Loans in pesos to the private sector, granted by banks, reflected a significant decline in the economy during the first half of the year. In April, these loans plunged more than 33%, marking the deepest decline since 2021, according to official figures.

Although in the following months the decline slowed, in April the balance of financing to families and companies in national currency decreased by 7.7% in nominal terms, which represents a real decrease of 1% compared month to month. In year-on-year terms, the balance of credit to the private sector showed a drop of 34% at a systemic level, the biggest crash since the Covid-19 pandemic in 2021, according to the BCRA Bank Report, released this Wednesday.

This happens despite the fact that the Central Bank (BCRA) decided to cut six times the monetary policy rate since the arrival of Javier Milei to the Government.

The report highlights that in April, the balance of credit to the private sector in pesos increased in real terms in public banks, although it contracted in private banks. The BCRA indicated that the monthly performance was heterogeneous between the different credit lines, with increases in consumer lines (4.3% in personal loans and 1.8% in credit cards) and in advances (1.7%). , while other loan lines registered falls.

BCRA Bank Report.png

The balance of credit to the private sector in April showed a sharp drop of 33.6% year-on-year, according to the Central Bank report. This indicates lower demand for loans in pesos by families and companies. In monthly terms, the drop was 1%, according to the Report on Banks published by the monetary authority.

The BCRA detailed that the monthly performance was varied, with increases in real terms in consumer lines (4.3% in personal loans and 1.8% in cards) and in advances (1.7%), but with reductions in other lines. In addition, it was observed that the balance of credit to the private sector in pesos increased in real terms in public banks, while it decreased in private banks.

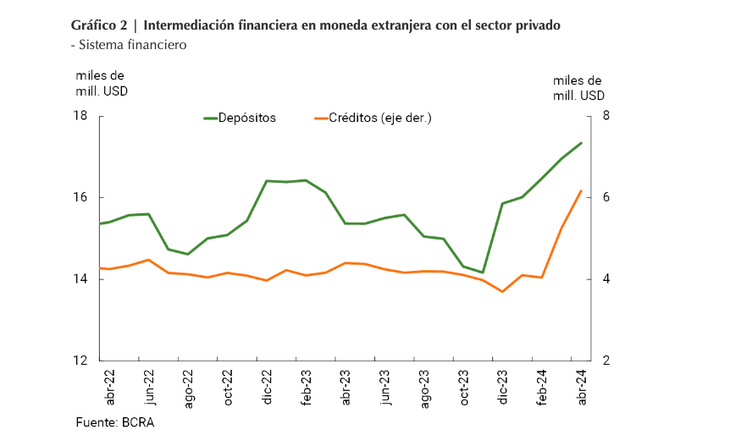

Credit in foreign currency

Regarding credit to the private sector in foreign currency, in April it increased by 17.3%, with increases of 30% in national private banks, 20% in public banks and 10.5% in foreign private banks (all these values expressed in the currency of origin).

Foreign currency BCRA.png

When considering all bank financing to the private sector, both in national and foreign currency, the real balance remained without significant changes between the months, accumulating a decrease of 10.1% compared to the same period in 2023.

This situation shows that credit has not yet managed to boost economic recovery. The report also reveals that the impact of mortgage credit has not yet been appreciated. However, an encouraging fact is the decrease in unpaid loans from both families and companies. The default rate of the loan portfolio destined for families stood at 2.6% (-0.7 percentage points year-on-year) and 1.3% in the corporate financing segment (-1.7 percentage points year-on-year).

Source: Ambito