The Christmas bonus failed to reverse the trend and despite lower inflation, food and beverages remain the hardest hit sector. What is the view of companies?

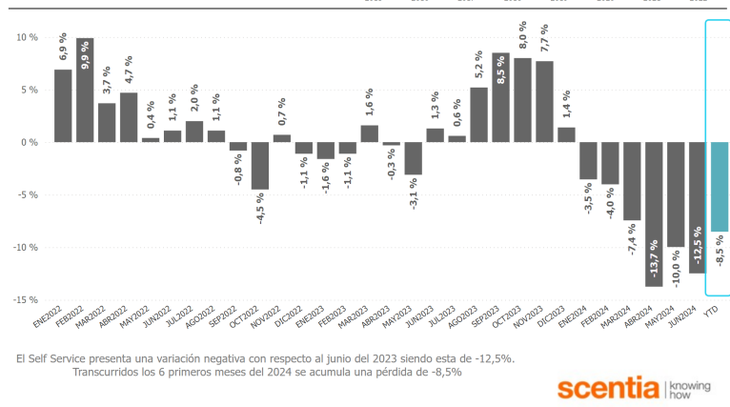

He massive consume fell by 12.5% in June. The bonus failed to reverse the trend and the decline was more pronounced compared to May. Thus, the cumulative total for the first half of the year shows a decline of 8.5% compared to 2023.

The content you want to access is exclusive for subscribers.

The official inflation data for June revealed what the Government itself was already visualizing through the Argentine Electronic Price Advertising System (SEPA): that Food and drink prices are growing well below (3%) of the variation in the General Consumer Price Index (4.6% INDEC CPI), in a highly recessive context. And the same trend is observed for July, according to public data and private estimates.

scentia.PNG

Despite lower inflation and extra pesos from the Christmas bonus, consumption has not recovered

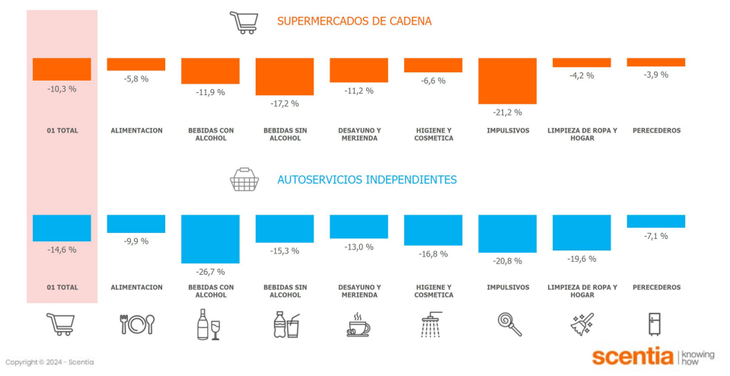

Supermarkets with greater decline than self-service stores

The The drop in sales worsened in supermarkets, with a decrease of 10.3% in June compared to the same month in 2023 and 14.6% for self-service stores in the same period.

“The performance of both channels had differences, given that the Supermarkets showed a retraction similar to that of May, while the Independent self-service stores accelerate decline. The variations were 10.3% and 14.6% in the inter-monthly, accumulating a half-yearly contraction of 10% and 7% in each case. We believe it is important to keep in mind the comparison bases, which until June 2023 were +8% for Supermarkets and -8% for Self-Service Stores. In relation to the weighted average price, the deceleration process continues, which is already at 279%.All baskets suffered setbacks in sales in both channels,” the consultant explained.

consumption444.PNG

Food and beverages, the hardest hit sector

Companies believe that current consumption is a floor and that it should begin to pick up towards the end of the year and are carrying out aggressive promotions to improve the numbers. The sector’s greatest expectations are set for 2025, hand in hand with economic growth driven by macroeconomic stabilization and the exit from the exchange rate restrictions.

Source: Ambito