The head of the Central Bank specified the new definitions of monetary policy that the organization will take.

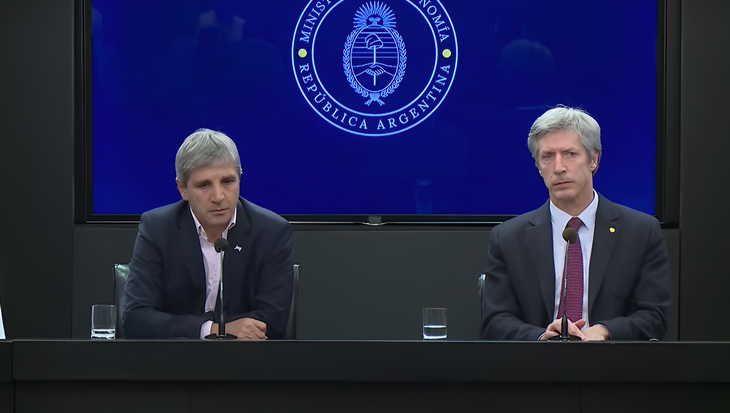

At a press conference with the Minister of Economy Luis Caputo, Santiago Bausili announced the gradual decisions that will be made by the Central Bank of the Argentine Republic (BCRA) for a new period of monetary policy, which will prioritize limiting the issuance. The entity called a meeting of private banks for next Monday.

The content you want to access is exclusive to subscribers.

“We are going to replace the liabilities of the BCRA with those of the Treasury and it will be the Treasury that will pay the interest. The BCRA will continue to manage monetary policy, but it no longer suffers the consequence of the movement in the interest rate resulting in higher monetary emission. These movements are going to end in greater debt for the treasury. That is, the Treasury is double committed to its fiscal performance,” said Bausili, head of the national financial organization.

In that sense, he considered that The decision “returns autonomy to the BCRA, which can set the interest rate without worrying about the damage it may cause to its own balance.” The official hoped that he could “move comfortably to a positive rate in real terms and the only thing it does is bet on a macro balance that will be resolved by fiscal performance. This is the tool that the BCRA has to focus on its main objective: eliminate inflation“.

With the aim of reducing monetary issuance to a minimum, The BCRA will transfer the paid debt to the National Treasury, which will open a process of obtaining external financing to enable it to meet the responsibilities that are due in the short term.. There will be a monetary regulation letter that banks will access to place their excess liquidity“, he said.

Caputo and Santiago Bausili.png

Luis Caputo and Santiago Bausili.

Luis Caputo: “We are going to close the second broadcast channel”

In the same line as Bausili, the minister Luis Caputo He pointed out at the press conference at the Treasury Palace that “we are already in the second stage of the stabilization plan, which consists of go to close the second monetary issue tap, which is the interest that the BCRA pays“.

“We want to provide greater certainty and greater solidity so that in some way there stops being anxiety about when the exit from the exchange rate“he said, referring to the restrictions in force on the foreign exchange market.

Furthermore, Caputo assured: “We are not in love with the exchange rate restrictions, we will lift them in the third stage of the recovery plan, although there is no date yet.”

Source: Ambito