Although the Biden administration believes East Coast ports will easily absorb cargo diverted from BaltimoreMaryland Governor Wes Moore warned that the port closure will have serious ripple effects throughout the city, surrounding counties, the state, the Mid-Atlantic and even the eastern half of the U.S. “This port is one busiest in the country, so this will affect the farmer in Kentucky, the car dealer in Ohio and the restaurant owner in Tennessee,” Moore illustrated.

In 2023, the port of baltimore handled $80.8 billion in trade, including 1.1 million 6-meter containers; 1.3 million tons of rolling agricultural and construction machinery; 11.7 million tons of general cargo and 847,158 shipments of cars and light trucks. Several major companies have distribution warehouses and other facilities at or near the port, including Amazon, FedEx and BMW.

Already one of the main risk rating agencies, Moody’s, warned that a prolonged closure of the port would affect the local economy and could lead to negative credit risk events for the city and state, but would also harm the transportation and storage sector. Why all the fuss over a bridge?

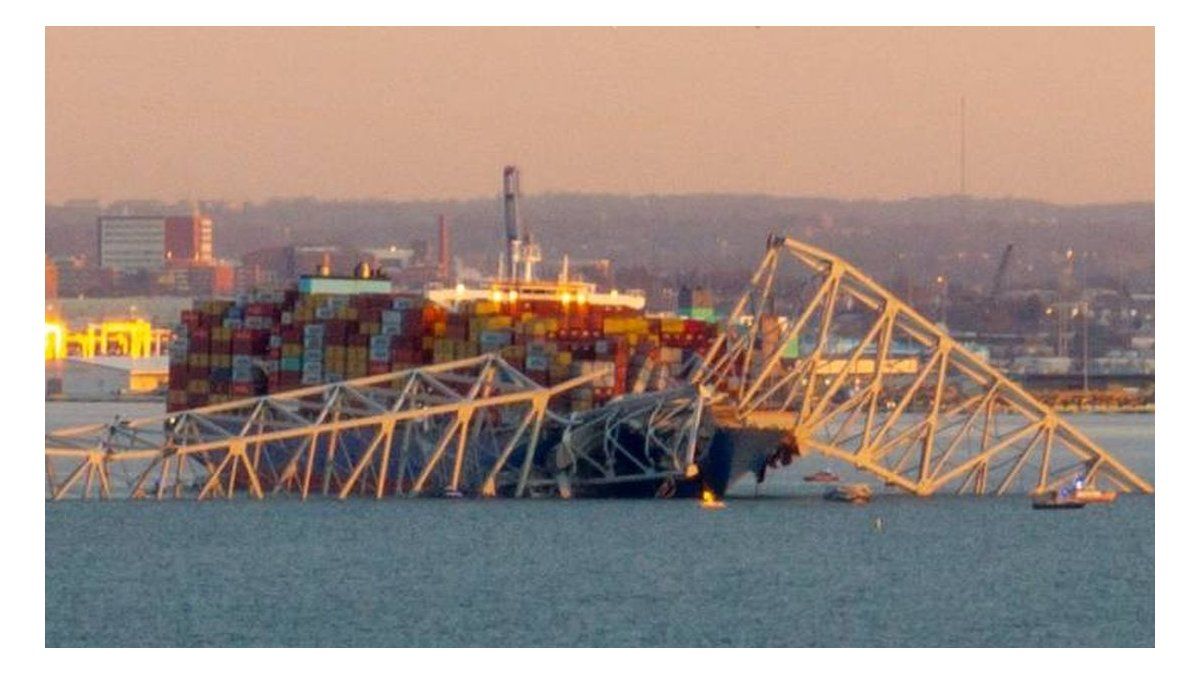

The collapse of Francis Scott Key Bridge of the city of Baltimore, state of Maryland, caused by the attack of the Singapore-flagged container ship, Dali, first affected the shares of the Danish holding Moeller-Maers, which chartered the freighter, with a drop of almost 3% on the day of the news (they later recovered part of the loss). But now analysts and investors are not only evaluating the costs of rebuilding the bridge, which is an essential link in US logistics communications, but also the damage it could cause to the US economy and the supply chain. At the same time, alarms were also raised in the international insurance sector due to its links with this unthinkable disaster. But what do analysts and investors fear?

On the one hand, analysts are trying to evaluate the impact that the closure of the port of Baltimore will have, with great economic influence in Maryland and the entire east coast of the United States. But they also foresee some inflationary effect, because the port of Baltimore It is a major hub for U.S. automobile and farm equipment imports.

In addition, the accident closed an important highway and container traffic is being diverted to other ports in the country, so, to the inconveniences in the Red Sea and the drought in the Panama Canal, the Baltimore factor is now added.

It is worth remembering that the total trade that passed through the port of Baltimore last year amounted to more than 80 billion dollars, so that every day that it is closed there are more than 215 million dollars that do not pass through its docks.

On the transportation side, it is estimated that they will surely increase since almost 4,000 commercial trucks use the Baltimore bridge each day, according to the American Trucking Association. So detours will increase delivery times and fuel costs. It is worth noting that there are large companies with distribution facilities near the bridge, including Amazon, FedEx, Under Armor and also some automotive companies such as General Motors and Ford.

For Oxford Economics experts, the accident will have more economic implications for the Baltimore economy than at the national level and they believe that disruptions to commerce or transportation will not impact the US GDP as much. However, they recognize that it is likely some temporary disruptions may occur in certain industries, including automobile manufacturers.

But the key is how long the interruption of this communication channel will be. In this regard, these experts warn that if it is extended too much, delivery times could be extended more than expected, fully impacting the US supply chain, mainly because Baltimore is the largest port in the country in terms of regarding the handling of light trucks, construction machinery, automobiles and imported plaster.

Therefore, not only are there fears of effects in terms of a drop in activity but also inflationary effects, which could be taken into account by the Federal Reserve (Fed). We will see.

But the problems do not end here because investors are now also looking at other possible victims, such as insurers. It was the CEO of Lloyd’s of London himself, John Neal, who warned that the aftermath of this event could involve the largest marine insurance payout in history. In any case, the CEO of the insurer is confident that the multimillion-dollar losses that this disaster will cause can be faced by the network of insurers and reinsurers involved.

Also the president of Lloyd’s of London, Bruce Carnegie-Brown, recognized that the payment for the collapse of the Baltimore bridge and its collateral damage, such as the closure of the port, delays in the supply chain and the need to divert traffic to other docks, could be the largest maritime insured loss in history, which according to the rating agency DBRS Morningstar It could be between 2,000 and 4,000 million dollars.

From Barclays They estimate it at a similar figure, around 3,000 million dollars, given that insurance claims for damage to the bridge alone could reach 1,200 million dollars, but other claims for additional liabilities of between 350 and 700 million dollars, related to wrongful deaths plus other amounts yet to be determined for business interruptions during the blockade of access to the port.

Furthermore, this accident, added to the commercial impact of the Houthi attacks in the Red Sea, will put upward pressure on the prices of marine insurance coverage around the world.

Source: Ambito