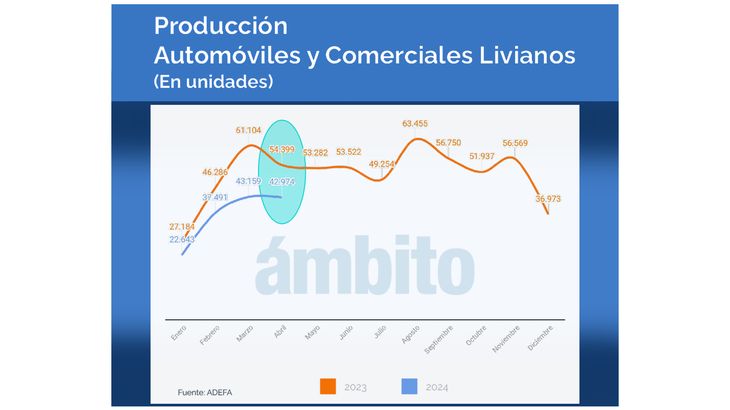

The drop in the first quarter exceeded 21%, and different factors suggest that there will be no rebound in the short term. The long terms for payment of imports are of concern. The RIGI, also in the sights of companies.

The floods in southern Brazil They ended up forming a perfect storm, beyond literality, in the production of Argentine automotive plants. The paralysis of three terminals due to difficulties in the logistics chain occurs at a time of decline in the local market and also in demand from export markets, with an exchange rate that is beginning to be looked at askance. Thus, the drop in local car manufacturing in the first quarter, of 21.6% compared to 2023, aims to continue the same trend in May.

The content you want to access is exclusive to subscribers.

The local automotive industry is going through volumes that, beyond the pandemic where there was total paralysis, resemble those 2004 figuresafter the rebound of the 2001 crisis. “The situation is difficult,” expressed to Ambit from a company. The floods that affected hundreds of towns in the province of Rio Grande do Sul They cut off shipments of parts, although a local terminal indicated that flights with auto parts have already begun to arrive for the assembly lines of these pampas. Other firms expressed that the situation will only be resolved in two weeks.

Days ago, General Motors announced that it will paralyze its production for ten days, and added to the similar inconveniences that they already registered Fiat, in Córdoba, and Peugeot, in El Palomar. The latter, of Stellantis grouphad reported “the unprecedented impact of the catastrophe on the entire logistics system of transportation and supply of components, added to the paralysis of the body in charge of issuing the environmental licenses required by current legislation.”

picture 1.jpg

However, the complications exceed climatic factors. “There was a drop in demand from markets such as Chile, Peru and Colombia”, they pointed out from an automotive company. He dollar that some companies already observe “behind” with the crawling peg The 2% monthly rate also does not encourage export projects. “It happens like with the countryside, which analyzes when to liquidate”, they mentioned this medium. In any case, they celebrated the Government’s decision to move forward with a tax reduction for incremental exports and for parts for production destined for the foreign market.

In addition to the tax pressure, which continues to be high with a loss of competitiveness, automotive companies are accelerating negotiations with the Government to reduce payments with importers, which today remains at 180 days for finished cars and 120 days for auto parts, in four sections. “That is the most important claim, because although payments are being fulfilled, it is still difficult to negotiate with suppliers abroad,” said an executive, who pointed out that they are now finishing paying for the parts that were brought to the country during the Government. former.

picture 2.jpg

Another point that production companies look at is the Incentive Regime for Large Automotive Companies, in the perfect storm: floods, drop in demand and a dollar that does not close investments (RIGI)included in the lhey Bases, whose discussion seems to have stalled in the National Senate. At that point, the discussion turns to Association of Automotive Factories (Adefa)which endorses an initiative that could benefit future investments, but asks, like the Argentine Industrial Union (UIA), that local suppliers be considered, since many have made investments and are part of the logistics chain.

Source: Ambito