The Houthi attacks in the Red Sea are increasingly affecting supply chains. Because ships travel longer, containers are becoming scarce. Instead of shipping by sea, some companies now want to rely on air transport.

The tense situation and the constant attacks by Houthi rebels on freighters in the Red Sea are increasingly leading to delivery bottlenecks for companies in Germany and Europe. Bringing goods directly by sea from Asia to Europe and vice versa has become dangerous due to the Houthi attacks.

Because supply chains no longer function smoothly, car manufacturers such as Tesla, Suzuki and Volvo are suspending production in Germany, Hungary and Belgium due to missing parts. The German discounters Aldi and Lidl are also waiting for goods, especially promotional items from the non-food sector. The Qatari state-owned company Qatar Energy is currently not allowing any liquid gas transporters to travel through the Red Sea.

The ongoing Houthi attacks are becoming a problem for the logistics industry: the lack of freight capacity and the detours make transport more expensive.

Less capacity and higher costs

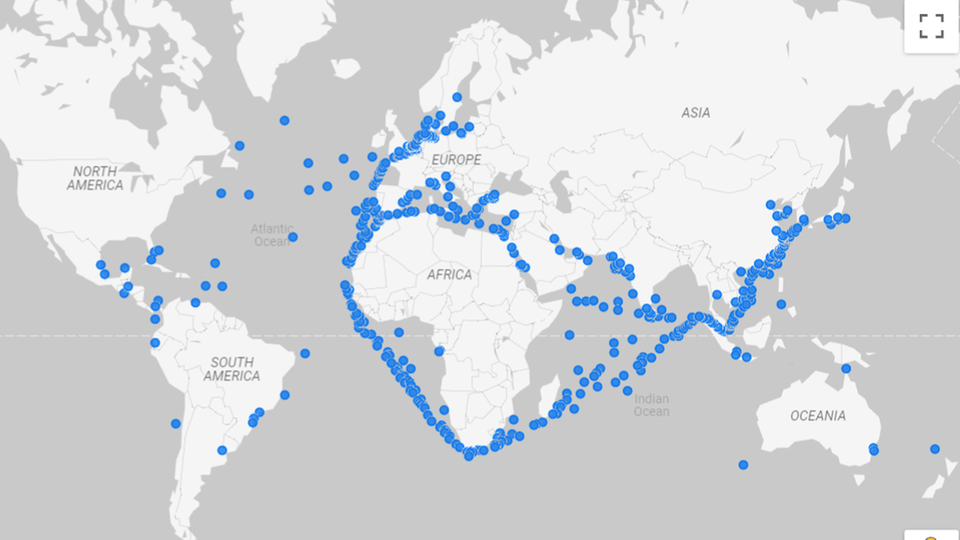

Instead of going through the Suez Canal, many shipping companies have been sailing around the Cape of Good Hope for several weeks now. Transporting goods between Europe and Asia currently takes around two weeks longer. The increase in costs is not as strong as during the corona pandemic. But the major Hamburg shipping company Hapag-Lloyd, which began the diversion in mid-December, was already expecting additional fuel costs amounting to a double-digit million amount by the end of the year, a spokesman told the business magazine “Capital” at the time.

Anyone who wants to travel through the Suez Canal despite the risk of attacks will have to pay more because insurance has become more expensive. “Insurance for ships in the Suez Canal increased to 0.75 to 1 percent of the ship’s value,” Michael Wax, founder of logistics company Forto, tells Capital. “A large container ship worth $100 million could pay up to a million dollars in insurance alone.”

What Wax sees as even more drastic, however, is that significantly fewer containers are available due to the longer route. Accordingly, a capacity reduction of 30 to 40 percent can be expected in the next few weeks. The Chinese New Year at the beginning of February could make the situation even worse because offices and factories are officially closed. The freight capacities used will be reduced during this time. The demand for freighters is particularly high beforehand because companies want to increase their inventories.

The importance of air freight for supply chains could increase

Urgent goods in particular could therefore increasingly be sent by plane in the next few weeks. However, this is significantly more expensive and far less can be transported. According to industry circles, the ratio between air and sea freight is around 1:100. Transporting goods by plane cannot under any circumstances compensate for ship deliveries.

Logisticians are already noticing that customers are increasingly asking for alternative transport routes. DB Schenker, one of the world’s leading logistics companies, states that it has secured additional cargo space in aviation “in order to be able to serve the expected shift from sea freight to air freight”. A spokesman for the postal company DHL reported that urgent shipments are already being transported by air freight.

Sustainable business ideas

These start-ups want to save the climate

The transport combination of sea and air freight is also becoming more popular. Yngve Ruud from the logistics group Kühne + Nagel reports that the first customers are switching to it. Goods are transported part of the route by ship and then by plane, for example from Dubai or Los Angeles. This shift could increase in the coming weeks, predicts Ruud. He is already having around 20 to 30 percent more conversations and inquiries than he normally does in January.

Forto logistics provider Wax also reports that customers compare prices. According to him, there is a particular demand for freight transport by train, but he does not yet see a significant shift from sea to air freight. “Despite the four-week closure of the Red Sea, air freight rates are only about 20 percent above normal prices,” says Wax. “During the pandemic, air freight costs increased by over 100 percent.” According to Schenker, visible effects on aviation can be expected in two to three weeks.

Habeck does not expect any “serious effects”

The attacks in the Red Sea, in the strait between Djibouti and Yemen, are directly related to the war in the Gaza Strip. The Houthi rebels show solidarity with the radical Islamist Hamas fighters and announced at the beginning of December that they would attack all ships bound for Israel that do not deliver aid to Gaza.

The head of the Danish shipping company Maersk, Vincent Clerc, warned at the World Economic Forum in Davos that shipping traffic would be disrupted for months. Almost 20 percent of world trade passes through the affected strait. “It is one of the most important arteries of world trade and global supply chains and is currently congested,” Clerc said. How the situation develops is unpredictable.

Federal Economics Minister Robert Habeck said in Davos that the situation in the Red Sea was being monitored very closely. However, he does not expect any major supply chain problems or “serious impacts” as a result.

This article appeared firstwhich, like stern, is part of RTL Deutschland.

Source: Stern