This Monday, the Central Bank will launch the new monetary policy scheme with which it will close another emission tap. It will stop placing passive passes to the banks to sterilize the pesos in circulation and will begin to manage them through the new Fiscal Liquidity Letters (LEFI), issued by the Ministry of Economy. Thus, The debt transfer from the BCRA to the Treasury will be completedFrom now on, the interest on these liabilities will no longer be met by issuing bonds, but rather by an additional fiscal adjustment. The market will closely follow the decision made by the entity chaired by Santiago Bausili regarding rates.: maintain them or raise them.

The BCRA will modify its operations starting today. He will no longer tender for more passes overnight liabilities, the remunerated debt that was placed with the banks whose stock stood at $11.5 billion as of July 17. From now on, it will offer financial institutions to subscribe to the LEFI, which will be the new instrument to manage monetary policy. Sources from the Central Bank told Ambit that They expected that the bulk of the stock of repos would initially be invested in Treasury bills..

Last Thursday, through joint resolution 40/2024 of the Treasury and Finance Secretariats, The Government made official the issuance of $20 billion in LEFI. This is a one-year bill (due on July 17, 2025), whose capital will be fully repaid at maturity and which will accrue interest that will be capitalized daily at the monetary policy rate (which will be set by the BCRA) and will also be cancelled at maturity. “At each change in the annual nominal monetary policy rate, the interest will be capitalized and considered as new capital,” the regulation details.

How will the operation be implemented then? The first step after its issuance is a exchange between both institutions: The Treasury delivers the LEFI in exchange for a set of public securities that were in the BCRA’s portfolio. This is a portion of the Boncer T4X4, T5X4, T2X5, TZX25, TX25, TX26 and TZXD5 equivalent to the $20 billion LEFI according to the exchange ratio established by the Government. With the notes already in its possession, the Central Bank will begin to operate them daily.

LEFI can only be traded between the monetary authority and banks. Starting this Monday, financial institutions will have the opportunity to buy and sell them every day when they need liquidity.For the latter, the Central Bank will open two windows: one between 18:30 and 20:30, which will be settled at 9:00 the following business day; and another between 15:00 and 17:00, which will allow banks to obtain the pesos on the same day.

This is why officials say that the new monetary scheme will not imply significant changes to the management of the liquidity of financial institutions. “The plan is that nothing will change for the banks on a day-to-day basis. The operation will be very similar to that of the passes”they told him Ambit in an official office. Furthermore, by order of the BCRA, despite being issued by the Treasury, the LEFI will not count towards the cap on public sector financing that the entities have.

image.png

LEFI, exchange rate restrictions and more adjustments

The objective of the new monetary scheme, according to Bausili and Luis Caputo, is end the issuance of pesos for the payment of interest on remunerated liabilities of the BCRA when it stops issuing them.

The measure, they say, is part of the “Phase 2” of the economic program, for which the closure of other monetary emission taps that remained open was also announced: since last week the Central Bank began to intervene in financial dollars with reserves purchased on the official market (which implies reabsorbing the pesos that were issued in the first movement) and on Thursday concluded a repurchase operation of $13.17 billion in insurance that the banks had on public securities (puts), which implied a latent debt for the BCRA and that could force it to issue in case of execution of the contracts. However, they are still in force puts for more than $3 billion.

Javier Milei assures that “Zero emissions” is a key step in creating the conditions to lift the exchange rate restrictions (In particular, he mentioned the end of the remunerated liabilities of the BCRA and the puts). However, there are economists who object to the migration of debt to the Treasury being decisive since, they say, it is the same stock of pesos that could put pressure on the dollar in the event of the opening of controls and that, in reality, the variables to be monitored are the deposits (which are the opposite of both the passes and the LEFI that the banks buy) and, above all, the reserves (whose accumulation is affected by the intervention in the CCL).

Even so, the President added another condition a few days ago for lifting the currency controls: that inflation and the monthly devaluation rate converge around 0%. An objective that practically no economist expects to be met in the remainder of the year. Beyond that, the Government assures that zero emission will be important to continue the slowdown in price increases.

In any case, the flip side of the elimination of the issue resulting from the payment of interest for the passive transfers of the Central Bank will have as a flip side a greater burden for the treasurythat will be responsible for paying the interest accrued daily by the LEFI. This will involve a additional adjustment on other items, which will be added to the harsh cuts already made and whose magnitude will depend on the monetary policy rate defined by the BCRA.

LEFI and expectations for rates

Fairly, One of the open questions in the market is whether the monetary authority will take advantage of the launch of the operation with the LEFI to raise the rate. interest or whether it will be inclined to maintain it at the current level.

image.png

For now, The debt handrail with the Treasury itself will bring with it an implicit rise in yields. It is that the countries were affected by the tax on Gross income in different districts (among them CABA, where 80% of the banks’ headquarters are located), something that will not happen with the new bills. “It will enjoy all the tax exemptions provided for in the laws and regulations in force on the matter,” clarified the joint resolution of the Treasury and Finance. In itself, this will imply a slight increase of 3.2 percentage points in the annual nominal rate (TNA) or almost 0.3 points in the monthly effective rate (TEM).

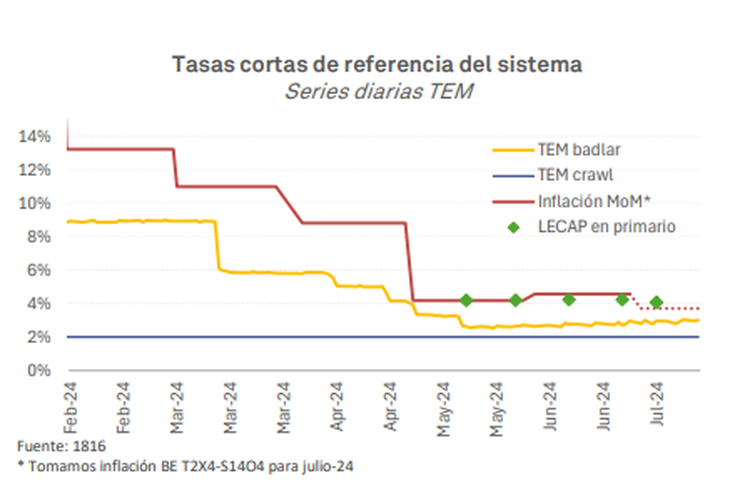

What will the BCRA decide beyond that? “It is not clear to us what the Central Bank will do because There are compelling arguments for both raising and maintaining the policy rate.“, the latest report of the consultant 1816.

He went on to say: “Maintaining the monetary policy rate at 40% would be a further demonstration of the economic team’s conviction to maintain the downward trajectory of all nominal variables (inflation and nominal rates) with the idea that they will converge to the 2% monthly ‘crawling peg’. Raising the rate, for its part, could deal the final blow to a bearish CCL after the announcement of the intervention by the Central Bank, which could accelerate disinflation (at the cost of a higher financial cost, now entirely borne by the Treasury).”

However, the consultancy firm considered that “The market does not seem to be anticipating an imminent increase in the policy rate” since during the last few days the LECAPs for September and October operated with yields similar to those that emerged in the last tender of the Economy, held on July 10, that is, 4.08% and 4.19% TEM respectively.

Source: Ambito