unnamed.png

The concern of companies

35.6% of the companies surveyed indicate that the most anticipated measure at this time would be a tax cut, while another 14.6% mention the relaxation of labour regulations. Both are policies that would allow costs to be reduced and profitability to be improved.

On the list of priorities, the third place of expected measures is shared by the stimulus to domestic demand and soft loans, in both cases mentioned by 13.6% of the industries surveyed.

As for the problems and challenges, the 43.4% of respondents mention the lack of sales, Another 34.9% are due to high production and logistics costs, and 11.1% are due to difficulties in accessing credit.

On the other hand, industries were consulted regarding the measures taken in the last 6 months to adapt to the context. 37.7% of companies said they had reduced operating costs22.6% said they had diversified products and another 20.7% reduced working hours.

SME industry: performance sector by sector

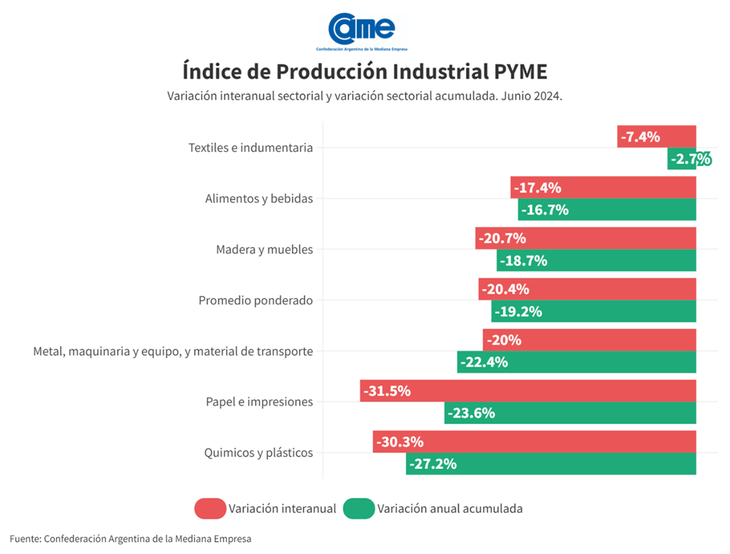

The six manufacturing sectors of the SME segment had strong falls in the annual comparison, being the most affected “Paper and Printing” (-31.5%) and “Chemicals and Plastics” (-30.3%).

unnamed (1).png

1. Food and drinks

The sector registered a 17.4% annual drop at constant prices in June and a -4.8% monthly drop. For the first half of the year, it has accumulated a 16.7% annual drop. Industries operated with only 58.1% of their installed capacity in the sixth month of the year (72.4% in May), very low levels for the sector.

The companies surveyed said that the month was affected by holidays and macroeconomic fluctuations. Some observed sporadic signs of recovery that were later interrupted.

2. Textiles and clothing

Production fell by 7.4% year-on-year in June and -4.3% compared to May. For the first half of the year, it has fallen by 2.7%. Industries operated at 63.3% of their installed capacity, below the previous month (71.5%).

More business closures were detected, and fears about the imminent release of imports increased, according to some official announcements.

3. Wood and furniture

In June, the sector shrank by 20.7% year-on-year at constant prices, and -3% in the seasonally adjusted monthly comparison. In the January-June period, activity fell by 18.7% compared to the same months last year.

Activity remains in decline, with inquiries not materialising and awaiting an improvement in purchasing power, which is the only variable that can move the market today.

4. Metal, machinery and equipment, and transportation material

The sector had an annual contraction of 20% in June, at constant prices, and -1.5% in the monthly comparison. For the first half of the year, it has accumulated a fall of 22.4% compared to the same months of 2023. Industries operated at 57.9% of their installed capacity, when in May that level was 66.6%, showing a sharp decline.

5. Chemicals and plastics

In June, the sector experienced another significant contraction of 30.3% year-on-year at constant prices, and -2.3% in the monthly comparison. For the first half of the year, production has accumulated a fall of 27.2% compared to the same months of 2023.

During this month, industries operated at 63.1% of their installed capacity (vs. 68.8% in May). Exporting companies are the ones that are best coping with the current crisis, while the rest see no signs of recovery in the near future and see their sources of employment at risk.

6. Paper and prints

Activity fell by 31.5% annually at constant prices, once again being the sector with the greatest decline. In monthly terms, a 2.6% decline was also recorded, and for the first half of the year activity has accumulated a fall of 23.6% compared to the same months of last year. Companies operated at 63.1% of their installed capacity, well below May, when it reached 78.7%.

Source: Ambito