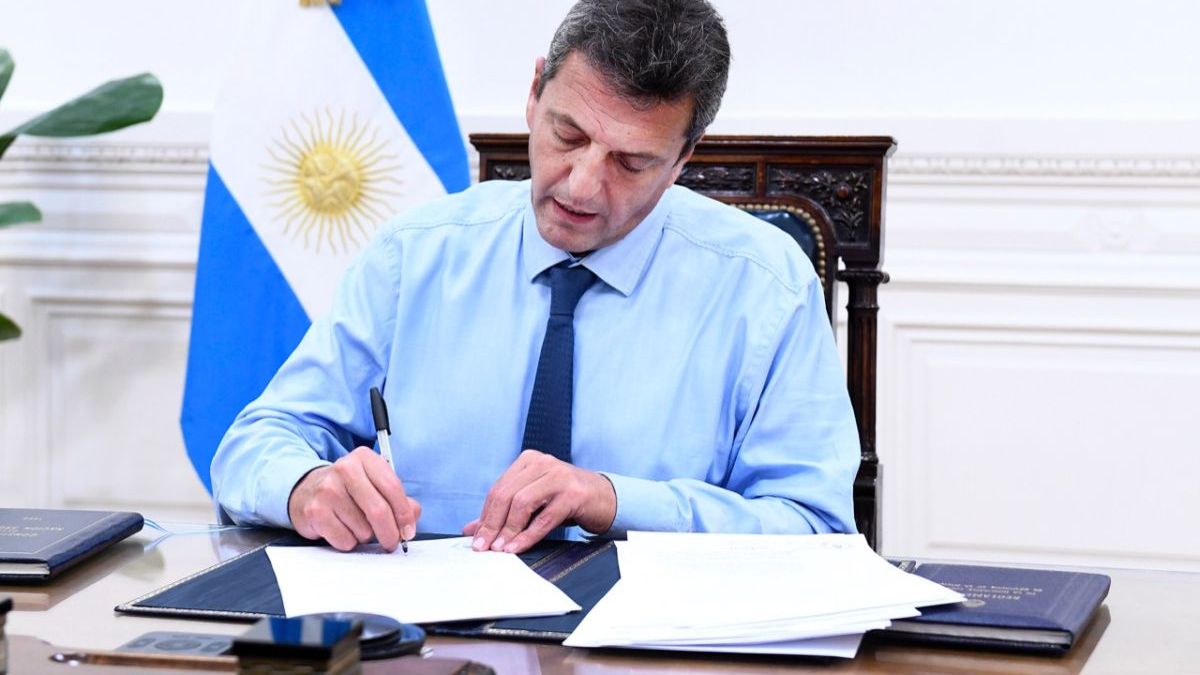

The minister Sergio Massa will present the project today so that they stop paying Income Tax fourth category: workers and retirees. According to the document you accessed Ambit, only directors of corporations, CEOs, managers and assistant managers and privilege pensions will be covered. In this sense, the project implies that a very minor percentage of the total number of employees in a dependency relationship in the entire country will be reached by the tax.

According to Economy, this proposal requires a law, since in addition to being a tax matter, it is an “annual” fiscal year tax. That is why it could only take effect from January 1, 2024.

However, as Ámbito learned. A “bridge” scheme will be implemented with similar benefits starting with the October salaries of this year.

The scheme promoted by the Government would imply an improvement for a wide range of incomes. According to the document, they would only pay Profits those workers whose gross monthly income exceeds $1 million, although this figure could be increased in the coming hours.

For example, A person who receives a gross monthly remuneration of $800,000 and who pays social charges of $132,001 must pay earnings of $117,690, so the net salary amounts to $550,308. With the modification proposed by the Government, the salary jumps 21%, since it would reach $667,998 (the balance discounted from Earnings is refunded).

The same applies in different upper bands. For example, for someone whose income reaches $1 million in gross monthly remuneration, in addition to social security contributions, income tax of $187,690 is deducted. With the reform proposed by the Government, in this case, the net income goes from $680,308 to $867,998.

As reported last night by Economy sources, the final project will be defined today at 5 p.m., so its communication is expected at that time.

At the same time, as he was able to know Ambit, We work on a mechanism that updates automatically and not by the Minimum Living and Mobile Wage.

Along these lines, it has not yet been reported whether the project plans to include a tax compensation article or, perhaps, a new tax to shore up collection.

According to Economy data, today salaries of up to just over 700,000 pesos are exempt from Profits. The projection with salary increases as of December 2023 is 890,000 with tax withholdings. This implies 7 percent of workers in a dependent relationship. This same figure had reached 30% of the total number of workers during the mandate of Mauricio Macri (2.4 million workers) and was 1.2 million in 2015.

Source: Ambito