The economist concluded that this process represents a “double scam” for exporters and defined the scheme as a form of confiscation.

The Economist Roberto Cachanosky harshly criticized The new strategy of “monetary tightening” announced by the president Javier Milei and the Minister of Economy, Luis Caputoover the weekend, comparing it to Kirchnerism policies.

The content you want to access is exclusive for subscribers.

On his social networks, the respected economist expressed his concern about the plan that involves the Central Bank buying Dollars to exporters at an exchange rate below the market ratedescribing it as a form of confiscation of exporters’ labor.

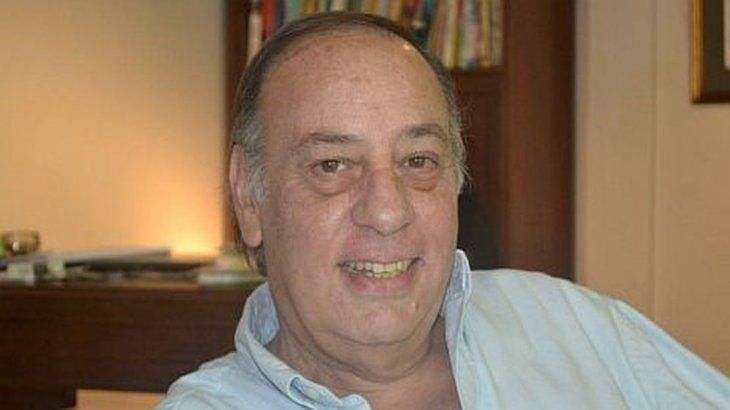

Dollar: what Roberto Cachanosky said about Javier Milei’s economic plan

According to CachanoskyThis mechanism forces exporters to hand over their dollars to the BCRA, which issues pesos in exchange. To remove those pesos from the market and keep the monetary base constant, the BCRA will then sell those dollars at the CCL, making a profit by selling them at a higher price than it bought them for.

To balance the initial issue, estimated that the BCRA would have to sell approximately US$ 63 at the CCL exchange rate last Fridaykeeping US$37 of every US$100 initially purchased.

The economist concluded that this process represents a “double scam“exporters, since it takes advantage of them twice: first, by buying their dollars at an exchange rate lower than the market rate, and then, by selling those dollars at a higher price.

He criticised the lack of liberalisation of the exchange market and accused the government of falling in love with interventionism and the confiscation of other people’s work.

economist cachanosky.jpg

He criticised the lack of liberalisation of the exchange market and accused the government of falling in love with interventionism and the confiscation of other people’s work.

On the other hand, the president defended the measure arguing that they will close the tap of the issuance of purchase of Dollarssterilizing the pesos issued by placing dollars on the market. The head of State said that this will contribute to maintaining the amount of money in circulation constant and will accelerate disinflation, anticipating a significant drop in the inflation rate and bringing the end of the exchange rate restriction closer.

He also acknowledged that the coming months will be difficult, especially during the winter, when demand for dollars increases due to energy.He pledged to restrict the amount of pesos in circulation to meet these economic challenges..

Source: Ambito