“Open the stocks, move towards currency competition and close the Central Bank.” That is the sequence that was proposed this week Javier Milei as a guideline for your adjustment plan. To take the first step, in addition to the effectiveness of the peso blender and an eventual new debt with the IMF, the Government bets a good part of its chips on the liquidation of the thick harvest. But there he faces the classics agricultural pressures for greater remuneration, after The ceiling achieved with the December megadevaluation was being consumed.

Luis Caputoin his recent meetings with mass consumption companies and supermarkets, He reiterated that he does not foresee a sharp devaluation in the short term. And during February, the market was aligning with that idea, at least in future dollar contracts. But In the countryside they wait for a signal from the Government, the recognition of a higher exchange rate in the face of the high season for agricultural exports, in which the BCRA aims to accelerate the purchase of reserves. It is something that began to be discussed with officials.

The truth is that, despite the strong devaluation in December, The real exchange rate that exporters access is already below that offered by previous editions of the so-called Export Increase Program, launched during the administration of Sergio Massa in the Ministry of Economy. This was calculated by the Economic and Social Reality Study Group (GERES). The inflationary flash of these months (accompanied by a crawling peg of 2% monthly) and, in recent weeks, the reduction of the exchange gap that put a ceiling on the dollar blendas the current scheme is known in which 80% of exports are settled in the official market and 20% in cash with settlement (CCL).

image.png

The trap of the economic team

GERES noted that “the current real export exchange rate (80/20), after the megadevaluation and inflation of recent months, reaches January 2022 levels, below the previous export increase programs (PIE). In nominal terms, the blend dollar today is around $893.

This reality appears qualified by the fact that, since December 11, the BCRA has recorded an extensive period of net purchase of currencies: He had a favorable balance in 61 of the last 63 rounds. However, GERES clarified that this occurs “under the protection of a strong import payment restriction and the significant drop in them due to the recession.” As he told Ambitthe staggered payment scheme for purchases abroad caused the commercial debt to grow during the summer in a magnitude similar to the foreign currency acquired by the Central Bank.

In this framework, there is an apparent paradox, which is reflected in the aforementioned group of studies: “Although the real export exchange rate shows rapid appreciation, the gap in the exchange rate of the current export increase program (80/20) with Regarding the CCL, it is at minimum levels.” One of the explanations is that the scheme of the dollar blend generates an additional offer in cash with settlement equivalent to 20% of sales abroad, which is significant in a relatively small market (and with reduced demand due to the liquefaction of pesos) and drags down its price.

That is today the encloses that the economic team faces in the face of the approaching heavy harvest. In this framework, GERES stated that “pressure from exporters to improve the exchange rate increases“by means of increasing the CCL, reducing withholdings or another measure that grants a differential exchange rate that results in an improvement in the export exchange rate.” These are alternatives that have their complexities: the blend dollar itself puts a limit on the increase in the CCL and a reduction in withholdings would complicate a fiscal front that, on the collection side, is already beginning to suffer due to the acute recession.

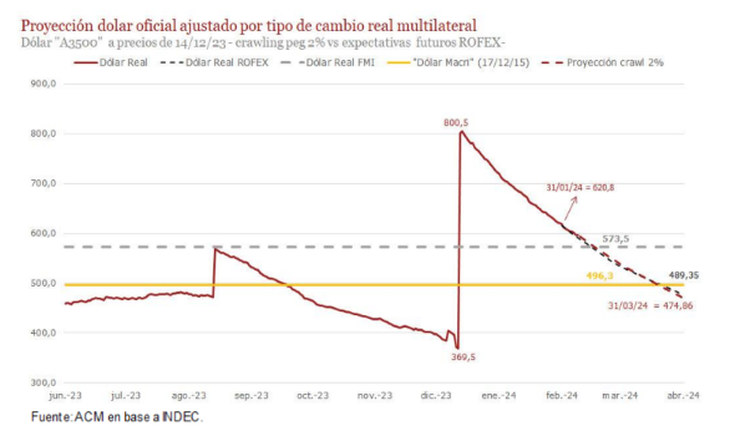

The consultant ACM He also kept an eye on exchange rate appreciation. He highlighted that, in the seventh review of the current program, the International Monetary Fund (IMF) called for “maintaining a real exchange rate aligned with the country’s historical average, which would be equivalent to $573.5 at prices on December 14, 2023.” However, the consulting firm pointed out that, currently, with data until March 6, 2024, the real exchange rate is already below this threshold.

image.png

“Therefore, if this crawl rate continues (2% monthly), The real exchange rate could experience a gap between 16 and 20 percentage points with respect to the recommended values. An important aspect to highlight is that the market seems to validate the crawl rate, given that based on the ROFEX futures contracts at the close of the date (March 12), the difference between the two is minimal,” ACM stated.

Source: Ambito