lclothes are expensive: Throughout last year the price of textiles rose more than other products and now, with the adjustment plan carried out by the Government, which reduces purchasing power to salaries, the sector is beginning to feel the effects that could lead it to a crisis.

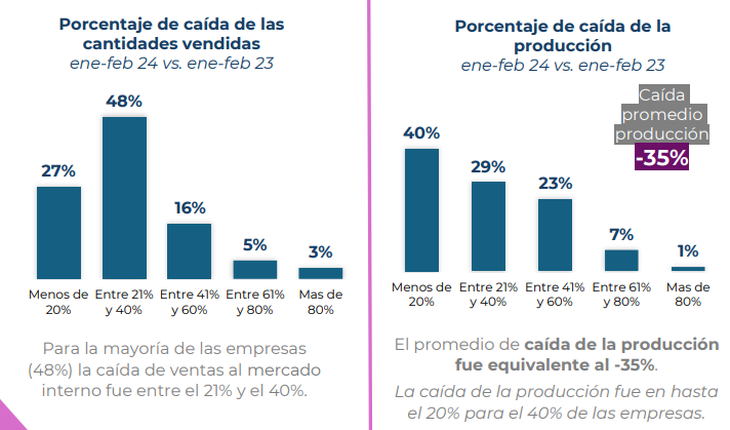

Private data reveals that 87% of companies in the textile sector registered in the first two months of this year a drop in sales. This is indicated by a survey carried out by the Protejer Foundationin which it is pointed out that the firms consulted had a 35% decline in demand.

The drop in sales of textiles comes hand in hand with a sharp rise in prices that occurred more than anything over the past year. In the first three months of the year the item accumulates an increase of 33%Meanwhile in March rose 11%.

protect.png

“More than 68% of companies decreased production year-on-year. Almost all of them attribute this dynamic to the loss of the population’s purchasing power,” says the Protejer report.

The report states that the “96% of the companies that reduced their production attribute this dynamic to the change in the purchasing power of the population” while on the other hand “34% of the companies that registered falls in their production identify macroeconomic expectations and change in the business climate regarding the future as the cause”.

Other reasons mentioned are variation in the costs of raw materials and inputs, exchange rate appreciation and changes in sectoral policies.

The study indicates that “the average drop in demand was 35%” during the first two months of this year and 69% of the companies surveyed registered “decreases in their use of installed capacity with an average drop of 26 points.”

According to the report, almost half of the companies (48%) suffer a drop in billing of between 21% and 40%.

On the other hand, to the extent that activity declines due to a decline in demand, the information indicates that “51% of companies have taken some measure that affected employment.” Among them are “cutting of shifts, overtime, non-renewal of contracts, suspensions and/or dismissals.”

protect2.png

The work specifies that “21% decreased the number of jobs in February 2024 in relation to December 2023, while “79% of companies will not make investments during 2024 and/or have canceled previously planned investments.”

Meanwhile, a 31% of companies “have shown difficulties in meeting the payment of their obligations.” “current, related to the payment of taxes and payment of inputs.”

In relation to the problems faced by the sector, it is mentioned andl payment of “taxes” (52%), payments to “national suppliers” (52%) and “imports” (42%).

On the other hand, Of the total number of companies with commercial debt, half were recorded in the Debtors Registry to tender BOPREAL and, of the latter, only 20% finally tendered BOPREAL.

They point out that it improves the confidence of businessmen

Despite the notorious problems faced by the SME industrial sector, business confidence in the economy remains highreveals a study carried out by the Pyme Observatory Foundation (FOP).

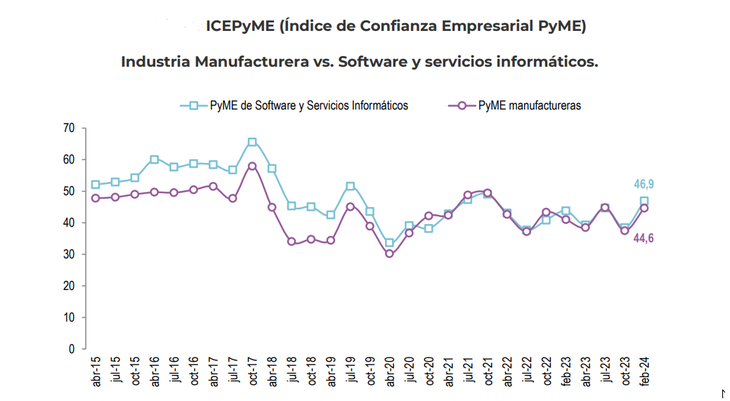

“Although the current productive situation of industrial SMEs differs substantially from Software and Computer Services SMEs (SSI), In the first two months of 2024, the level of business confidence for next year increased by 20% in both sectorsin accordance with what was recorded by the SME Business Confidence Index (ICEPyME) surveyed for more than 20 years by FOP”, highlights the entity.

icepyme-fop.png

The report shows that In February of this year, the confidence index stood at 44.6% for industries and 46.9% for software and technology companies.

The work also points out that “positive expectations about the country (one of the subcomponents of FOP’s ICEPyME), They started from very low, but between October ’23 and February ’24 they increased by 57%, both among industrial and SSI SMEs”.

“Expectations also increased in both sectors in the subcomponent on the performance of the company itself, which, although starting from a much higher level than the Country subcomponent, since October ’23 they have grown by 12% among industrial companies and 16% among SSI companies,” highlights the FOP.

Source: Ambito