This information must be sent to the email address [email protected] in pdf format.

II. In the event that the Obligated Subject is a human person, they must attach to the email a note signed by them or their representative, addressed to the President of the UIF, which must state:

a) full name and surname;

b) identity document number (National Identity Document, Civic Book, Enrollment Book, Identity Card granted by the competent authority of the respective bordering countries or Passport);

c) Unique Labor Identification Code number (CUIL), Unique Tax Identification Code (CUIT) or Identification Code (CDI) or the identification code that is created in the future by the Federal Administration of Public Revenues (AFIP), or its equivalent for foreign persons, if applicable;

d) real address (street, number, town, province, postal code);

e) telephone number;

f) electronic address (email address) which will have the status of address established before the FIU;

g) main activity carried out;

h) If you are a Politically Exposed Person, in accordance with the current resolution on the matter.

To this end, you must attach the following documentation:

1) copy of the identity document reported in section b) above;

2) copy of the certificate reported in section c) above;

3) copy of the authorization, license, registration and/or any other qualifying certificate issued by the organizations, registries, colleges, councils and other competent authorities, if applicable;

4) in the event that the note is signed by a representative of the human person, a copy of the respective power of attorney must be attached;

5) certification issued by the National Registry of Recidivism regarding criminal records;

III. In the event that the Obligated Subject is a person or legal structure, it must include a note signed by its highest authority, legal representative or Compliance Officer, stating:

a) name or company name;

b) Unique Tax Identification Code (CUIT) or Identification Code (CDI) number of the person or legal structure or the identification code that in the future is created by the Federal Administration of Public Revenue (AFIP), or its equivalent for foreigners, if applicable;

c) main activity carried out;

d) real address (street, number, town, province and postal code);

e) telephone number;

f) electronic address (email address) which will have the status of address established before the FIU;

g) details of the titular and alternate Compliance Officer – stated in point II, subsections a) to f) above –, indicating the position they hold in the administrative body of the person or legal structure;

h) details of the members of the administrative body – listed in point II, subsections a) to h) above –, indicating the positions they hold in the person or legal structure and the start and end dates of the mandate;

i) list of the final beneficiaries of the Obligated Subject in accordance with current regulations.

To this end, you must attach the following documentation:

1) copy of the updated corporate statute or incorporation contract duly registered, where applicable;

2) copy of the certificate reported in section b) above;

3) copy of the authorization, license, registration and/or any other enabling certificate for the performance of the activity of the Obligated Subject, issued by the organizations, registries, colleges, councils and other competent authorities, if applicable;

4) copy of the minutes that certify the appointment of the members of the administrative body and the distribution of positions. In the case of Public Organizations, a copy of the administrative act of appointment to the position will be sufficient;

5) copy of the minutes of the decision-making body or record of the appointment of the titular Compliance Officer and the alternate;

6) sworn declaration with the following data of the final beneficiaries: name/s and surname/s, DNI, real address, nationality, profession, marital status, percentage of participation and/or ownership and/or control and CUIL, CUIT, CDI, if applicable, and if it is a Politically Exposed Person in accordance with the current resolution on the matter.

Without prejudice to this, the FIU may request any other data, information and/or documentation that, at the discretion of the Agency, allows the identification and verification of the identity of the final beneficiaries of the Obligated Subjects, in order to adequately know them. When the majority participation of the Obligated Subject person or legal structure corresponds to a company that makes a public offer of its negotiable securities, listed on an authorized local or international market and the same is subject to requirements regarding transparency and/or disclosure of information, it must indicate such circumstance for the purposes of being exempt from this identification requirement. This exception will only take place to the extent that timely access to information is guaranteed;

7) certification issued by the National Registry of Recidivism on criminal records of the members of the administrative body and the final beneficiaries.”

Obligated Subjects: how they should request their withdrawal from the SRO+

“Obligated Subjects must request their withdrawal from the SRO+ to the email address [email protected] when, among others, any of the following circumstances are verified:

