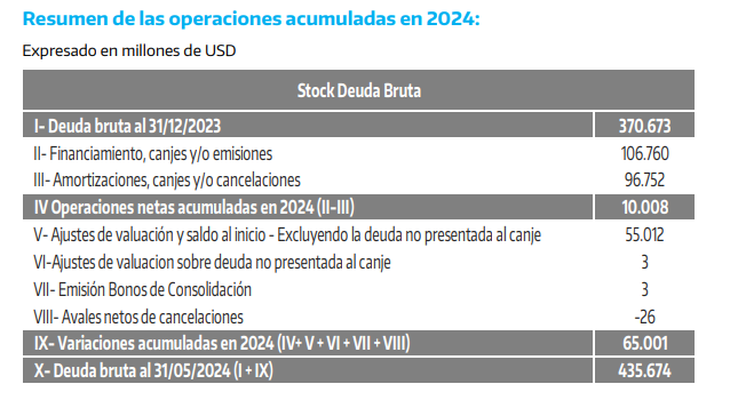

In Maythe stock of gross debt amounted to the equivalent of US$435,674 million, which implies a growth of 17.5% since the beginning of the year, as reported by the Ministry of Finance. Strictly speaking, the increase in gross debt can be explained for the most part by the evolution of commitments in pesos, since those in foreign currency remain stable. At the end of December, the stock of gross debt was US$370,674 million, which increased US$65,000 million in five months.

Of the total liabilities, US$433,222 million are in a normal payment situation, reported the Treasury Palace. From them, 41% of the debt is payable in local currency and the remaining 59% in foreign currency.

debt-for-currency.png

Regarding the comparison with the previous month, The debt in a normal payment situation increased by the equivalent of US$21,606 million, representing a monthly growth of 5.25%. The variation is explained by the decrease in obligations in foreign currency in US$1,825 million and the increase in debt in local currency for an equivalent amount in dollars of US$23,431 million.

The data indicate that a 35% of the increase in debt under normal payment conditions occurred last month, fact that is explained by the decision of the Treasury Palace of absorb the debt of the Central Bank through paid repos, which would still reach about $20 billion.

The official report indicates that “80% of the gross debt in a normal payment situation corresponds to Treasury Securities and Bills National, 18% to obligations with Official External Creditors, 1% corresponds to Transitory Advances, and the remaining 1% to other instruments.

On the other hand, it is pointed out that “during the last 12 months, the stock of gross debt in normal payment status increased by the equivalent of US$36,878 million, due to the decrease in debt in foreign currency by US$5,878 million and the increase in debt in local currency for an amount equivalent to US$42,756 million.”

The Government decided that the stock of national consolidated commitments (which includes the Central Bank) remains in the National Treasury, as a way to clean up the entity’s balance sheet. In that sense, while in the BCRA the debt generated interest, which multiplied the creation of money in the long runin the Treasury this does not happen.

public-debt.png

The large mass of debt that the Treasury Palace is taking on does not affect the financial surplus, but increases the debt. That is because the Capitalizable Bills that the Secretary of Finance, Pablo Quirno, is now using to take the pesos from the banks, are placed at a lower price than the nominal one.

In the market We look to the future paying attention to ensuring that the Government does not soon have problems with accumulation of maturities again, which could generate doubts as occurred during 2022 and 2023

The difference now is that the Government has the firm idea of sustaining the fiscal surplus, something that did not happen in those two years, which creates a better climate for investors.

For now, the Staff Report of the eighth review of the agreement with the IMF He has praise for the economic team on debt management and its concern about lengthening maturity periods. Some analysts consider that the key to everything is to maintain the fiscal anchor in order to maintain the “rollover.” But they also point out that in order to be calm in 2025, Argentina has to return to voluntary markets international and to do so you must have a country risk below 1000 points.

Source: Ambito