State companies in the energy sector are those that received the largest amount of transfers from the Treasury in 2023. It was more than $1 trillion, the equivalent of 0.6% of GDP, which implied that Half of the contributions that the State makes to its companies are allocated to the energy sector. Outside of YPF, which is a mixed company and did not receive contributions from the Treasury, there were 4 energy companies that received money, but the magnitude is explained by only one: the state-owned Energía Argentina SA (formerly Enarsa). However, it is worth clarifying that the explanation for this deficit does not lie in the company’s inefficiency, but rather in the energy subsidy policy defined by the Government.

The data comes from the Congressional Budget Office (CPO), which has been carrying out a series of reports on the omnibus law, titled by LLA as the Law of bases and starting points for the freedom of Argentines. In their report number 5, they refer to articles 8 to 11 of the law, which are the ones that talk about the privatization of public companies. The annex lists 41 public companies that are subject to privatization.

How much does the State contribute?

During 2023 Transfers and contributions were made to public companies for a total of $2,301,385 million, equivalent to 1.22% of GDP. 0.78% corresponded to current transfers, while the remaining 0.44% corresponded to capital transfers, according to the OPC.

Half of these transfers are explained by what the State sends to the energy companies. In 2023, between current and capital transfers, the Treasury sent the energy companies a total of $1,184,458 million, equivalent to 0.63% of GDP. Of that more than a trillion pesos, 95% were shipments made to Energía Argentina SA ($1,128,808 million, or 0.60% of GDP). The other 5% is explained by the other 3 energy companies subject to privatization: the mining company Yacimientos Carboniferos de Rio Turbio, which received $47.45 billion; Nucleoelectrica, which operates nuclear power plants, for $3,000 million and DIOXITEK SA, which supplies nuclear inputs, for $5,200 million.

What Energía Argentina does

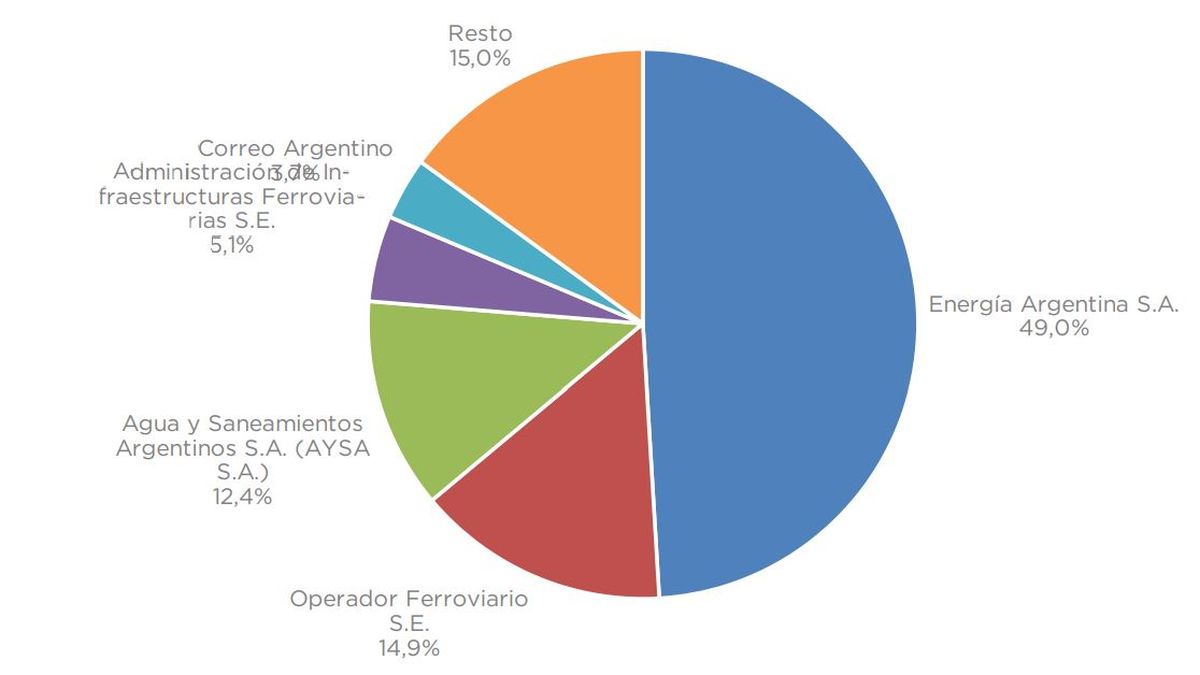

The amount that Energía Argentina receives is not only notable among energy companies, but also with respect to the total of state companies. It keeps 49% of the total transfers and capital contributions that the State makes to all companies. It is followed by Railway Operator (14.9%), AYSA (12.4%), Railway Infrastructures (5.1%), Correo Argentino (3.7%) and the others make up the remaining 15%. And it is not even close to being the one with the largest number of employees.