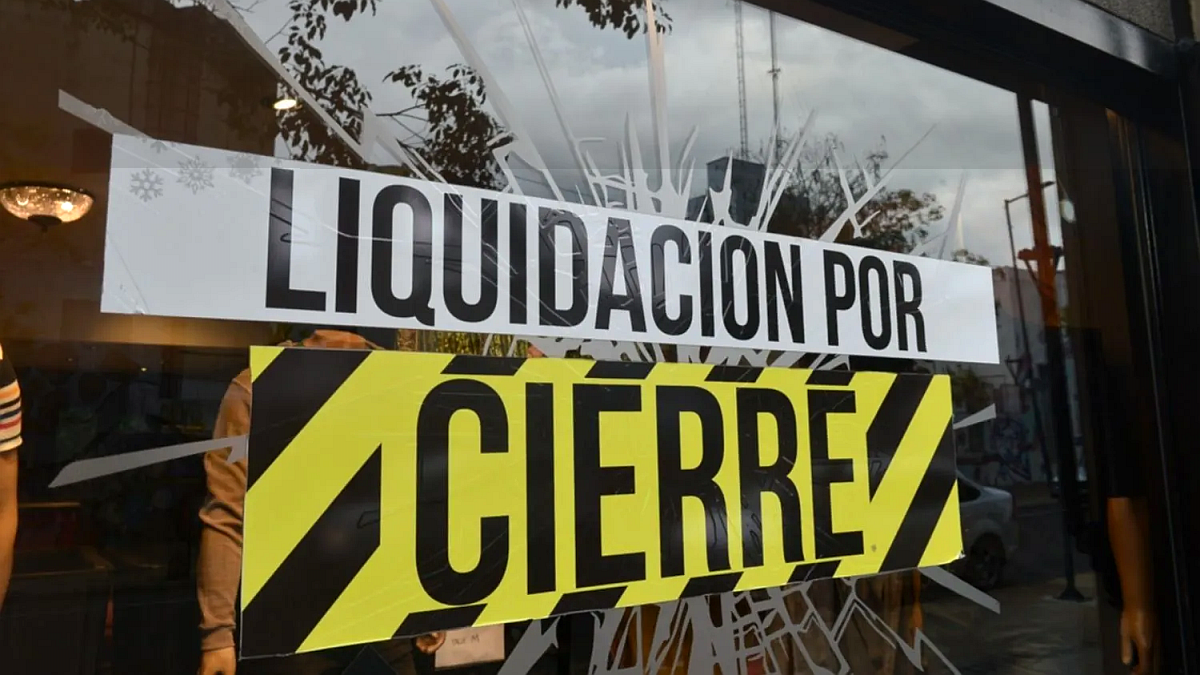

1) death, dissolution, liquidation or extinction;

2) retirement;

3) cessation of activity;

4) expiration, cancellation or withdrawal of the authorization to operate;

For this purpose, supporting documentation that proves the reasons for the request must be attached in PDF format.

The granting of the withdrawal will be communicated to the electronic address registered in the SRO+.”

Obligated Subjects: who must inform the FIU

1. The financial entities subject to the regime of law 21,526 and amendments; and retirement and pension fund administrators;

2. The entities subject to the regime of Law 18,924 and amendments and the authorized natural or legal persons by the Central Bank to operate in the Buy foreign exchange in the form of money or checks issued in foreign currency or through the use of credit or payment cards, or in the transmission of funds within and outside the national territory;

3. The natural or legal persons who, as a habitual activity, exploit games of chance;

4. The agents and brokerage companies, mutual fund management companies, electronic open market agents, and all those intermediaries in the purchase, rental or loan of securities that operate under the orbit of trading exchanges with or without attached markets;

5. The intermediary agents registered in the futures and options markets whatever its object may be;

6. The Public Commerce Registriesthe representative bodies for the Supervision and Control of Legal Entities, the Real Estate Registries, the Automotive Registries and the Pledge Registries;

7. The natural or legal persons dedicated to the purchase and sale of works of art, antiques or other luxury goods, philatelic or numismatic investment, or the export, import, manufacturing or industrialization of jewelry or goods with precious metals or stones;

8. The insurance companies;

9. The companies issuing traveler’s checks or credit or purchase card operators;

10. The companies dedicated to the transportation of flows;

11. The companies providing or concessionaires of postal services that carry out currency transfer operations or the transfer of different types of currency or banknotes;

12. The Public Notaries;

13. The entities included in article 9 of Law 22,315;

14. The registered natural or legal persons in the records established by article 23, paragraph t) of the Custom code (Law 22,415 and amendments).

15. Its Public Administration bodies and decentralized and/or autonomous entities that perform functions regulatory, control, supervision and/or superintendence over economic activities and/or legal businesses and/or on subjects of law, individual or collective: the Central Bank of the Argentine Republic, the Federal Administration of Public Revenues, the Insurance Superintendency of the Nation, the National Securities Commission and the General Inspection of Justice;

16. The producers, insurance advisors, agents, intermediaries, insurance adjusters and adjusters whose activities are governed by laws 20,091 and 22,400, their amending, concordant and complementary laws;

17. The pregistered professionals whose activities are regulated by the Professional Councils of Economic Sciences, except when they act as a defense in court; 18. All legal entities that receive donations or contributions from third parties are also obliged to inform.

Source: Ambito