The economic team advanced last week in a series of steps that, according to the president, Javier Mileithey have their sights set on eliminating obstacles to get out of the stocks exchange. The Central Bank modified the regulations that required it to intervene daily with purchasing positions in the peso securities market and lowered the monetary policy rate again to stimulate transfer of debt from the BCRA to the Treasury, with the aim of limiting two of the monetary emission factors still open. Something that later materialized with the bulky placement of letters carried out by the Ministry of Economy. But There is a latent obstacle that Milei follows closely and on which no action has yet been taken: the puts issued by the Central Bank that are in the hands of the banks.

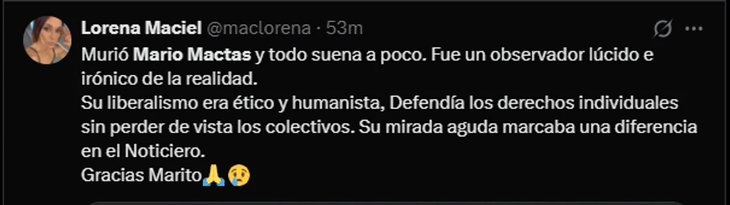

According to estimates by the consulting firm 1816, as of May 16, before the last tender of the Ministry of Finance, The stock of puts still in force that are in the portfolio of financial entities was $20.5 billion. It is a tool that works as a kind of insurance for banks and that the Luis Caputo – Santiago Bausili tandem used to promote the migration of liabilities from the BCRA to the Treasury: the entity that has a put can execute it whenever it wants to obtain liquidity and the Central Bank must go out and buy it through the issuance of money. That is why they constitute a kind of latent debt for the monetary authority that grew significantly this year.

In April, the BCRA began to limit this mechanism: it stopped offering puts that can be executed at any time and began to grant others that can only be activated in the 30 days prior to the expiration of the insured security. But according to the calculations of 1816, this last variant represents a small portion of the total stock of puts (about $2.5 trillion). So, There are almost $18 billion of public securities held by banks insured by the BCRA whose sale option can be executed from one day to the next.. The risk is that, if there is a change of mood in the market, these could be massively activated and force the Central Bank to inject a large amount of pesos. Without stocks, they could put pressure on the dollar.

image.png

That is why today the Government sees this element as one of the obstacles to be overcome before removing exchange controls. In fact, Milei mentioned this point last Wednesday in her speech to businessmen from the Inter-American Council of Commerce and Production (CICyP) when explaining why she is delaying lifting the restrictions: “We are in the zone of being able to open. If we solve the problem of paid liabilities. If we solve the puts. And we are fixing the issue of dividends. When we finish doing that, we are going to open the stocks. It is in our plans to open it as quickly as possible.”

In fact, the BCRA put three banks under the microscope and seeks to determine whether they manipulated the value of some bonds that they had insured with puts to force the monetary authority to buy them at a price higher than the market price.

From BCRA debt to Treasury debt

Meanwhile, The economic team made a series of decisions last week to accelerate the migration of debt from the BCRA to the Treasury National. On the one hand, the Central Bank lowered the reference rate again: the interest on passive repos went to 40% nominal annual rate, which implies a monthly effective rate (TEM) of 3.3% or 3.06% if netted. the impact on gross income (below the 8.8% inflation rate in April but also below the projections for May).

In return, Economía offered in the last tender very short-term bills with minimum rates of between 4% and 4.2%, as an incentive for banks to migrate their holdings. In addition, the entity chaired by Bausili established that LECAP (fixed rate bills) do not count towards the limits of financing to the Treasury that banks have for up to the amount they reduce from their repos holdings.

“The Ministry of Economy raised the 30-day reference rate for non-bank investors sharply, because fixed terms yielded 3.3% TEM on Monday (last week) and now there are short LECAPs in the primary at 4.2% . So, rather than lowering the rate, the Government ‘raised it by lowering it’ and sent a very strong incentive to the market to lengthen terms by going from one-day placements to the new one-month Treasury instruments,” said the consulting firm 1816 in his latest report.

The result was that Caputo and his Secretary of Finance, Pablo Quirno, placed debt in pesos for $11.7 billion against maturities of about $3 billion, which implied new debt for $8.63 billion. According to the Institute of Applied Economics (IEA) of the Universidad del Este, it implies a disarmament of the passes of around 33%.

By 1816, with the latest measurements, The Government seems to want to move towards the “definitive elimination of the remunerated liabilities of the BCRA, replacing them with Treasury securities.” A reading with which different market agents consulted by Ámbito agreed. A recent IEA report also stated that these signs mark “very strong progress towards the total eradication of passes.”

On the other hand, the Central Bank modified the rule that forced it to permanently intervene in the secondary debt market in pesos with purchase positions at a certain price, for which it had to issue more than $2 billion so far this year, according to estimates. private. Thus, he decided to move to a discretionary intervention scheme.

Source: Ambito