The Government promoted the idea of “zero emissions” from the purchase of reserves, announced in a hurry by Javier Milei and Luis Caputo from the United States last weekend, is a deepening of the contractionary monetary policy to dry up pesos from the economy. The most widespread interpretation among analysts and investors is that, in reality, the heart of the measure is to allocate the bulk of dollars that should go to the reserves to the foreign exchange intervention to contain the escalation of the gap. However, there is a data that helps to understand the concern of officials in the light of the attempts to prevent a new surge in inflation.

A slide of the report in English that the vice president of the Central Bank, Vladimir Werningrevealed that During the first half of the year, one third of imports were paid for using the dollar settled with liquidation (CCL). It was in a series of meetings that this Monday in New Yorkwhere he traveled with the aim of transmitting some calm after the announcement, which also resulted in a jump in the country risk. On another slide, a graph showed how the net international reserves (which will now be dispensed with in order to address the gap) returned to negative territory following last week’s payment to bondholders.

Between the end of January and the last days of May, there were times of stability and even a decline in financial dollars. At times, the gap between the CCL and the import dollar (wholesale plus country tax) became almost zero. This led firms that did not have the margin from their suppliers to continue financing payments to turn to cash with liquidation. And it involved accepting that They would not have access to the official dollar during the following monthsperhaps in anticipation that the restrictions would be lifted earlier.

image.png

All this has a effect on price formation: If through the dollar blend mechanism we already knew that 20% of the price of all exportable products was based on the CCL, now we see that a third of imported goods are imported at the same rate. but for the full cost. As long as the gap was almost zero, there was no impact. But the overheating of the parallel dollars that began in the second half of May changed the equation.

Gap, inflation and yellow lights

June already showed the first brake on the slowdown in inflation so far this year: INDEC measured 4.6% monthly, which was higher than the 4.2% in May. It is true that, in this case, the rise in the general index had the impact of the increase in rates. But it is also true that the Core CPI (which excludes seasonal and regulated prices) stagnated at 3.7%, the same level as the previous month.

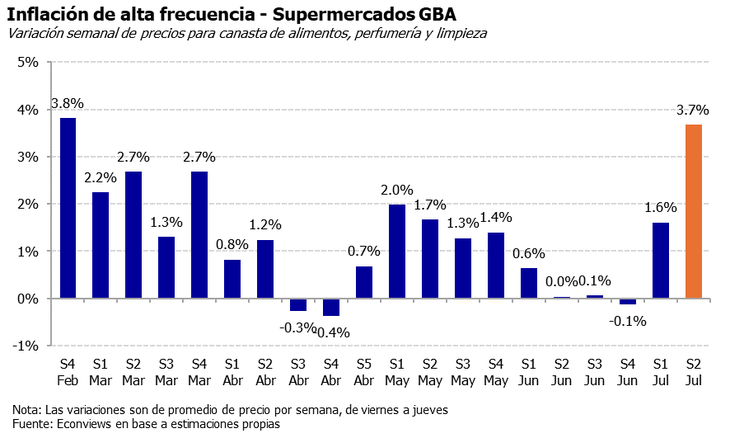

What some private measurements revealed during the beginning of July It was a wake-up call. For example, EconviewsMiguel Kiguel’s consultancy, revealed that in the supermarkets of Greater Buenos Aires the prices a basket of food, cleaning supplies and perfumes increased 1.6% in the first week of the month and accelerated to 3.7% in the seconda weekly jump that has not been seen since the end of February.

image.png

As reported by Ámbito, Caputo met a few days ago with executives from the main consumer goods firms and asked them to avoid “preventive” increases in the price lists.

The acceleration recorded in some of the high frequency measurements coincided with the rise of parallel dollars which was triggered by market doubts about the sustainability of the exchange rate scheme. Last Friday, the gap between the CCL and the wholesaler had exceeded 55%.

The widening gap reflected devaluation pressures and, at the same time, influenced exporters’ decision to delay shipments of their merchandise while waiting for a more convenient dollar, which (along with other factors) contributed to the BCRA’s currency purchases coming to a screeching halt since June.