note graph.JPG

Energía Argentina SA (formerly Enarsa), was created in 2004. As detailed by the OPC, its objective is: to carry out the study, exploration and exploitation of hydrocarbons, the transportation, storage, distribution, marketing and industrialization of these products, as well as the provision of the public service of transportation and distribution of natural gas, and the generation, transportation, distribution and marketing of electrical energy.

In practice, it is known for having been the company behind manage the Néstor Kirchner gas pipeline, or for being in charge of the gas imports What Argentina needs.

Transfer Provision

The OPC report makes a reservation about Enarsa. The thing is that in public opinion it is associated with the transfers and capital contributions of the State to the financing of the losses of public companies. However, the document clarifies that there are funds that are transferred to these companies “that should not be considered as part of the financing of the companies’ deficit, since “It is about the funding of certain public policies.”

This is how the work details it: “Not all transfers to state companies can be associated with an economic loss attributable to the companies. The analysis of energy subsidies is a good example. That subsidies for gas demand be channeled mostly through a certain state organization (ENARSA) It does not mean that the activity of these companies is being subsidized. It is the State that decides to subsidize energy consumption and does so by imposing prices on state companies below those that would arise from an autonomous business decision. As an example, if ENARSA imports liquefied natural gas at a price higher than that at which it resells it in the domestic market, this does not necessarily make the company itself inefficient, but rather it is the Government that imposes this economic loss on it to lower the price. of gas in homes.”

Furthermore, he adds: “The compensatory budget transfer goes from the Treasury to ENARSA, but The subsidy is aimed at local natural gas consumers.”

Another issue related to Enarsa is that a large part of the funds it received was for capital expenses, that is, infrastructure development, such as the construction of the Néstor Kirchner gas pipeline in 2023, which allows gas from Vaca Muerta to be transported to large centers. urban.

Anyway, This does not mean that they may contain operational inefficiencies, the OPC clarifies.

ENARSA subsidies in 2023

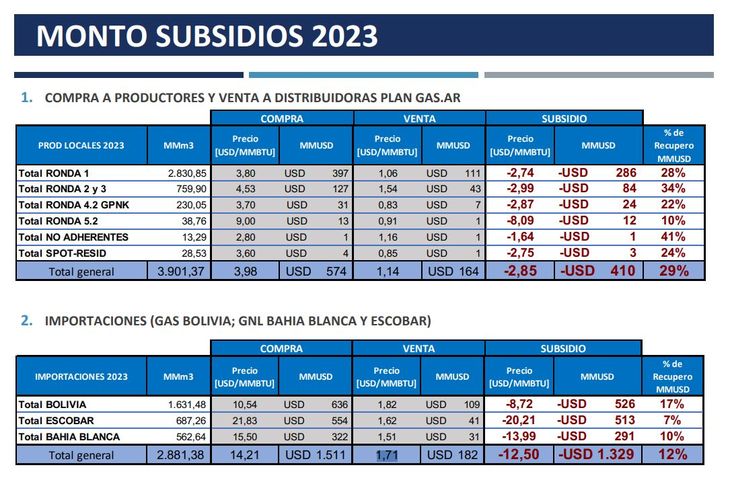

As an example, there is the data that showed Carlos Bischoff, executive director of Enarsa, during the public hearing to advance the future of gas rates. During the year 2023, The company imported gas for US$1,511 million, either from Bolivia or by LNG ships. This gave an average of $14.21 per million BTU. However, when it came time to sell it, she had to do it $1.71 per million BTU, per a previous government definition. This implied a subsidy of US$1,329 million, and a recovery percentage of only 12%.

graphic note2.JPG

In 2023, Energía Argentina imported gas at $14 and had to sell it for less than $2

Source: Ambito