These are people or companies that, under the protection of a law or a special regime, do not pay taxes in the same way as the rest of society. The opposition questions Tierra del Fuego’s electronics.

As a result of the insistence of the dialoguing opposition, the opinion of the fiscal package that the Chamber of Deputies will try from this Thursday again includes the article 111 that orders the Executive Branch within 60 days to propose the elimination of tax expenditures for up to 2 points of GDP.

The content you want to access is exclusive to subscribers.

He Argentine Institute of Fiscal Analysis (IARAF) points out that “tax expenditure is defined as the income that the treasury stops receiving by granting a tax treatment that deviates from that generally established in tax legislation.

In other words, it is about companies or people who do not pay taxes in the same way as the rest of taxpayers, protected by exemptions established in the laws that create taxes, or in special regimes.

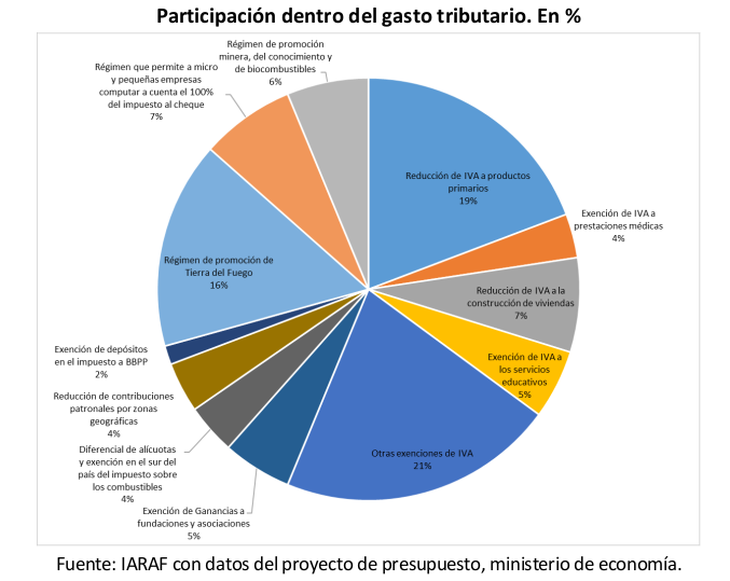

graphic-ex-taxes.png

One of the regimes that arouses controversy is that of the electronic industry of Tierra del Fuegowhich is questioned by the opposition Javier Milei. It must be taken into account that beyond the fiscal cost, There is an important portion of economic activity, especially in the interior, that without these types of advantages would not exist or, If so, it would be lower than the current one.

Some analysts They consider it ridiculous that Argentina grants benefits to build air conditioners in southern Patagonia, instead of doing it in the northern provinces, where it is hot.

The thing is that the regime was born of a geopolitical necessity. It is the Argentine State trying to establish a population presence in a region in which, throughout the 20th century, there were border tensions with Chile, to the point of almost reaching a war in 1978.

Beyond that, This promotion regime represents one of the highest tax expenses, since the treasury stops collecting taxes for 0.33 points of GDP. It represents 16% of total fiscal spending. It is equivalent to what the restitution of the Income Tax of the fourth category will produce, or the reduction of Personal Assets.

So that he Article 111 remains in force, a special majority of the Deputies will be required because the Senate rejected it by two-thirds of the vote.

He IARAF estimated, excluding earnings from wages, that tax expenditure is equivalent to 2.08% of GDP. 71% originates from one’s own laws that, when creating taxes, determine who does not have to pay them. The remaining 29% are special regimes.

The three most important tax expenses are “Other VAT exemptions”, with 21% of the total tax expenditure. They are followed by the “Reduction of VAT on primary products”, with 19%, and the Tierra del Fuego promotion regime, with 16%.

The details of those who “do not pay taxes”

- According to the IARAF, Regarding VAT, the most important causes of tax expenditure are originated by legal provisions that are reduced rates of primary products by 0.4 points of GDP. There is an exemption for medical benefits (0.07 points), a reduced rate for housing construction (0.15 points) and an exemption for educational services (0.11 points).

- With a value of 0.44 percentage points of GDP, there is the exemption for medicines for human use, books, newspapers and magazines and the reduced rate for prepaid medicine and bakery products. Of less significance are the exemptions on interest for loans from official banks and for housing and the sale of fluid milk.

- In relation to Income Tax exemptions add 0.07 points of GDP that benefit foundations and non-profit associations.

- Regarding the fuel tax, the expense comes from the difference in amounts applied to gasoline and diesel, and from the exemption that the south of the country has (0.08 points).

- In terms of social security, the impact is the reduction of employer contributions by geographical areas, which represents 0.08 points.

- In Personal Assets, the exemption for deposits in the personal property tax represents 0.03 percentage points of GDP.

Those who do not pay taxes because they have special regimes

- There is the one mentioned Tierra del Fuego regime, which impacts 0.33 points of GDP.

- The regime that allows micro and small businesses to compute 100% of the check tax on account represents 0.15 percentage points of GDP.

- The promotion of mining activity, the knowledge economy and biofuels implies between 0.3 and 0.4 percentage points of GDP.

- With values between 0.1 and 0.2 percentage points of GDP are the industrial promotion regimes of decrees 2054/92, 804/96, 1553/98 and 2334/06 (as a whole), the reimbursement of assets of capital, the promotion of Reciprocal Guarantee Companies (SGR), the regime to promote the use of renewable energies and the auto parts regime.

Source: Ambito