration houses.

Sales rose 0.8% annually in August, at constant prices, and in the accumulated of the first eight months of the year they remain unchanged compared to the same period in 2022. In the month-on-month comparison they grew 1.6%. There were few deliveries of merchandise from suppliers and businesses went out to liquidate products early to gain liquidity. This allowed the item to end with a slight annual increase. Sales were oriented almost exclusively to national products due to the inconvenience of obtaining imported footwear.

Sales fell 2.6% annually in August, at constant prices, and accumulated growth of 5.2% in the first eight months of the year compared to the same period in 2022. In the month-on-month comparison, they fell 4.3%. The sharp increase in medicines increased sales of generic products and decreased sales of leading brands. People mainly bought essential medicines and prioritized pharmacies with discounts or that accept social and prepaid benefits. Imported products disappeared from supply.

Sales fell 2.1% annually in August, at constant prices, and accumulate a drop of 1% in the first eight months of the year compared to the same period in 2022. In the month-on-month comparison they decreased 4.3%. Mostly low-value and domestically produced products were sold. The businessmen consulted maintain that prices remained high in relation to income, but they trust that this will be corrected in the coming weeks as salaries also recover. Businesses in this sector increased their presence on networks to seduce the public.

- Hardware, electrical materials and construction materials

Sales fell 5% annually in August, at constant prices, and accumulate a drop of 0.9% in the first eight months of the year compared to the same months of 2022. In the month-on-month comparison they fell 1.4%. The public bought what was necessary, more as a replacement out of necessity than out of a decision to implement improvements. There were more shortages than usual, but it didn’t have as much impact because demand was low.

Sales fell 1.3% annually in August, at constant prices, and accumulate a drop of 7.9% in the first eight months of the year compared to the same period in 2022. In the month-on-month comparison they rose 6%. It is important to note that this comparison is made with months that had relatively low sales levels throughout 2022.

Source: Ambito