During the month of March, import payments remained moderate, which is already a constant so far this year and one of the main factors of reserve accumulation by the central bank (BCRA). This trend, influenced by import restrictions, would largely explain the external current account surplus during the first quarter of the year.

Limitations on imports cause a remarkable effect in the economic dynamics of the country and that is reflected in a lower flow of payments abroad for imported goods. This phenomenon led to the accumulation of reserves by the BCRAin the midst of the search to stabilize the balance of payments.

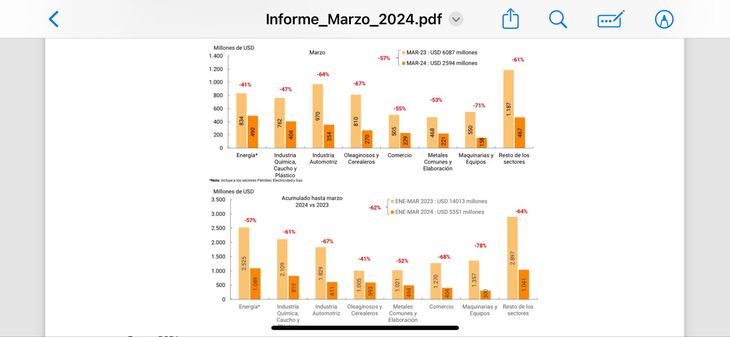

In March, Payments for imports of goods through the exchange market totaled US$2,594 million, 57% below the same month of the previous year, according to the Central Bank itself. “This value was below the imports of FOB goods for the month, which resulted in US$4,112 million. which would indicate an increase in commercial debt or a decrease in foreign assets“.

Reservations and Purchases in Mulc. Courtesy of EcoGo.jpeg

In this way, and as explained Alejandro Giacoiaeconomist Econviews in dialogue with Ambitthe commercial debt for imports grew by US$1.7 billion in March yu$s7.5 billion in the accumulated total of the first quarter. “According to the latest information from the BCRA, the stock at the end of 2023 was almost US$46,000 million, so at the end of March it would already be US$53,500 million,” analyzes the economist.

The BCRA strategy

Strictly speaking, since the new Government took office, the Central Bank has managed to buy a total of US$14,653 million in the official exchange market. This milestone was achieved thanks to the restrictions of the exchange market and the economic recession, the latter, triggered after the 54% devaluation on December 13.

Thus, during the period between January 1 and March 31 of this year, Dollar purchases by the BCRA totaled US$8,512 million and the increase in commercial debt explained 90% of the accumulation of reserves during the first quarter. To which is added that, with the issue of imports, the BOPREAL tenders “They do not even reach 25% of the foreign currency necessary to pay off the debt,” he details. Federico VaccarezzaMaster in International Business Relations UNTREF.

The analyst maintains that the recession had an impact and generated a reduction in imports, while exchange restrictions delayed payments in foreign currency and warns that “The Government expects that the effects of the abrupt economic depression will increase the trade balance through a fall in imports and an increase in exportsbut that strategy has a very high political and economic cost.”

In that same line it is expressed Sebastián Menescaldi, from EcoGo, who adds that “most of the foreign currency purchases made by the Central Bank in the Single and Free Exchange Market (MULC) can be attributed to a regulation that regulated the payment of imports at 30, 60, 90 and 120 days”.

As he points out, this regulation resulted in an alleged accumulation of commercial debt for a total of US$7,610 million during the first quarter of the year. This phenomenon was especially relevant in the first months of 2024.

BCRA monetary report March.jpeg

However, as of March, “The rest of the foreign exchange purchases are mainly due to an increase in exports, along with a decrease in imports, a result of a further economic recession“, shares Menescaldi.

Furthermore, since March, it has been observed that 60% of import purchases are canceled with the MULC flow. It is important to highlight that the value of the debt is greater than the theoretical one, “because the companies that had access to credit chose to postpone payments to take advantage of the exchange gap, given that the crawling was at 2% and the rate above this level“, Menescaldi slides.

Doubts about BOPREAL

For Leo Anzalonedirector of the Center for Political and Economic Studies (CEPEC), the issue of debt with importers is “to be followed closely”, but today the Government’s strategy is in place. lower inflation and gather reservesso any analysis must be done starting from there.

Therefore, for Anzalone, it is not a short-term priority and he considers it okay that it is so. In any case, he explains that with the arrival of the BOPREAL An attempt was made to find a way out of those obligations, “Although it does not seem to have been the best, the truth is that in December 17% of that amount had been paid, in January 24% and in February 42%.

He adds that the idea seems to be go towards the normalization of international trade. Anzalone maintains that today there is no longer a trade deficit and the lower demand for imports due to the economic cycle itself will tend to normalize the situation. “The point now is balance the level of reserves with the level of activity“, he warns. That is, the percentage of imports paid in relation to those earned began to rise and that causes less debt to accumulate.

“It is likely that the import payment scheme in four installments of 30/60/90/120 days that the BCRA established in December has had to do with the accumulation of reserves,”But it must also be said that during the previous Government an enormous stock of debt was accumulated because imports were not paid and the reserves, far from increasing, fell sharply.“concludes Giacoia.

Thus, and thinking about the future, the question about the accumulation of foreign currency for reserves focuses on the exchange rate delay and the necessary stimuli to persuade agriculture to liquidate, considering that exchange restrictions gradually fade away, as emphasized by the Government.

Source: Ambito