Analysts estimate that the government of Javier Milei intends for the pension system to be at a spending level equivalent to between 5 and 6 points of GDP. It would be lower than during the government of Alberto Fernández, which was at levels close to 7 points and much less than the 9.6 points of 2017, during the administration of Mauricio Macri.

To be sustainable, an adjustment in expenses in Argentina cannot avoid having to dip into pensions, because it is the item that has the greatest impact on the total expenditures that the state has.

Daniel Artana, In a recent talk with investors, he noted that “In previous years, pension payments averaged 7 points of GDP and as a result of the fact that the formula runs back to the nominality of the economy, “In January, February and March, payments will be 5 points or even less.”

The FIEL economist stressed that if inflation is partially compensated during the second quarter of this year, The weight of the retirement system will remain at about 6 points of GDP.

Retirements: the market view

The research team of Adcap Financial Group points out in a brief comment that the new formula announced by the Government allows consolidating a saving of almost 1 point of GDP in 2024.

“The pension indexation formula included in the last decree seeks partially recompose the current minimum asset but keep it constant in real terms starting in July. If the disinflation scenario continues, by December 2024, real assets would recover to the levels of December 2023, remaining stable spending below 6 points of GDP, compared to 6.8 points in 2023,” the report states.

That level of retirement spending is “historically low” defined Adcap, but the question arises whether it can be stable in the long term.

Screenshot_2024-03-26_12-38-45.png

“This level (6 points of GDP) is well below 2017 (9.6 points of GDP), moment at which the acceleration of inflation began to liquefy retirements,” maintains the research team of the brokerage company.

In this sense, they point out that “without the ability to recover in a disinflation scenario, The level of spending on benefits would remain similar to that of the 1990s, but with (approximately) twice as many beneficiaries.”

“That is, almost half per capita, which does not seem to be sustainable. Possibly the change in formula is a measure that aims to first achieve fiscal consolidation and then move on to a reform of the complete pension system,” predicts Adcap Grupo Financiero.

AboutMartín Polo, from Cohen Aliados Financieros, He said in a talk with investors that “the main government expense, which weighs the most, is the retirement system that contemplates 9 points of GDP, while the second one that follows in importance does not even reach 3 points (subsidies),” he explained.

“Starting in March, beyond the discussion about the adjustment formula, whether or not there is a bonus, the important thing to keep in mind is that this liquefaction would be ending”, advance.

“Pensions are going to rise 28% in April and May the same, 25%, and then they will adjust for past inflation,” he explained.

In that sense, Polo stated that “the primary spending in the first two months was adjusted by 1 point of GDP, 30% came from retirements, another 30% for subsidies and transfers.” “For this spending cut to be persistent, the Government requires laws,” insisted the economist from Cohen Aliados Financieros.

For his part, Nadin Argañaraz, from the Argentine Institute of Fiscal Analysis, states that “if in April salaries are adjusted by 13.2% for February inflation, plus 12.5% one time, retirees with the minimum “They would have a real income in May that was 25% lower than what they had in 2017.”

“For its part, the May earnings of retirees outside the minimum would be 49% lower than in 2017,” he warned.

Retirements: the critique of heterodoxy

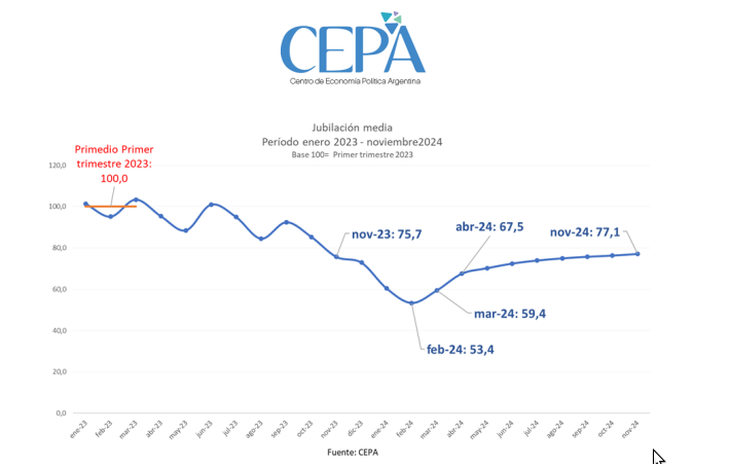

From the Center for Argentine Political Economy (CEPA), Hernán Letcher, suggests that “compared to the first quarter of 2023, in April retirements would be 32.5% lower in real terms.”

“In February they would reach a minimum of 53% (a cut of 47%), compared to the first quarter of 2023. Retirees can aspire, in the best of cases, for the loss to consolidate around 25%,” Indian.

center-strain-retired.png

Source: Ambito