The Government stepped on the accelerator in May and advanced in its country disarmament strategy liabilities of the Central Bank, considered by Javier Milei as a key step before opening the stocks, through a rapid handrail of debt with the Treasury National. This caused the stock of remunerated liabilities of the BCRA to fall to its lowest level since 2014, measured at constant prices. But this was achieved at the cost of a weakening of the Treasury’s position, which added a record monthly net debt and that began to increase its short term maturities.

At the City tables, they began to pay attention to this dynamic. It happens that the migration of bank holdings from Central debt to treasury debt, encouraged by a series of measures by the economic team, moves the stock of pesos from one area to another.

Thus, Luis Caputo’s team ended last month with a net debt in record pesos. The Ministry of In May, the Economy placed $11.9 billion more than what it needed to renew its maturitieswhich implied additional financing equivalent to 3.4% of GDP, according to Facimex calculations. The previous months with the highest net debt in pesos in the last four years did not exceed half that percentage. In total, since Milei took office, the Treasury’s net debt in pesos amounts to around $26 billion.

image.png

Other elements are added to the increase in the total volume of the treasury’s financial commitments. The positive fact is that the proportion of securities indexed to inflation and the dollar that were placed last month was very low; and In the last auction 100% was at a fixed rate (LECAP). But in order for the banks to agree to dismantle their holdings of passes issued by the BCRA and enter the tenders of the Ministry of Finance, Caputo paid them a interest rate higher than that of the secondary market and the one that the Central grants them for the repos.

After the last reduction, the pass rate remained at 3.3% effective monthly (or 3.06% if the impact of Gross Income is taken into account), while the shortest LECAP was placed at 4.2%. Romano Group highlighted that this is a differential not seen since April 2023, in the midst of the exchange rate run.

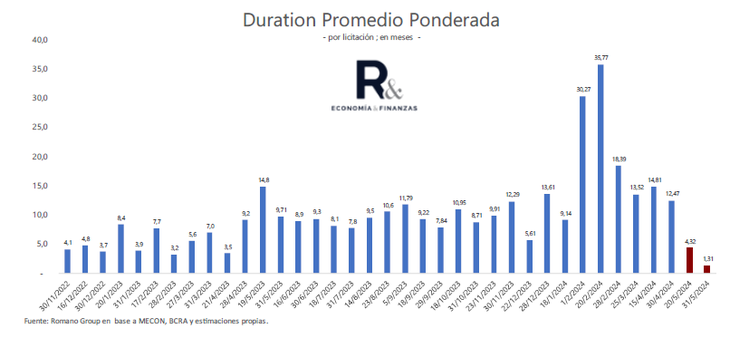

Additionally, Caputo’s strategy included a drastic shortening of placement times. Romano Group estimated that Economía went from issuing debt in pesos with a weighted average duration of 12 months in April to 1.3 months in the last tender in May. The economic team maintains that it is logical that this happens when seeking to create a short debt curve in pesos and by drawing on the disarmament of overnight repos.

image.png

In any case, the correlation is an increase in short-term Treasury commitments. “The maturity profile is beginning to steepen, which for the LECAP will be biweekly,” says an operator. For now, the next tenderscheduled for May 12, Finance will have to renew the $5 billion of the shorter bill that was placed during May plus some other maturities of smaller amounts.

The Romano Group report stated that the other side of the sharp reduction in the stock of remunerated liabilities of the BCRA is “a deterioration in the Treasury’s credit profile, with shorter duration and more bulky. Although he clarified that the market “for now does not feel resentment” Given this, as a result of the “liquidity cushion” that the Economy generated by leaving the bulk of the net debt achieved in May without application in the Treasury account at the Central Bank. According to Economía, that figure amounts to $13.66 billion.

The official argument for leaving the money obtained from net debt without application is that it seeks to generate a “liquidity cushion” that allows “guaranteeing future roll over” of the debt that was taken on. In the market, some voices question that the Treasury pays around 4% of the monthly effective rate for pesos, which it then deposits at a zero rate in the Central Bank, at the same time that the BCRA maintains Treasury bonds that continue to accrue interest. However, during the week the Government repurchased its holdings of the title in AL29 dollars from the monetary authority for the equivalent of $553,000 million.

Debt, disarmament of countries and debate

The background of this scenario for the Treasury’s financial account is the government strategy to accelerate the disarmament of the BCRA’s paid liabilities, something that the President mentioned as one of the necessary prior steps for the opening of the stocks exchange rate, which still does not have a defined date since Caputo himself recently mentioned that they still do not have sufficient reserves to do so.

“We believe that the strategy of migration of pesos to the Treasury is in line with the Government’s intention to clean up the remunerated liabilities of the BCRA, and thereby achieve an opening of capital controls more quickly. This implies less endogenous issuance and, consequently, a lower monetary supply that is likely to generate exchange pressures,” they analyzed in Romano Group.

Although they clarified that “this migration places the Treasury in a weaker position, whose profile begins to thicken in the shortest part, potentially generating instability in the curve to the extent that the market encounters some bad news,” despite the fact that They do not see it as something probable in the short term.

As Ámbito said, there are objections from other analysts about the impact of this strategy on the possibilities of opening exchange controls. A report by PxQ, the consulting firm of former Vice Minister of Economy Emmanuel Álvarez Agis, stated: “The transfer of passes to LECAP implies an increase in the Treasury’s commitments in the short term, and this makes it more difficult to get out of the trap given that if “There were no exchange controls, the refinancing of Treasury securities would become more complicated.”

PxQ added that “exchanging short-term BCRA debt” for “short-term Treasury debt” does not modify “the nature of the problem.” In that sense, he maintained that “the surplus of pesos of the private sector positioned in public sector securities (whether BCRA or Treasury) is the same and the conditions for exiting the stocks continue to depend on the level of the real exchange rate, the stock of reserves international, country risk and expectations about the economic program.”

Source: Ambito