All this represented a Challenge for Milei and Caputo’s strategy to cling to the “crawling peg” (devaluation rate) of 2% per month and the blend, as an exchange rate anchor to try to avoid an overheating of inflation, Contrary to the demands of the International Monetary Fund (IMF) devaluing and removing restrictions to speed up the shoring up of reserves. In fact, Werning’s data showed that the blend added an offer to the CCL during the first half (US$7.6 billion) that was less than the demand of importers in that market (US$9.3 billion). Nevertheless, many in the City read this weekend’s measure as a silver bullet from the Government to sustain its scheme.

Announcement, reservations and IMF

The first impacts of the heavy foreign exchange intervention policy on the CCL market were twofold: The parallel dollar fell considerably, although sovereign bonds in dollars also fell sharply and country risk rose. The concern of the operators is the decision to contain the gap at the cost of foregoing the recovery of reserves, which are currently in negative territory. In addition, many City desks see the measure as a confirmation that IMF dollars do not appear on the horizon.

After the gap exceeded 60% last week, The Government once again turned around. Days ago, the economic team pointed out that the only “benign” source of monetary emission was the purchase of dollars by the BCRA because it was important to rebuild reserves; over the weekend, Javier Milei swept away that idea and announced that from this Monday it would no longer be broadcast on that channel either.

What does this mean? The pesos injected by the purchase of dollars in the official market will be sterilized by the BCRA through direct foreign exchange intervention in the CCL by selling most of the foreign currency purchased in the other window. If the outlook that the Government was already handling was that of a fall in net reserves of up to US$3 billion in the third quarter (always unfavorable for the flow of dollars due to seasonality), this measure is aimed at exacerbating that trend.

The economic team reported that They plan to sterilize $2.5 billion through currency intervention in the CCL over the next few weeks. If this materialises, as in net terms there is no period of currency purchases in the offing, this would be equivalent (depending on how the financial dollar exchange rate varies) to to dispose of between US$1.6 billion and US$2 billion of reservesIn May, the last month closed with a positive balance, the Central Bank bought US$2.532 billion.

“As net reserves remain negative, using almost everything they buy to plug the gap virtually guarantees they will remain in the red.unless new external financing appears,” he told Ambit an operator, concerned about the negative signal this represents for the chances of refinancing the mountain of foreign currency debt maturities in 2025. Only between sovereign bonds held by private bondholders and BOPREAL, the maturities amount to almost US$10 billion, according to calculations by 1816. If all external debt commitments are added, the number rises to more than US$17 billion.

In this context, many people see it as a short-sighted measure. “This lasts as long as there are dollars to intervene,” the financial analyst raised Christian Buteler in conversation with this media. And he affirmed that there are discursive contradictions in the Government: “Until Friday the priority was to buy reserves, to clean up the BCRA… Now, the priority is to reduce the gap. Last week they told us that the rise of the dollar was not worrying, that the gap was going to converge downwards, and the announcement of this operation shows the opposite.”

Furthermore, the market takes it for granted that the decision is made at the expense of deepening the short circuits with the Fundfrom whom the Government intends to receive new debt for US$10 billion. Unlike the announcement of the final migration of the BCRA debt to the Treasury, which was supported by sources from the organization minutes after the press conference of Caputo and Santiago Bausili on June 28, This time the IMF chose silence. Already in 2018, the foreign exchange intervention was one of the key points of the discussions between the current Minister of Economy (then president of the BCRA of Mauricio Macri) and the Washington bureaucracy, which led to Caputo’s departure.

“The priority is not to come to an agreement with the Fund. Because the measure is the opposite of what the IMF was asking for: if it criticized the dollar blend, imagine this. I think there will be a new agreement anyway. But I already didn’t believe that there would be new dollars; this confirms it for me. “I don’t think they’re going to give Caputo any more dollars,” Buteler said.

For its part, an analysis by the consulting firm Vectorialof Eduardo Hecker and Harold Montaguheld: “Rather than blowing up a saving agreement with the IMF (which, as we insist, was difficult to imagine for September considering the North American elections and that capital payments to the organization only begin in 2026), It is the recognition that this possibility was not on the table today.”.

Source: Ambito